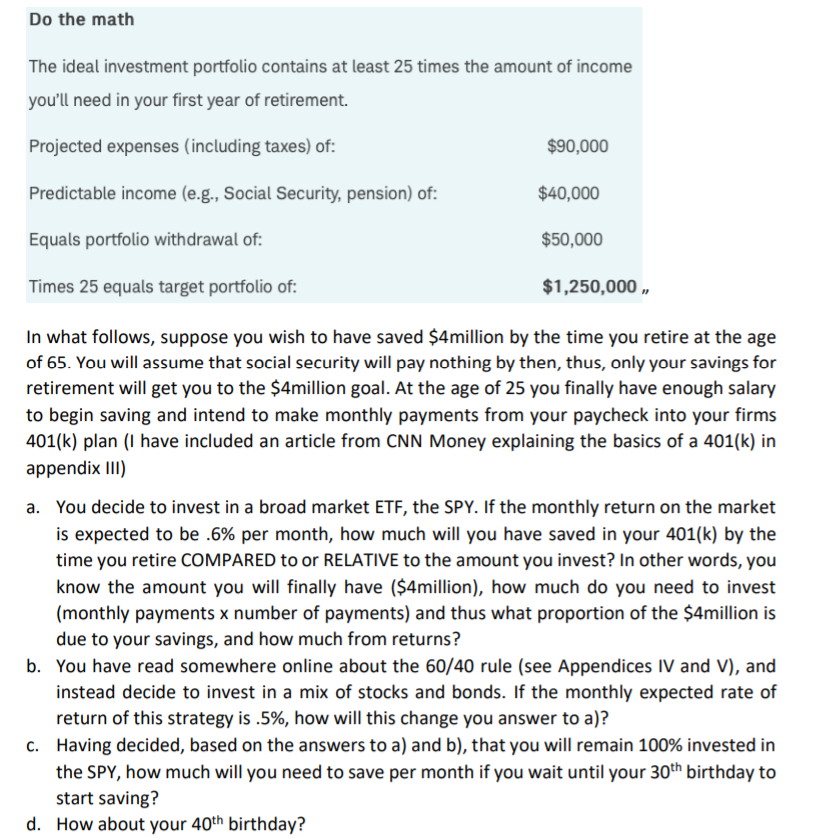

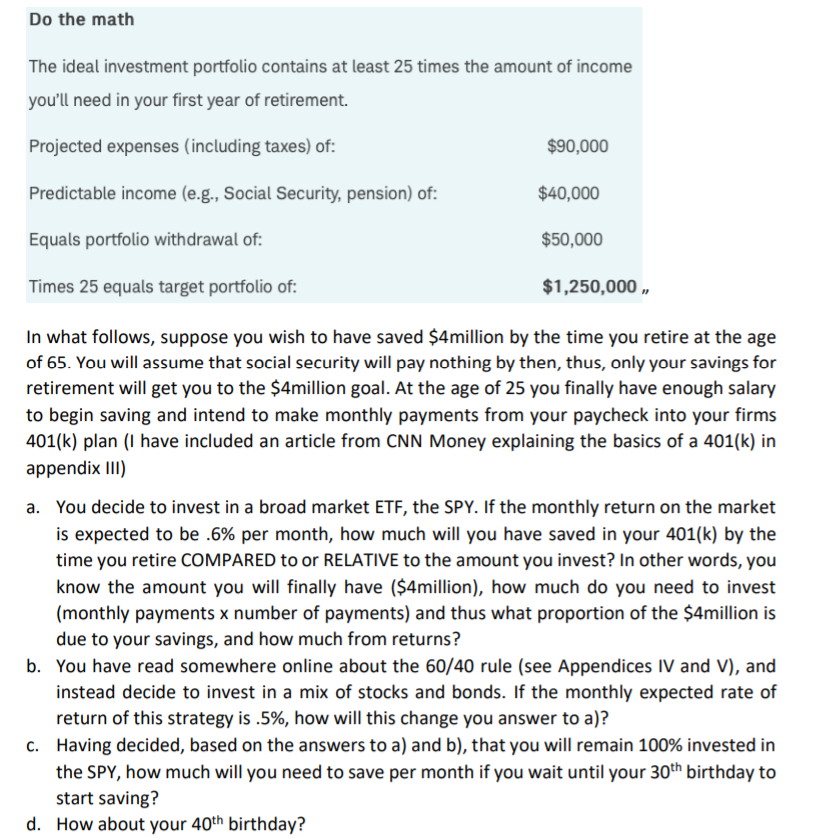

Do the math The ideal investment portfolio contains at least 25 times the amount of income you'll need in your first year of retirement. Projected expenses (including taxes) of: $90,000 Predictable income (e.g., Social Security, pension) of: $40,000 Equals portfolio withdrawal of: $50,000 Times 25 equals target portfolio of: $1,250,000, In what follows, suppose you wish to have saved $4million by the time you retire at the age of 65. You will assume that social security will pay nothing by then, thus, only your savings for retirement will get you to the $4million goal. At the age of 25 you finally have enough salary to begin saving and intend to make monthly payments from your paycheck into your firms 401(k) plan (I have included an article from CNN Money explaining the basics of a 401(k) in appendix III) a. You decide to invest in a broad market ETF, the SPY. If the monthly return on the market is expected to be .6% per month, how much will you have saved in your 401(k) by the time you retire COMPARED to or RELATIVE to the amount you invest? In other words, you know the amount you will finally have ($4million), how much do you need to invest (monthly payments x number of payments) and thus what proportion of the $4million is due to your savings, and how much from returns? b. You have read somewhere online about the 60/40 rule (see Appendices IV and V), and instead decide to invest in a mix of stocks and bonds. If the monthly expected rate of return of this strategy is .5%, how will this change you answer to a)? C. Having decided, based on the answers to a) and b), that you will remain 100% invested in the SPY, how much will you need to save per month if you wait until your 30th birthday to start saving? d. How about your 40th birthday? Do the math The ideal investment portfolio contains at least 25 times the amount of income you'll need in your first year of retirement. Projected expenses (including taxes) of: $90,000 Predictable income (e.g., Social Security, pension) of: $40,000 Equals portfolio withdrawal of: $50,000 Times 25 equals target portfolio of: $1,250,000, In what follows, suppose you wish to have saved $4million by the time you retire at the age of 65. You will assume that social security will pay nothing by then, thus, only your savings for retirement will get you to the $4million goal. At the age of 25 you finally have enough salary to begin saving and intend to make monthly payments from your paycheck into your firms 401(k) plan (I have included an article from CNN Money explaining the basics of a 401(k) in appendix III) a. You decide to invest in a broad market ETF, the SPY. If the monthly return on the market is expected to be .6% per month, how much will you have saved in your 401(k) by the time you retire COMPARED to or RELATIVE to the amount you invest? In other words, you know the amount you will finally have ($4million), how much do you need to invest (monthly payments x number of payments) and thus what proportion of the $4million is due to your savings, and how much from returns? b. You have read somewhere online about the 60/40 rule (see Appendices IV and V), and instead decide to invest in a mix of stocks and bonds. If the monthly expected rate of return of this strategy is .5%, how will this change you answer to a)? C. Having decided, based on the answers to a) and b), that you will remain 100% invested in the SPY, how much will you need to save per month if you wait until your 30th birthday to start saving? d. How about your 40th birthday