Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do the posting in General Journal, Worksheet, Income Statement, Owners Equity, Balance Sheet and Trial balance of this Transacafions. Corner Dress Shop The Tele Mini

Do the posting in General Journal,

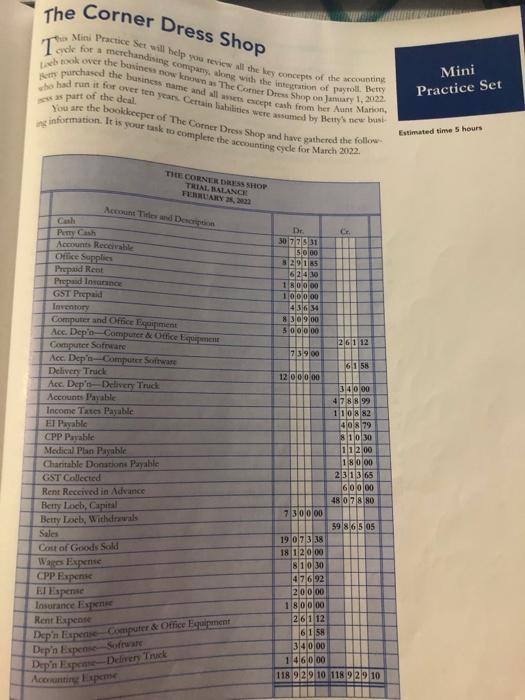

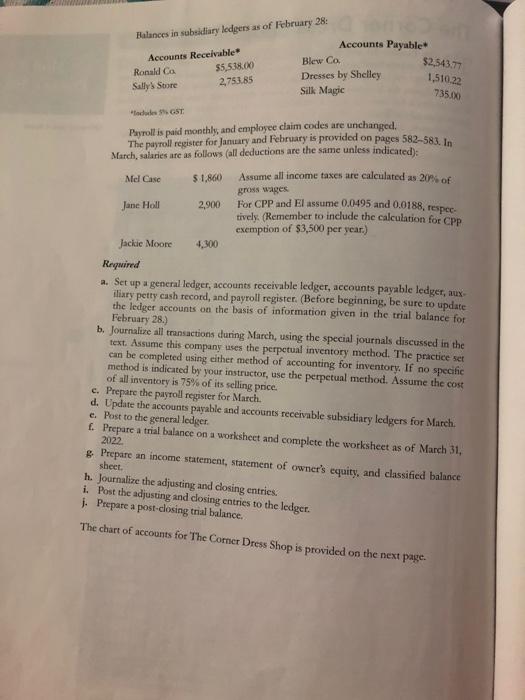

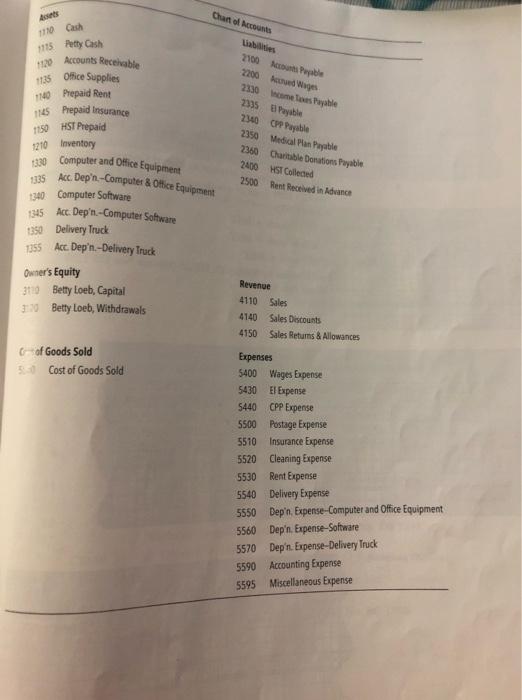

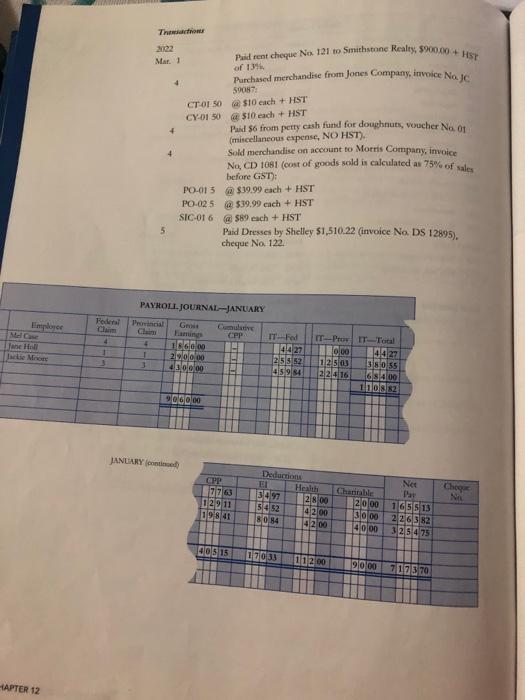

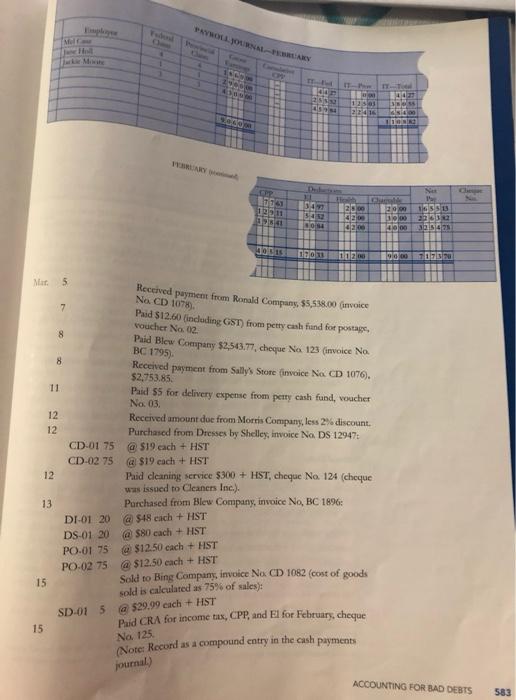

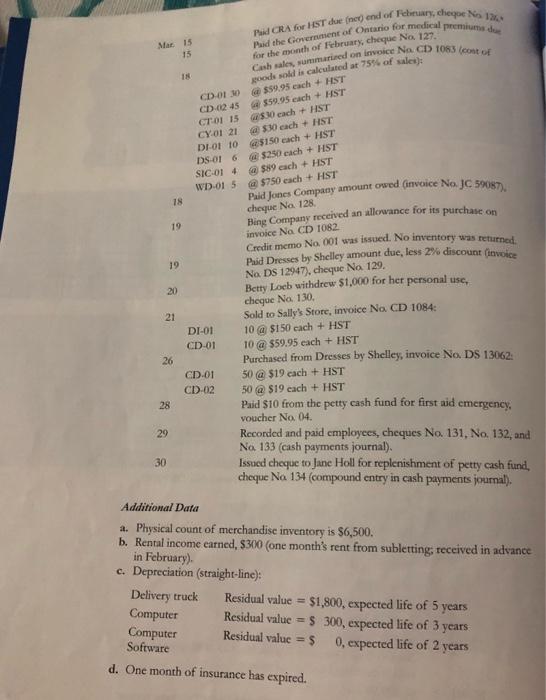

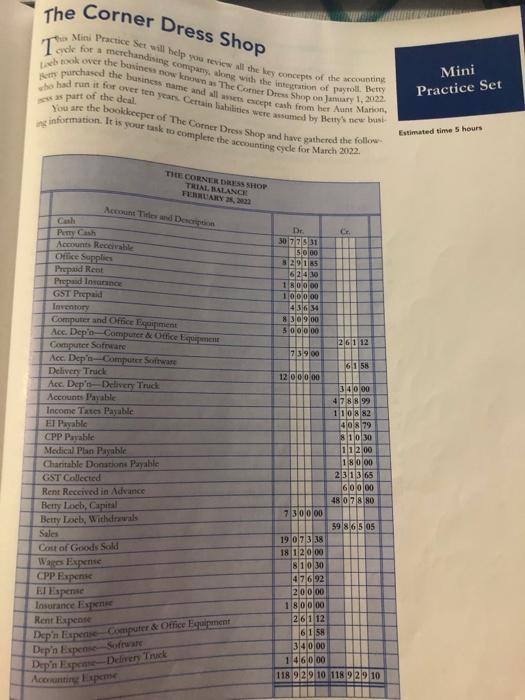

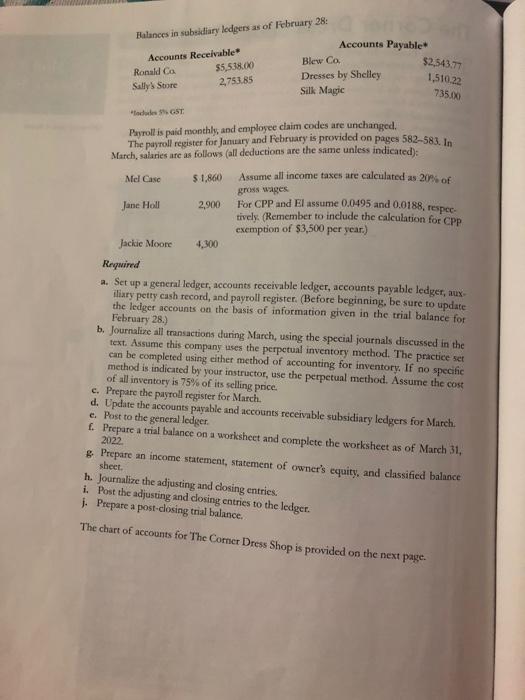

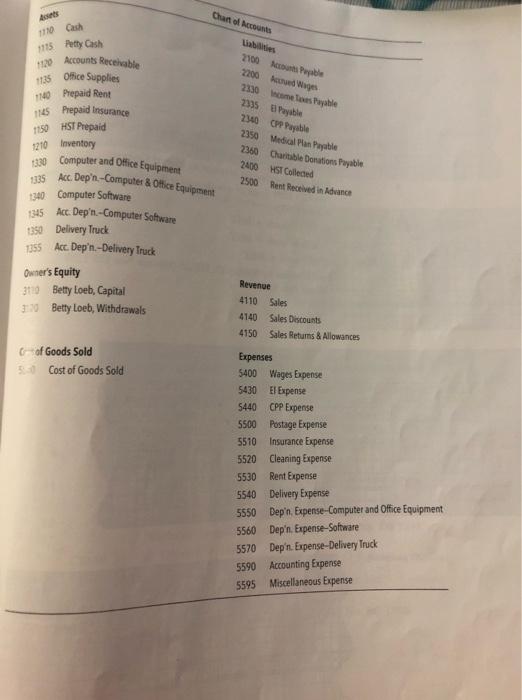

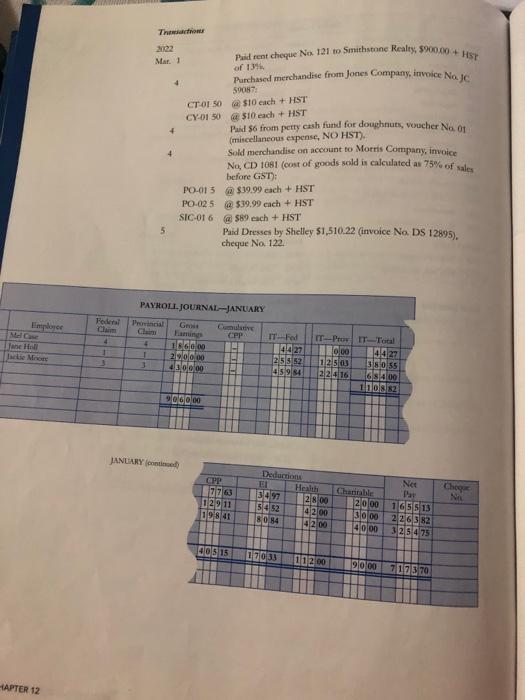

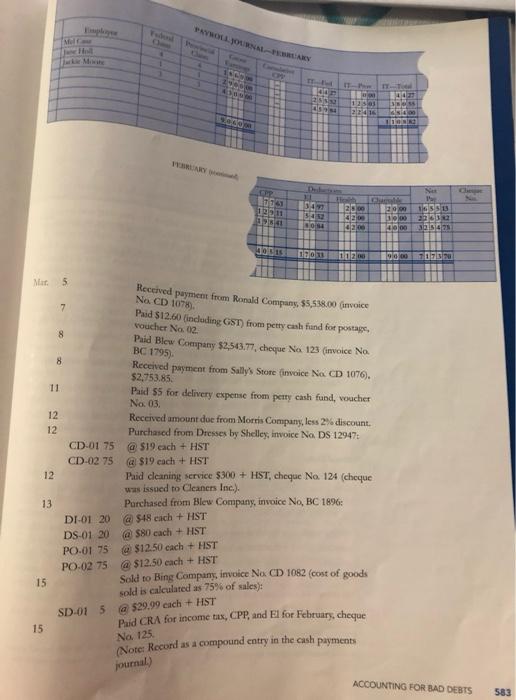

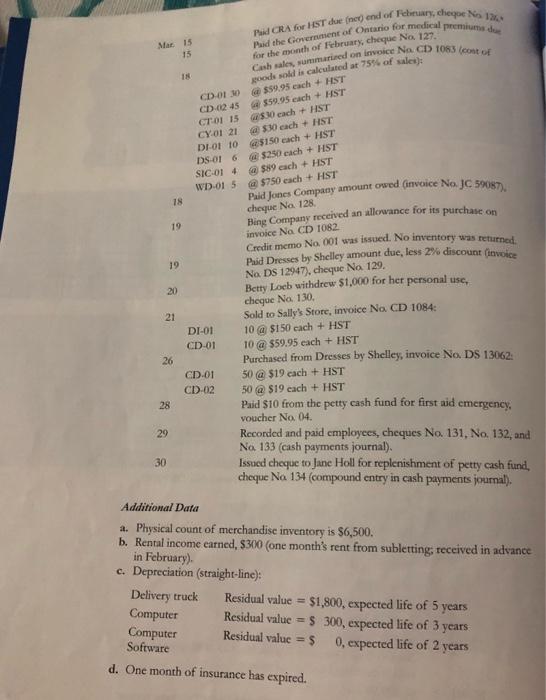

Corner Dress Shop The Tele Mini Practice Set will help you even wil the key concepts of the accounting de for merchandising company, along with the integration of payroll Betty Lab tok over the bovine known as The Corner Dress Shop on January 1, 2022 who had run it for over ten years Certain alles were assumed by Hetty's nebus Rom purchased the business name and we cept cash from her Aunt Marion, as part of the deal. information. It is your task to complete the accounting cycle for March 2022 You are the bookeeper of The Corner Dress Shop and have gathered the follow Mini Practice Set Estimated time 5 hours THE CORNER DES STOP TRIAL BALANCE FEBRUARY 26, 2 Account Title and Denon Call Perry Cash Accounts Receivaht Office Supplies Prepaid Rent Prepaid loan GST Prepaid Inventory Computer and Office Ferment Acc. Depo-Computer & Office Equipment Computer Software Ace Dep-Computer Software Delivery Truck Acc. Der's Delivery Truck Accounts Payable Income Taxes Payable El Payable CPP Parable Medical Plan Payable Charitable Donations Payable GST Collected Rent Received in Advance Berry Locb, Capital Betty Loeb, Withdrawals Sales Cost of Goods Sold Wares Expenses CPP Expense El apenas Insurance Es Rent Espeare Dr. 30 7 29 31 S000 829 185 62.430 180 000 100 000 43644 30 900 50 000 261 12 173900 6158 12 000 00 34000 4788 99 110 882 410879 810 30 112.00 180.00 2 31 366 60 000 480 78 80 7 30 000 598 6505 1907318 18 1/2000 81030 147 6 92 20 000 1 800 00 26112 61 58 340.00 1/460 00 118 92/9 10 118 929 10 Depo Esporte Computer & Otfice Equipment Dip'n span Sofra Dop'n Espano-Deliver Trick Acoranti peme Balances in subsidiary ledgers as of February 28: Accounts Receivable Ronald Co 55,538.00 Sully Store 2,75385 $2,543.77 1.51022 735.00 Accounts Payable Blew Co Dresses by Shelley Silk Magic de SGST Payroll is paid monthly, and employee claim codes are unchanged. The payroll register for January and February is provided on pages 582-583. In March, salaries are as follows (all deductions are the same unless indicated): Miel Casc $1,860 Assume all income taxes are calculated as 20% of gross wages Jane Holl 2,900 For CPP and El assume 0.0495 and 0.0188, respec tively. (Remember to include the calculation for CPP exemption of $3,500 per year.) Jackie Moore 4,300 Required a. Set up a general ledger, accounts receivable ledger, accounts payable ledger, max ciliary petty cash record, and payroll register. (Before beginning, be sure to update the ledger accounts on the basis of information given in the trial balance for February 28.) b. Journalize all transactions during March, using the special journals discussed in the text. Assume this company uses the perpetual inventory method. The practice set can be completed using either method of accounting for inventory. If no specife method is indicated by your instructor, use the perpetual method. Assume the cost of all inventory is 75% of its selling price. c. Prepare the payroll register for March. d. Update the accounts payable and accounts receivable subsidiary ledgers for March e. Post to the general ledger f. Prepare a trial balance on a worksheet and complete the worksheet as of March 31, 2022 Prepare an income statement, statement of owner's equity, and classified balance sheet. h. Journalize the adjusting and closing entries. i. Post the adjusting and closing entries to the ledger. 1. Prepare a post-closing trial balance. The chart of accounts for The Comer Dress Shop is provided on the next page 1110 Cash 1115 Petty Cash Chant of Account Liabilities 2100 Popole 2200w Wiges 2390 comessaytle 2335 Payable 2340CPP Payable 2350 Media Plan Payable 112 Accounts Receivable 1135 Office Supplies 140 Prepaid Rent 1145 Prepaid Insurance 1150 HST Prepaid 1210 Inventory 130 Computer and Office Equipment 1335 Ace Dep'n-Computer & Office Equipment 1340 Computer Software 345 Acc. Dep'n-Computer Software 1350 Delivery Truck 1355 Act. Dep'n-Delivery Truck Owner's Equity 310 Betty Loeb, Capital 30 Betty Loeb, Withdrawals 2360 Charitable Donations Public 2400 HST Collected 2500 Rent Received in Advance Revenue 4110 Sales 4140 Sales Discounts 4150 Sales Returns & Allowances 6 of Goods Sold 5 Cost of Goods Sold Expenses 5400 Wages Expense 5430 El Expense 5440 CPP Expense 5500 Postage Expense 5510 Insurance Expense 5520 Cleaning Expense 5530 Rent Expense 5540 Delivery Expense 5550 Dep'n, Expense-Computer and Office Equipment 5560 Dep'n. Expense-Software 5570 Dep'n. Expense-Delivery Truck 5590 Accounting Expense 5595 Miscellaneous Expense Throw 4 Paid rent cheque No 121 to Smithstone Realty, 5900,00 + HST Mar. 1 of 1.39 Purchased merchandise from Jones Company, invoice No C S07: CTO 50 $10 each + HST CY-01 50 510 each + HST Puid $6 from petty cash fund for doughnuts, voucher Na o (miscellaneous expense, NO HST). Sold merchandise on account to Morris Company, invoice No, CD 1081 (cost of goods sold is calculated as 75% of sales before GST): PO-015 $39.99 each + HST PO-025 $39.99 each + HST SIC-01 6 589 each + HST 5 Paid Dresses by Shelley 51,510.22 (invoice No DS 12895). cheque No. 122 Federal sor G PAYROLL.JOURNAL- JANUARY Provincial Cumulative CPP IT Fed + 1066.00 14.427 29 00 00 25 $52 3 Solo 459 84 fabe HD 4 21 IT-PowTocal 0.00 10027 1/2 503 so 55 22016 6 84.00 11082 9000.00 JANUARY CPP 1973 1 2 9 11 1 9841 Deduction Health Chantal 5097 2/8 00 2000 5452 4200 8084 42.00 40.00 M Net Py 11655 13 226582 325 475 9000 00515 17033 112.00 190.00 717570 APTER 12 PAYROLL JOURNALLARY Mel 40 2 14 ES 12 2018 GOO si 11 Che 11 50 10 1981 1941 28 Na 1 29 16SS 1900 3 4000 325823 420 20 TEO 11200 0752 Mat. 5 7 8 8 Received payment from Ronald Company, $5,558.00 invoice No CD 1078) Paid $12.60 (including GST) from petty cash fund for postage, voucher No. 02 Paid Blew Company $2,543.77, cheque No 123 (invoice No. BC 1795). Received payment from Sally Store invoice No CD 1076). $2,753.85 Paid 55 for delivery expense from petty cash fund, voucher No 03 Received amount due from Morris Company, less 25% discount Purchased from Dresses by Shelley, invoice No DS 12947 11 12 12 12 CD-01 75 @ $19 each + HST CD-02 75 $19 each + HST Paid cleaning service $300 + HST, cheque No. 124 (choque was issued to Cleaners Inc.). 13 Purchased from Blew Company, invoice No, BC 1896: DI-01 20 548 each + HST DS-01 20 @ $80 cach + HST PO-01 75 0 $12.50 cach + HST PO-02 75 @ $12.50 each + HST 15 Sold to Bing Company, invoice No CD 1082 (cost of goods sold is calculated as 75% of sales: SD-015 @ $29.99 each + HST 15 Puid CRA for income tax, CPP, and El for February, cheque (Note: Record as a compound entry in the cash payments No, 125 journal ACCOUNTING FOR BAD DEBTS 583 PCRA for HST duenery end of dry, chegoc12 Paid the Government of Ontario for medical premium du Cash sale summarized on invoice Na CD 1083 cont of Mar 15 15 for the month of February, cheque No 127. IN goods soll is calculated at 75% of sales); CD.OLO $59.95 each + HST CD 6245 $59.95 each + HST CT ON 15 5.10 each + HST CY.01 21 50 each + HST DIOP 10 $150 each + HIST DS 016 02 $250 each + HST SIC-014 $99 each + HST WD-01 5 $750 each + HST 18 cheque Na 128 19 invoice Na CD 1082 19 20 21 DI-01 CD-01 Paid Jones Company amount owed invoice No JC 52087) Bing Company received an allowance for its purchase on Credit memo No 001 was issued. No inventory was returned Paid Dresses by Shelley amount due, less 2% discount (invoice Na DS 12947). cheque No 129. Betty Locb withdrew $1,000 for her personal use, cheque Na 130, Sold to Sally's Store, invoice No CD 1084 10 @ $150 each + HST 10 @ $59.95 each + HST Purchased from Dresses by Shelley, invoice No. DS 13062. 50 @ $19 cach + HST 50 a $19 cach +HST Paid $10 from the petty cash fund for first aid emergency, voucher No. 04. Recorded and paid employees, cheques No 131, No 132 and Na 133 (cash payments journal). Issued cheque to Jane Holl for replenishment of petty cash fund, cheque Na 134 (compound entry in cash payments journal). 26 CD.01 CD-02 28 29 30 Additional Data a. Physical count of merchandise inventory is $6,500. b. Rental income earned, $300 (one month's rent from subletting, received in advance in February) c. Depreciation (straight-line): Delivery truck Residual value = $1,800, expected life of 5 years Computer Residual value = $ 300, expected life of 3 years Computer Residual value = 5 0, expected life of 2 years Software d. One month of insurance has expired. Corner Dress Shop The Tele Mini Practice Set will help you even wil the key concepts of the accounting de for merchandising company, along with the integration of payroll Betty Lab tok over the bovine known as The Corner Dress Shop on January 1, 2022 who had run it for over ten years Certain alles were assumed by Hetty's nebus Rom purchased the business name and we cept cash from her Aunt Marion, as part of the deal. information. It is your task to complete the accounting cycle for March 2022 You are the bookeeper of The Corner Dress Shop and have gathered the follow Mini Practice Set Estimated time 5 hours THE CORNER DES STOP TRIAL BALANCE FEBRUARY 26, 2 Account Title and Denon Call Perry Cash Accounts Receivaht Office Supplies Prepaid Rent Prepaid loan GST Prepaid Inventory Computer and Office Ferment Acc. Depo-Computer & Office Equipment Computer Software Ace Dep-Computer Software Delivery Truck Acc. Der's Delivery Truck Accounts Payable Income Taxes Payable El Payable CPP Parable Medical Plan Payable Charitable Donations Payable GST Collected Rent Received in Advance Berry Locb, Capital Betty Loeb, Withdrawals Sales Cost of Goods Sold Wares Expenses CPP Expense El apenas Insurance Es Rent Espeare Dr. 30 7 29 31 S000 829 185 62.430 180 000 100 000 43644 30 900 50 000 261 12 173900 6158 12 000 00 34000 4788 99 110 882 410879 810 30 112.00 180.00 2 31 366 60 000 480 78 80 7 30 000 598 6505 1907318 18 1/2000 81030 147 6 92 20 000 1 800 00 26112 61 58 340.00 1/460 00 118 92/9 10 118 929 10 Depo Esporte Computer & Otfice Equipment Dip'n span Sofra Dop'n Espano-Deliver Trick Acoranti peme Balances in subsidiary ledgers as of February 28: Accounts Receivable Ronald Co 55,538.00 Sully Store 2,75385 $2,543.77 1.51022 735.00 Accounts Payable Blew Co Dresses by Shelley Silk Magic de SGST Payroll is paid monthly, and employee claim codes are unchanged. The payroll register for January and February is provided on pages 582-583. In March, salaries are as follows (all deductions are the same unless indicated): Miel Casc $1,860 Assume all income taxes are calculated as 20% of gross wages Jane Holl 2,900 For CPP and El assume 0.0495 and 0.0188, respec tively. (Remember to include the calculation for CPP exemption of $3,500 per year.) Jackie Moore 4,300 Required a. Set up a general ledger, accounts receivable ledger, accounts payable ledger, max ciliary petty cash record, and payroll register. (Before beginning, be sure to update the ledger accounts on the basis of information given in the trial balance for February 28.) b. Journalize all transactions during March, using the special journals discussed in the text. Assume this company uses the perpetual inventory method. The practice set can be completed using either method of accounting for inventory. If no specife method is indicated by your instructor, use the perpetual method. Assume the cost of all inventory is 75% of its selling price. c. Prepare the payroll register for March. d. Update the accounts payable and accounts receivable subsidiary ledgers for March e. Post to the general ledger f. Prepare a trial balance on a worksheet and complete the worksheet as of March 31, 2022 Prepare an income statement, statement of owner's equity, and classified balance sheet. h. Journalize the adjusting and closing entries. i. Post the adjusting and closing entries to the ledger. 1. Prepare a post-closing trial balance. The chart of accounts for The Comer Dress Shop is provided on the next page 1110 Cash 1115 Petty Cash Chant of Account Liabilities 2100 Popole 2200w Wiges 2390 comessaytle 2335 Payable 2340CPP Payable 2350 Media Plan Payable 112 Accounts Receivable 1135 Office Supplies 140 Prepaid Rent 1145 Prepaid Insurance 1150 HST Prepaid 1210 Inventory 130 Computer and Office Equipment 1335 Ace Dep'n-Computer & Office Equipment 1340 Computer Software 345 Acc. Dep'n-Computer Software 1350 Delivery Truck 1355 Act. Dep'n-Delivery Truck Owner's Equity 310 Betty Loeb, Capital 30 Betty Loeb, Withdrawals 2360 Charitable Donations Public 2400 HST Collected 2500 Rent Received in Advance Revenue 4110 Sales 4140 Sales Discounts 4150 Sales Returns & Allowances 6 of Goods Sold 5 Cost of Goods Sold Expenses 5400 Wages Expense 5430 El Expense 5440 CPP Expense 5500 Postage Expense 5510 Insurance Expense 5520 Cleaning Expense 5530 Rent Expense 5540 Delivery Expense 5550 Dep'n, Expense-Computer and Office Equipment 5560 Dep'n. Expense-Software 5570 Dep'n. Expense-Delivery Truck 5590 Accounting Expense 5595 Miscellaneous Expense Throw 4 Paid rent cheque No 121 to Smithstone Realty, 5900,00 + HST Mar. 1 of 1.39 Purchased merchandise from Jones Company, invoice No C S07: CTO 50 $10 each + HST CY-01 50 510 each + HST Puid $6 from petty cash fund for doughnuts, voucher Na o (miscellaneous expense, NO HST). Sold merchandise on account to Morris Company, invoice No, CD 1081 (cost of goods sold is calculated as 75% of sales before GST): PO-015 $39.99 each + HST PO-025 $39.99 each + HST SIC-01 6 589 each + HST 5 Paid Dresses by Shelley 51,510.22 (invoice No DS 12895). cheque No. 122 Federal sor G PAYROLL.JOURNAL- JANUARY Provincial Cumulative CPP IT Fed + 1066.00 14.427 29 00 00 25 $52 3 Solo 459 84 fabe HD 4 21 IT-PowTocal 0.00 10027 1/2 503 so 55 22016 6 84.00 11082 9000.00 JANUARY CPP 1973 1 2 9 11 1 9841 Deduction Health Chantal 5097 2/8 00 2000 5452 4200 8084 42.00 40.00 M Net Py 11655 13 226582 325 475 9000 00515 17033 112.00 190.00 717570 APTER 12 PAYROLL JOURNALLARY Mel 40 2 14 ES 12 2018 GOO si 11 Che 11 50 10 1981 1941 28 Na 1 29 16SS 1900 3 4000 325823 420 20 TEO 11200 0752 Mat. 5 7 8 8 Received payment from Ronald Company, $5,558.00 invoice No CD 1078) Paid $12.60 (including GST) from petty cash fund for postage, voucher No. 02 Paid Blew Company $2,543.77, cheque No 123 (invoice No. BC 1795). Received payment from Sally Store invoice No CD 1076). $2,753.85 Paid 55 for delivery expense from petty cash fund, voucher No 03 Received amount due from Morris Company, less 25% discount Purchased from Dresses by Shelley, invoice No DS 12947 11 12 12 12 CD-01 75 @ $19 each + HST CD-02 75 $19 each + HST Paid cleaning service $300 + HST, cheque No. 124 (choque was issued to Cleaners Inc.). 13 Purchased from Blew Company, invoice No, BC 1896: DI-01 20 548 each + HST DS-01 20 @ $80 cach + HST PO-01 75 0 $12.50 cach + HST PO-02 75 @ $12.50 each + HST 15 Sold to Bing Company, invoice No CD 1082 (cost of goods sold is calculated as 75% of sales: SD-015 @ $29.99 each + HST 15 Puid CRA for income tax, CPP, and El for February, cheque (Note: Record as a compound entry in the cash payments No, 125 journal ACCOUNTING FOR BAD DEBTS 583 PCRA for HST duenery end of dry, chegoc12 Paid the Government of Ontario for medical premium du Cash sale summarized on invoice Na CD 1083 cont of Mar 15 15 for the month of February, cheque No 127. IN goods soll is calculated at 75% of sales); CD.OLO $59.95 each + HST CD 6245 $59.95 each + HST CT ON 15 5.10 each + HST CY.01 21 50 each + HST DIOP 10 $150 each + HIST DS 016 02 $250 each + HST SIC-014 $99 each + HST WD-01 5 $750 each + HST 18 cheque Na 128 19 invoice Na CD 1082 19 20 21 DI-01 CD-01 Paid Jones Company amount owed invoice No JC 52087) Bing Company received an allowance for its purchase on Credit memo No 001 was issued. No inventory was returned Paid Dresses by Shelley amount due, less 2% discount (invoice Na DS 12947). cheque No 129. Betty Locb withdrew $1,000 for her personal use, cheque Na 130, Sold to Sally's Store, invoice No CD 1084 10 @ $150 each + HST 10 @ $59.95 each + HST Purchased from Dresses by Shelley, invoice No. DS 13062. 50 @ $19 cach + HST 50 a $19 cach +HST Paid $10 from the petty cash fund for first aid emergency, voucher No. 04. Recorded and paid employees, cheques No 131, No 132 and Na 133 (cash payments journal). Issued cheque to Jane Holl for replenishment of petty cash fund, cheque Na 134 (compound entry in cash payments journal). 26 CD.01 CD-02 28 29 30 Additional Data a. Physical count of merchandise inventory is $6,500. b. Rental income earned, $300 (one month's rent from subletting, received in advance in February) c. Depreciation (straight-line): Delivery truck Residual value = $1,800, expected life of 5 years Computer Residual value = $ 300, expected life of 3 years Computer Residual value = 5 0, expected life of 2 years Software d. One month of insurance has expired Worksheet, Income Statement, Owners Equity, Balance Sheet and Trial balance of this Transacafions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started