Question: Do you happen to know the answers for all 7 questions? Let me know and show work below. Question 1. Question 2. Question 3. Question

Do you happen to know the answers for all 7 questions? Let me know and show work below.

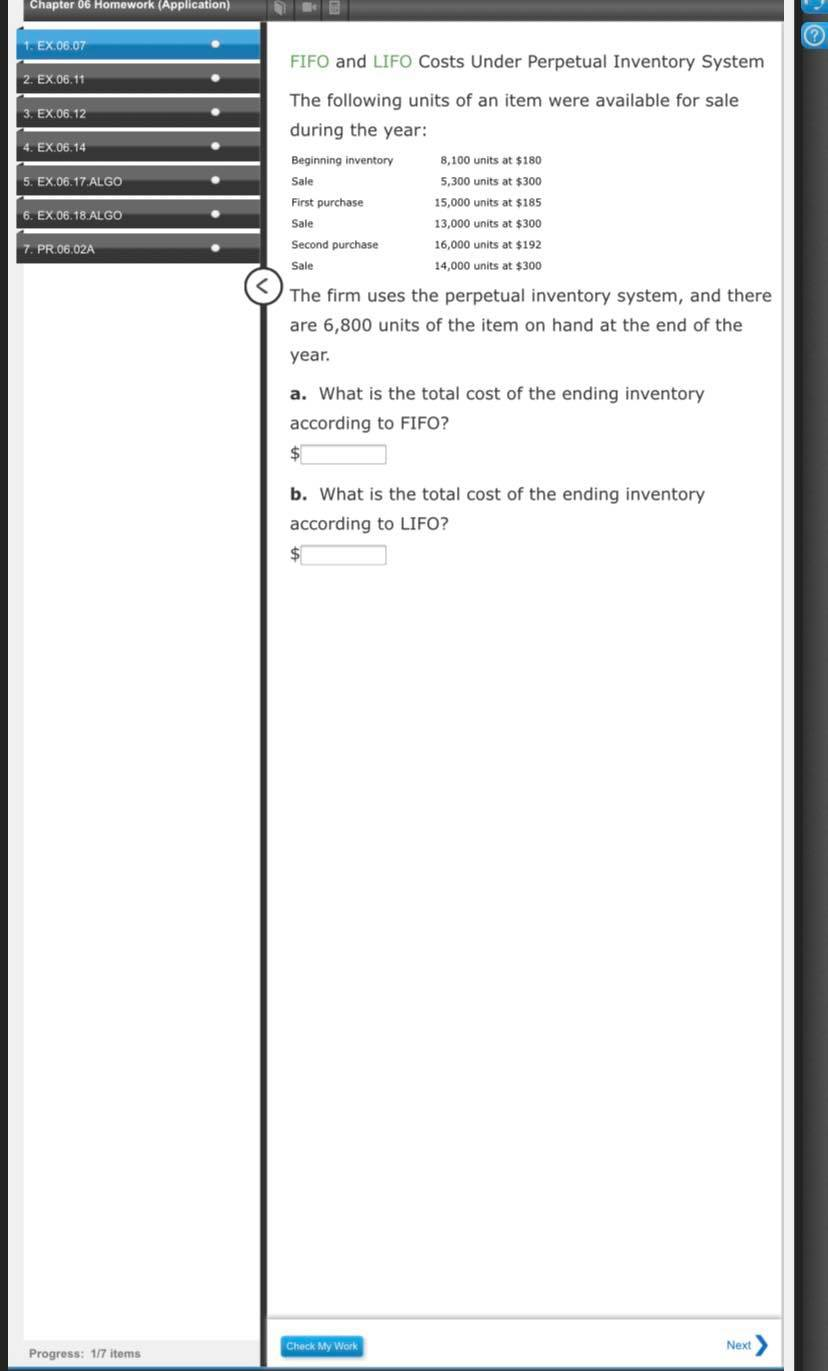

Question 1.

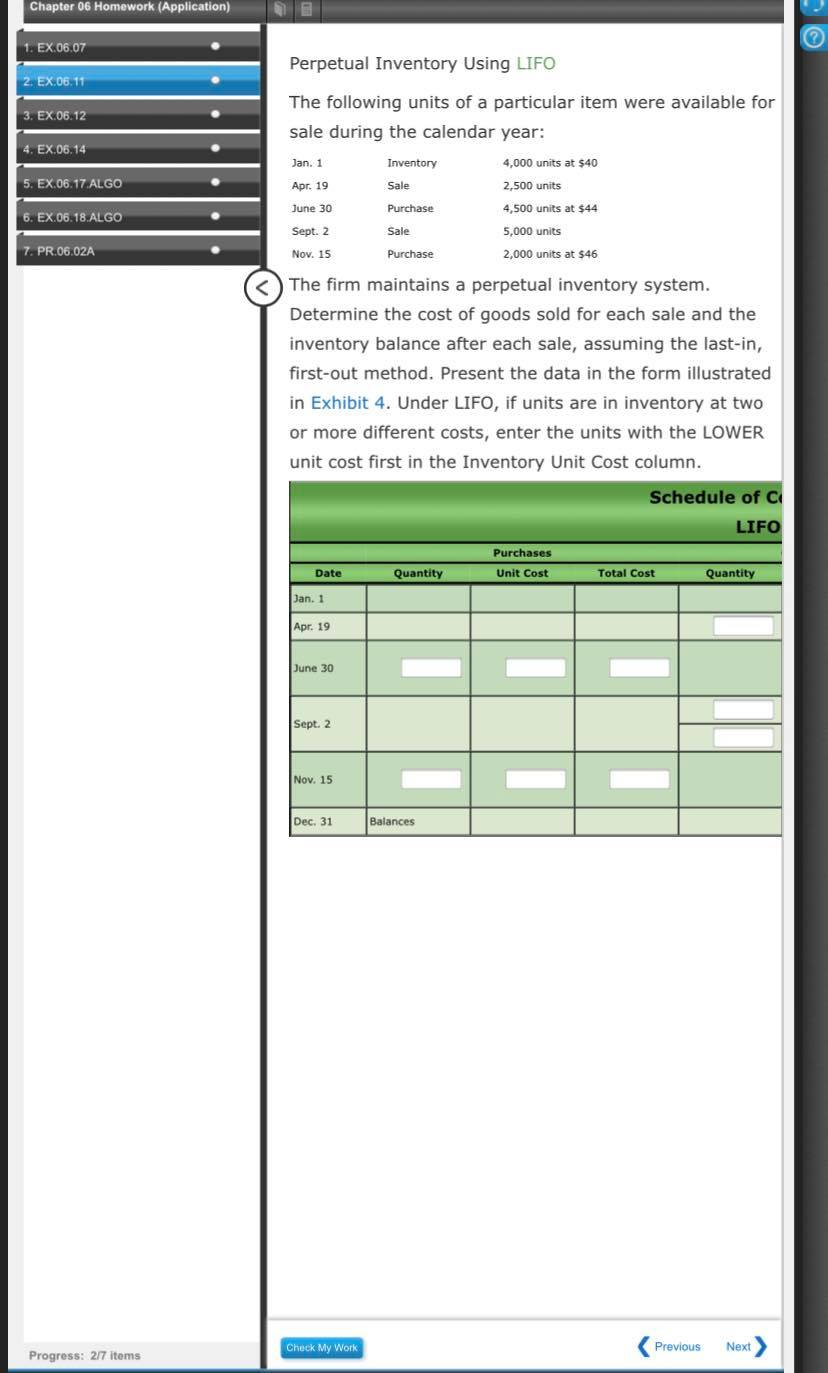

Question 2.

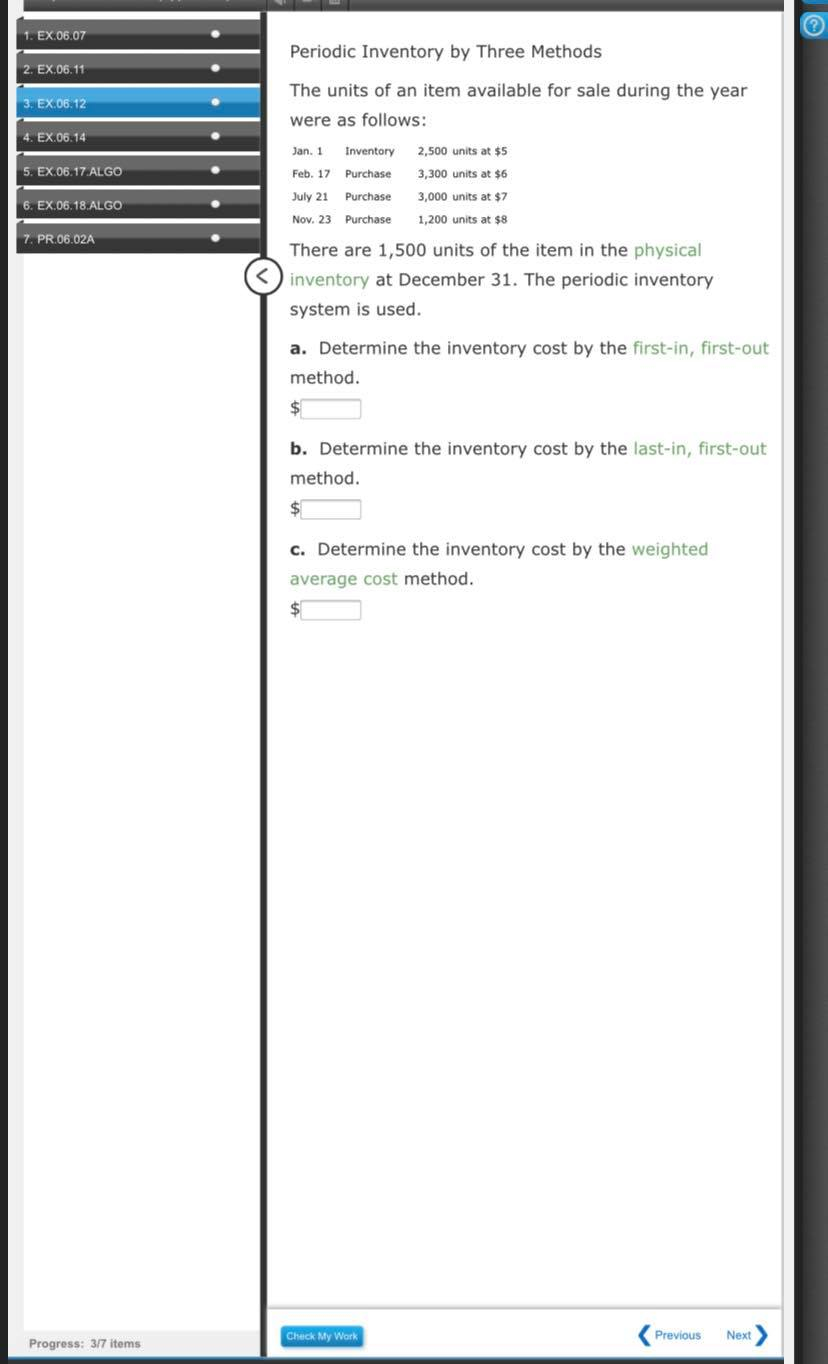

Question 3.

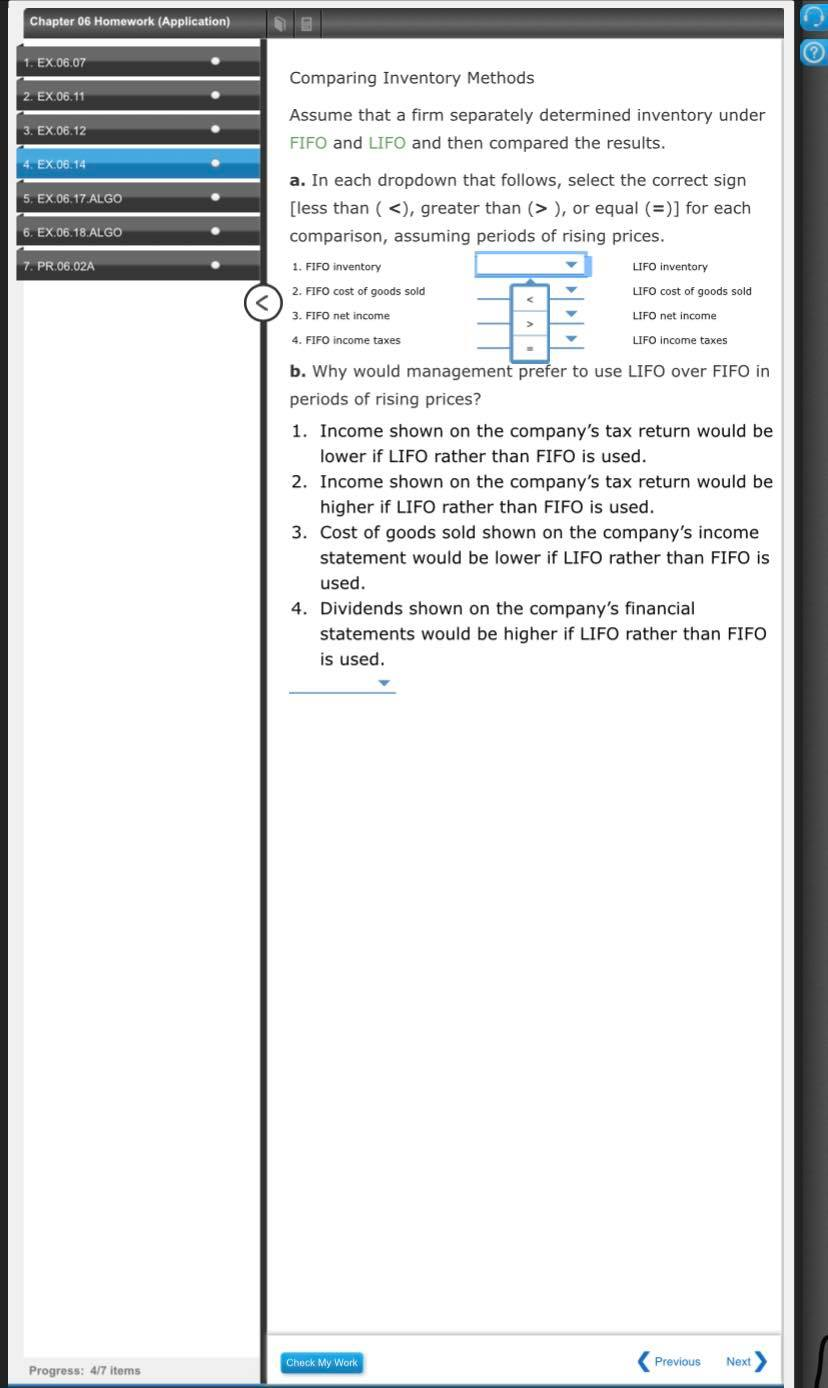

Question 4.

Question 5.

Question 6

Question 7.

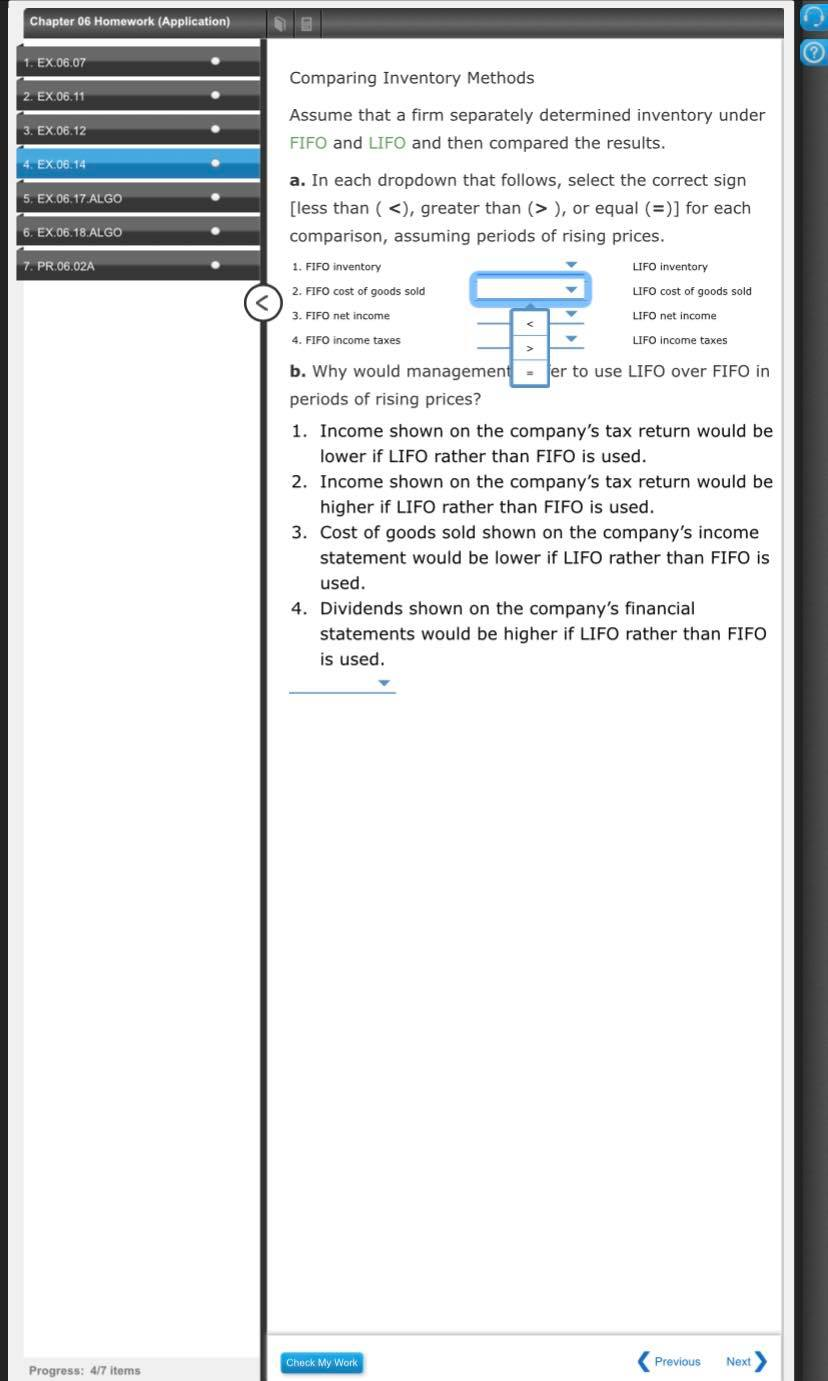

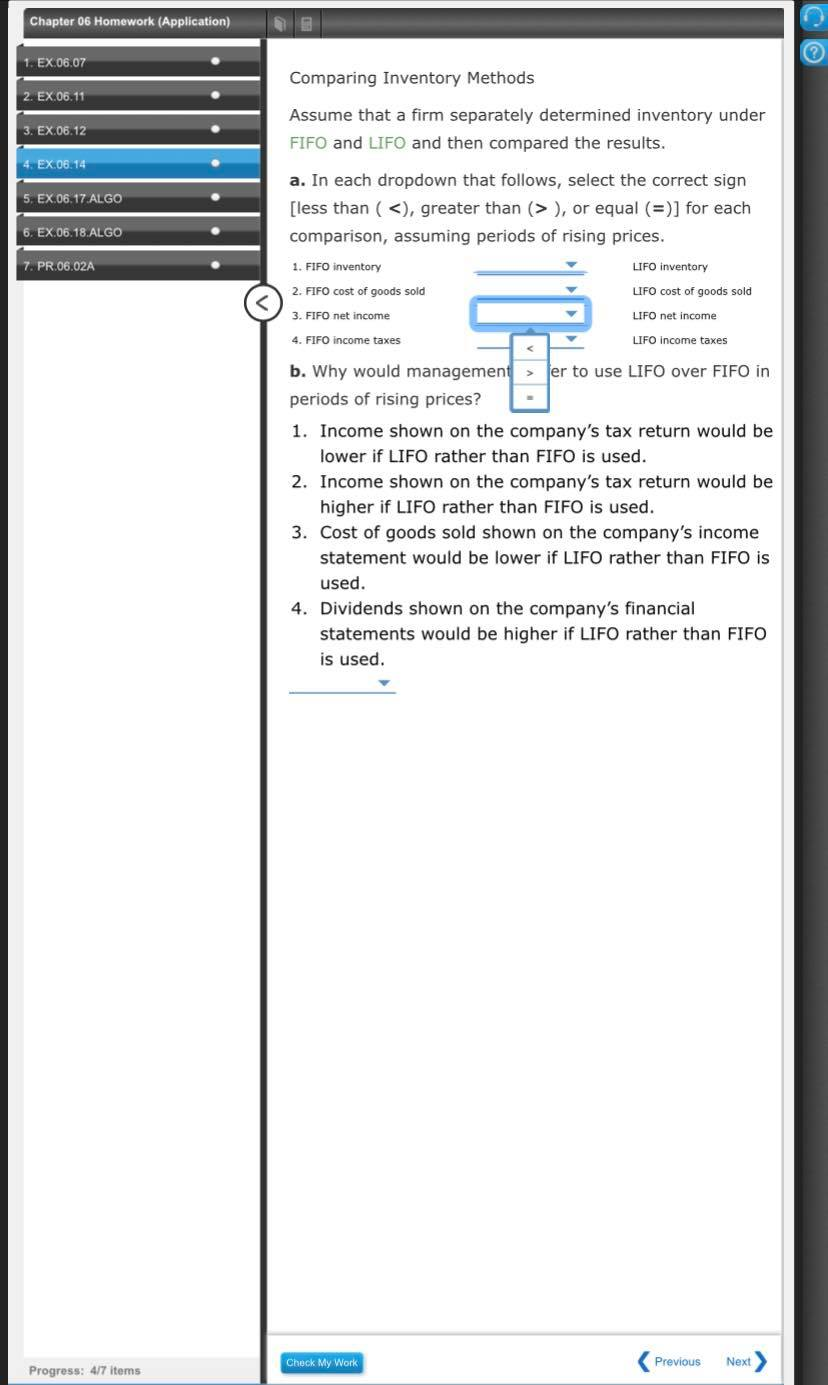

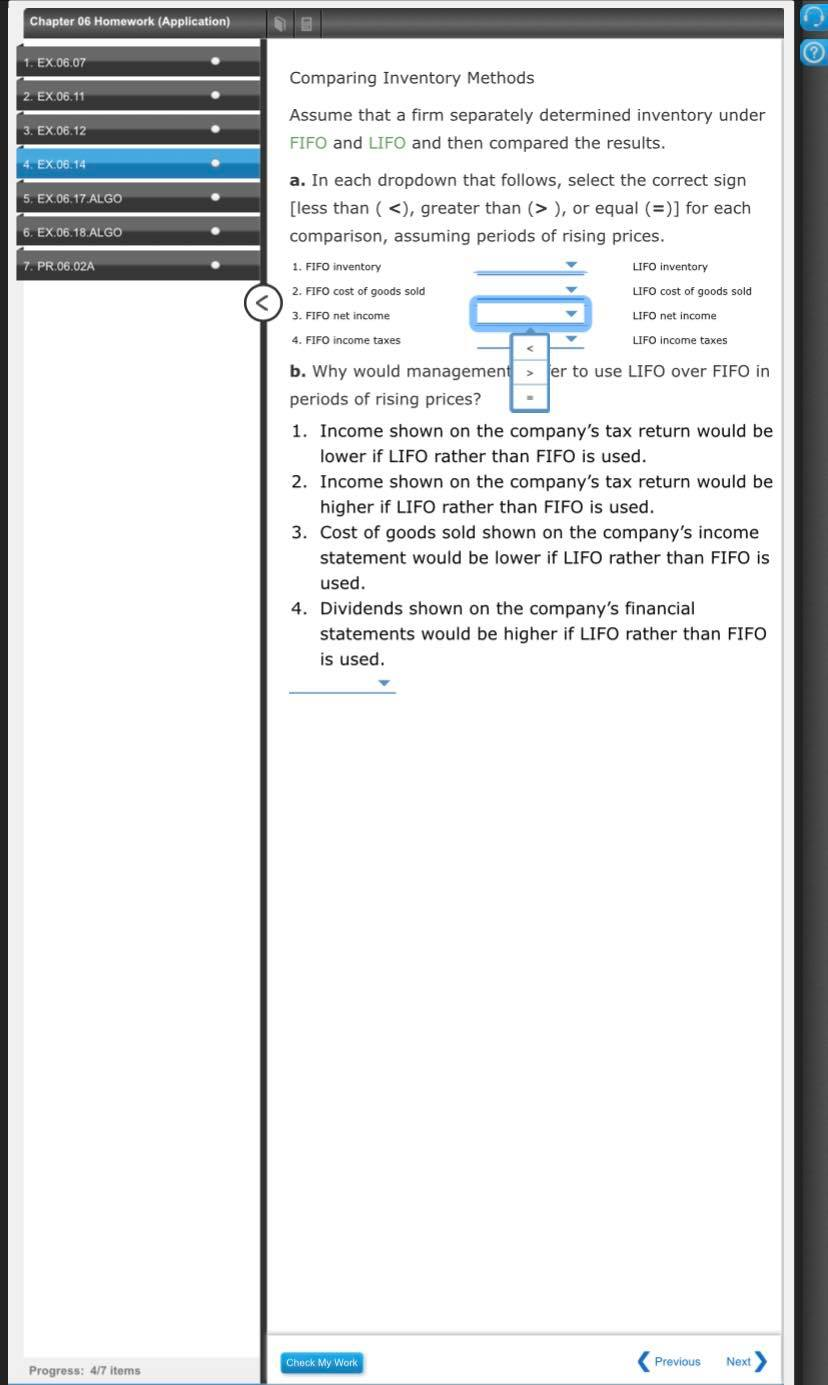

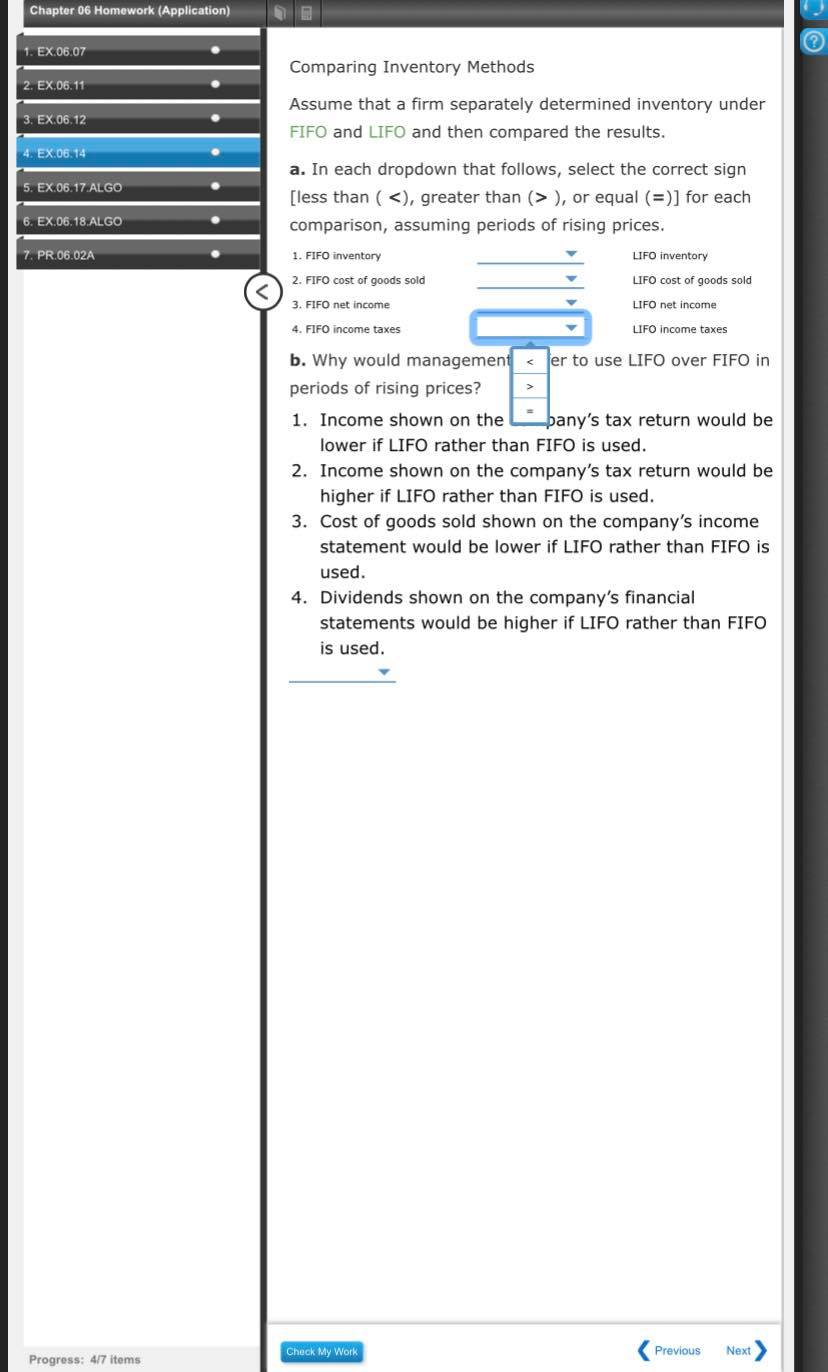

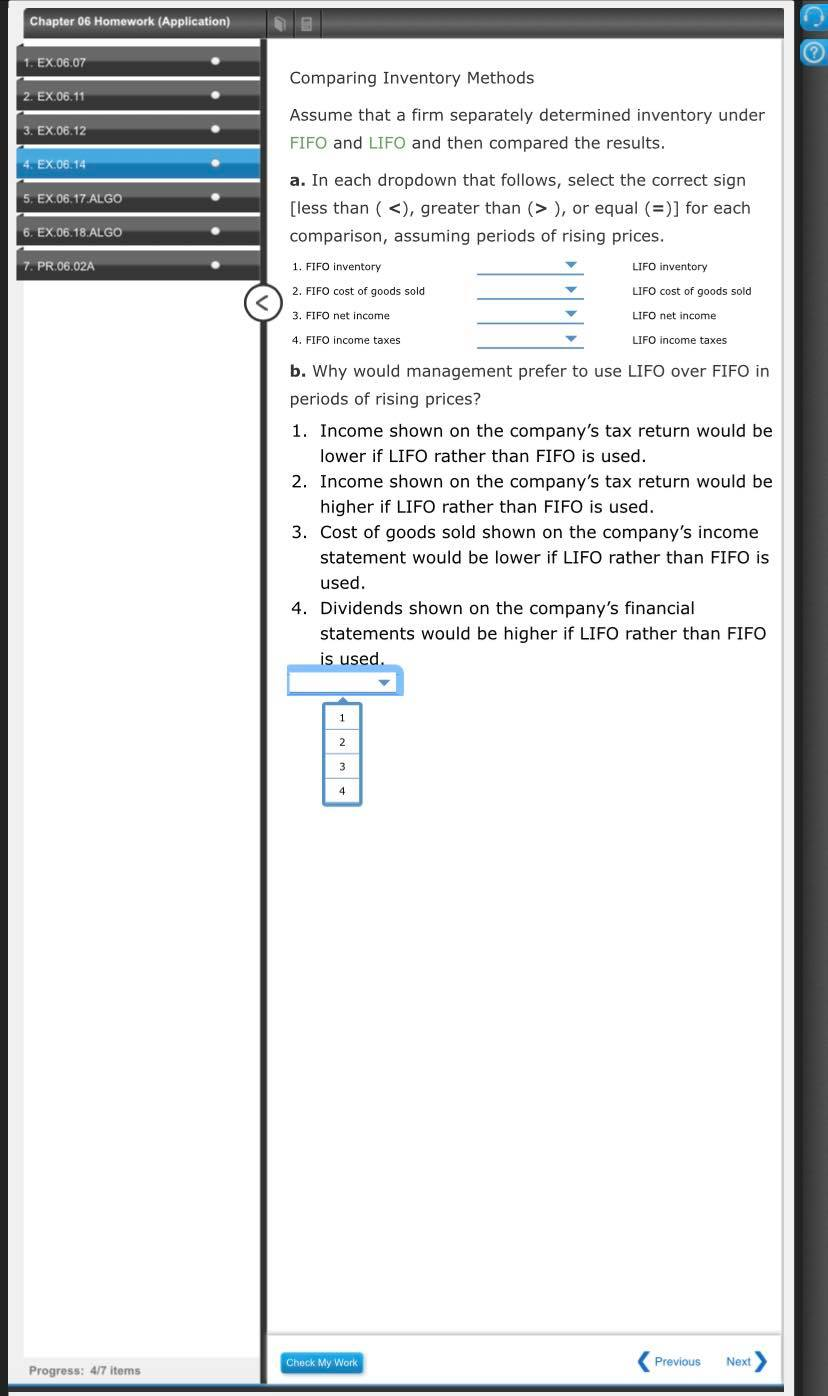

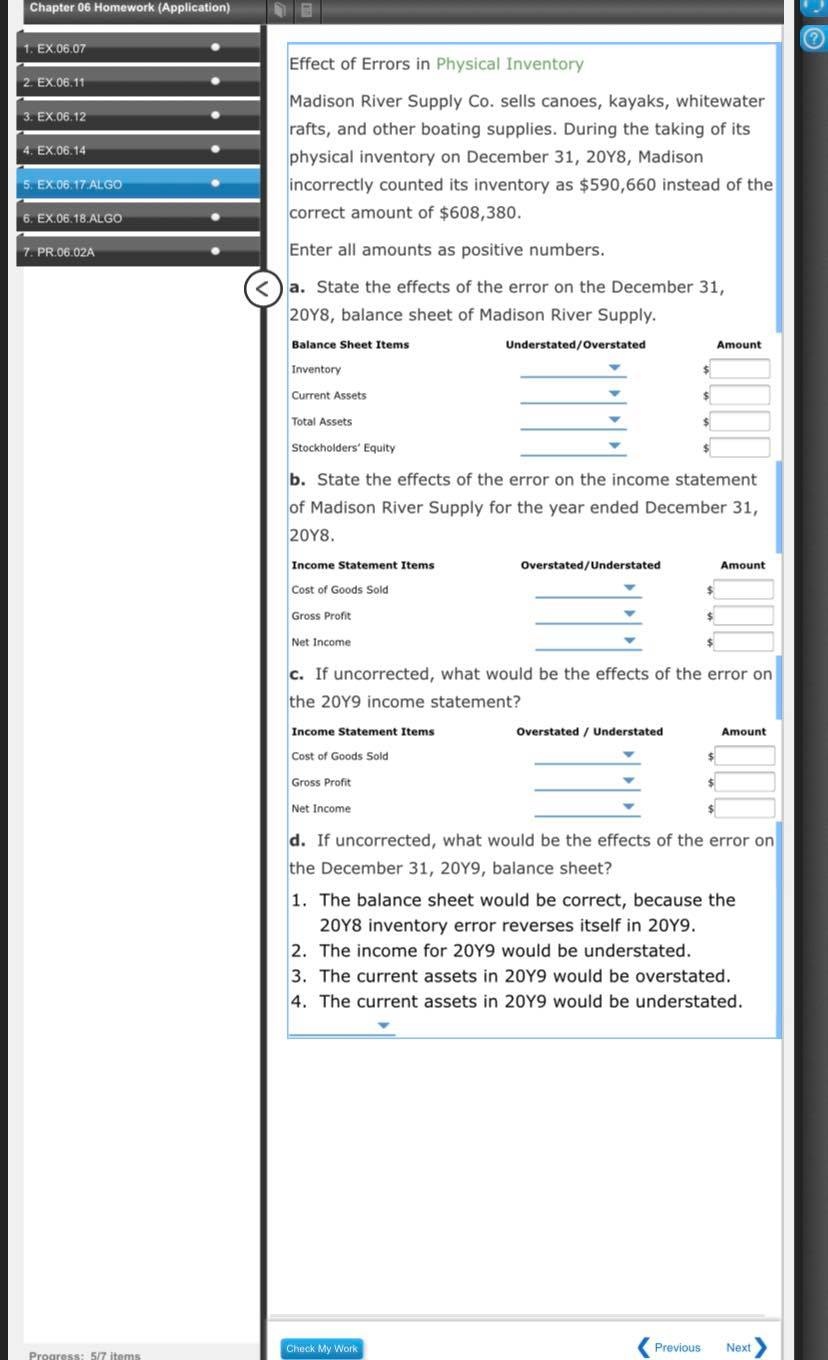

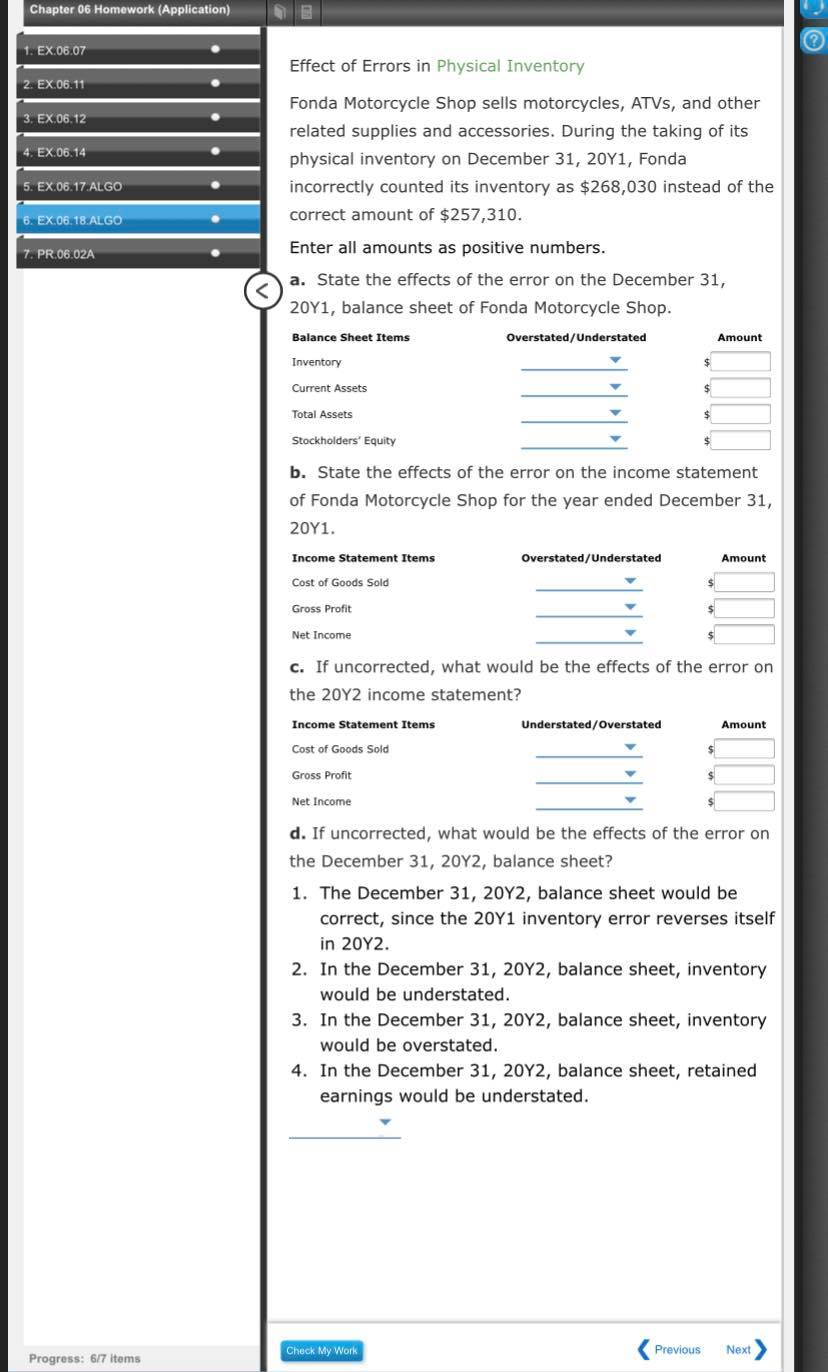

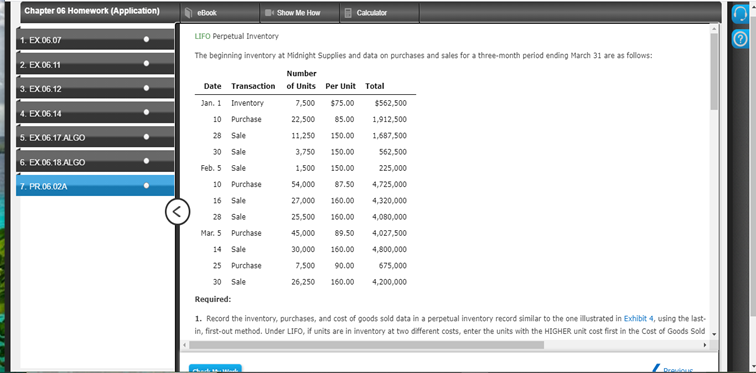

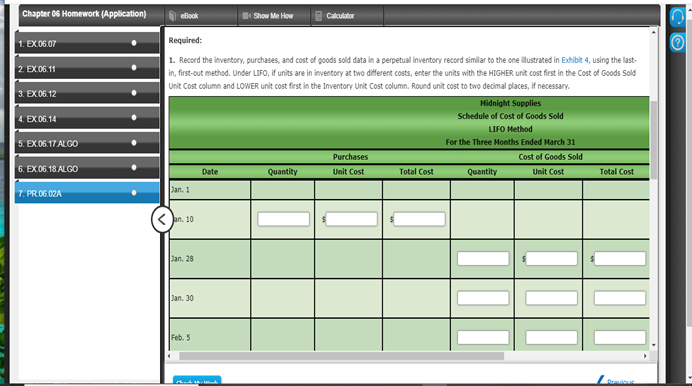

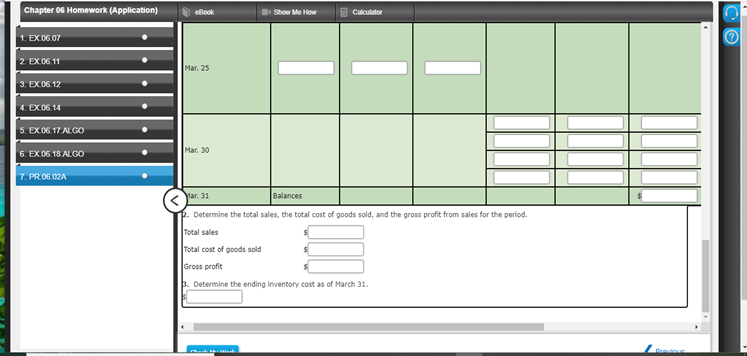

Chapter 06 Homework (Application) ? 1. EX.06.07 FIFO and LIFO Costs Under Perpetual Inventory System 2. EX.06.11 3. EX.06.12 4. EX.06.14 5. EX.06.17 ALGO 6. EX.06.18.ALGO The following units of an item were available for sale during the year: Beginning inventory 8,100 units at $180 Sale 5,300 units at $300 First purchase 15,000 units at $185 Sale 13,000 units at $300 Second purchase 16,000 units at $192 Sale 14,000 units at $300 The firm uses the perpetual inventory system, and there are 6,800 units of the item on hand at the end of the year. 7. PR.06.02A a. What is the total cost of the ending inventory according to FIFO? $ b. What is the total cost of the ending inventory according to LIFO? Check My Work Next Progress: 1/7 items Chapter 06 Homework (Application) 1. EX.06.07 Perpetual Inventory Using LIFO 2. EX.06.11 3. EX.06.12 The following units of a particular item were available for sale during the calendar year: 4. EX.06.14 4,000 units at $40 Jan. 1 Apr. 19 Inventory Sale 5. EX.06.17 ALGO 2,500 units June 30 4,500 units at $44 6. EX.06.18.ALGO Purchase Sale 5,000 units Sept. 2 Nov. 15 7. PR.06.02A Purchase 2,000 units at $46 The firm maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two or more different costs, enter the units with the LOWER unit cost first in the Inventory Unit Cost column. Schedule of C LIFO Purchases Unit Cost Date Quantity Total Cost Quantity Jan. 1 Apr. 19 June 30 Sept. 2 Nov. 15 Dec. 31 Balances Check My Work Previous Next Progress: 217 items 1. EX.06.07 Periodic Inventory by Three Methods 2. EX.06.11 3. EX.06.12 4. EX.06.14 The units of an item available for sale during the year were as follows: Jan. 1 Inventory 2,500 units at $5 Feb. 17 Purchase 3,300 units at $6 July 21 Purchase 3,000 units at $7 Nov. 23 Purchase 1,200 units at $8 5. EX.06.17. ALGO 6. EX.06.18.ALGO 7. PR.06.02A There are 1,500 units of the item in the physical inventory at December 31. The periodic inventory system is used. a. Determine the inventory cost by the first-in, first-out method. $ b. Determine the inventory cost by the last-in, first-out method. $ c. Determine the inventory cost by the weighted average cost method. $ Check My Work Previous Next Progress: 3/7 items Chapter 06 Homework (Application) 1. EX.06.07 Comparing Inventory Methods 2. EX.06.11 3. EX.06.12 Assume that a firm separately determined inventory under FIFO and LIFO and then compared the results. 4. EX.06.14 5. EX.06.17.ALGO a. In each dropdown that follows, select the correct sign [less than (), or equal (=)] for each comparison, assuming periods of rising prices. EX.06.18.ALGO 7. PR.06.02A 1. FIFO inventory LIFO inventory 2. FIFO cost of goods sold LIFO cost of goods sold 3. FIFO net income LIFO net income 4. FIFO income taxes LIFO income taxes b. Why would management prefer to use LIFO over FIFO in periods of rising prices? 1. Income shown on the company's tax return would be lower if LIFO rather than FIFO is used. 2. Income shown on the company's tax return would be higher if LIFO rather than FIFO is used. 3. Cost of goods sold shown on the company's income statement would be lower if LIFO rather than FIFO is used. 4. Dividends shown on the company's financial statements would be higher if LIFO rather than FIFO is used. Check My Work ( Previous Previous Next Progress: 4/7 items Chapter 06 Homework (Application) 1. EX.06.07 Comparing Inventory Methods 2. EX.06.11 3. EX.06.12 Assume that a firm separately determined inventory under FIFO and LIFO and then compared the results. 4. EX.06.14 5. EX.06.17.ALGO a. In each dropdown that follows, select the correct sign [less than (), or equal (=)] for each comparison, assuming periods of rising prices. EX.06.18.ALGO 7. PR.06.02A 1. FIFO inventory LIFO inventory LIFO cost of goods sold 2. FIFO cost of goods sold 3. FIFO net income LIFO net income 4. FIFO income taxes LIFO income taxes b. Why would management jer to use LIFO over FIFO in periods of rising prices? 1. Income shown on the company's tax return would be lower if LIFO rather than FIFO is used. 2. Income shown on the company's tax return would be higher if LIFO rather than FIFO is used. 3. Cost of goods sold shown on the company's income statement would be lower if LIFO rather than FIFO is used. 4. Dividends shown on the company's financial statements would be higher if LIFO rather than FIFO is used. Check My Work Previous Next Progress: 4/7 items Chapter 06 Homework (Application) 1. EX.06.07 Comparing Inventory Methods 2. EX.06.11 3. EX.06.12 Assume that a firm separately determined inventory under FIFO and LIFO and then compared the results. 4. EX.06.14 5. EX.06.17.ALGO a. In each dropdown that follows, select the correct sign [less than (), or equal (=)] for each comparison, assuming periods of rising prices. EX.06.18.ALGO 7. PR.06.02A 1. FIFO inventory LIFO inventory LIFO cost of goods sold 2. FIFO cost of goods sold 3. FIFO net income LIFO net income 4. FIFO income taxes LIFO income taxes b. Why would management > jer to use LIFO over FIFO in periods of rising prices? 1. Income shown on the company's tax return would be lower if LIFO rather than FIFO is used. 2. Income shown on the company's tax return would be higher if LIFO rather than FIFO is used. 3. Cost of goods sold shown on the company's income statement would be lower if LIFO rather than FIFO is used. 4. Dividends shown on the company's financial statements would be higher if LIFO rather than FIFO is used. Check My Work Previous Previous Next Progress: 4/7 items Chapter 06 Homework (Application) 1. EX.06.07 Comparing Inventory Methods 2. EX.06.11 3. EX.06.12 Assume that a firm separately determined inventory under FIFO and LIFO and then compared the results. 4. EX.06.14 5. EX.06.17.ALGO a. In each dropdown that follows, select the correct sign [less than (), or equal (=)] for each comparison, assuming periods of rising prices. EX.06.18.ALGO 7. PR.06.02A 1. FIFO inventory LIFO inventory LIFO cost of goods sold 2. FIFO cost of goods sold 3. FIFO net income LIFO net income 4. FIFO income taxes LIFO income taxes b. Why would management > jer to use LIFO over FIFO in periods of rising prices? 1. Income shown on the company's tax return would be lower if LIFO rather than FIFO is used. 2. Income shown on the company's tax return would be higher if LIFO rather than FIFO is used. 3. Cost of goods sold shown on the company's income statement would be lower if LIFO rather than FIFO is used. 4. Dividends shown on the company's financial statements would be higher if LIFO rather than FIFO is used. Check My Work Previous Previous Next Progress: 4/7 items Chapter 06 Homework (Application) 1. EX.06.07 Comparing Inventory Methods 2. EX.06.11 3. EX.06.12 Assume that a firm separately determined inventory under FIFO and LIFO and then compared the results. 4. EX.06.14 5. EX.06.17. ALGO a. In each dropdown that follows, select the correct sign [less than (), or equal (=)] for each comparison, assuming periods of rising prices. 6. EX.06.18.ALGO 7. PR.06.02A 1. FIFO inventory LIFO inventory LIFO cost of goods sold 2. FIFO cost of goods sold 3. FIFO net income 4. FIFO income taxes LIFO net income LIFO income taxes b. Why would management ), or equal (=)] for each comparison, assuming periods of rising prices. EX.06.18.ALGO 7. PR.06.02A 1. FIFO inventory LIFO inventory 2. FIFO cost of goods sold LIFO cost of goods sold 3. FIFO net income LIFO net income 4. FIFO income taxes LIFO income taxes b. Why would management prefer to use LIFO over FIFO in periods of rising prices? 1. Income shown on the company's tax return would be lower if LIFO rather than FIFO is used. 2. Income shown on the company's tax return would be higher if LIFO rather than FIFO is used. 3. Cost of goods sold shown on the company's income statement would be lower if LIFO rather than FIFO is used. 4. Dividends shown on the company's financial statements would be higher if LIFO rather than FIFO is used. 1 2 3 4 Check My Work Previous Next Progress: 4/7 items Chapter 06 Homework (Application) 1. EX.06.07 Effect of Errors in Physical Inventory 2. EX.06.11 3. EX.06.12 4. EX.06.14 EX.06.17 ALGO 6. EX.06.18.ALGO Madison River Supply Co. sells canoes, kayaks, whitewater rafts, and other boating supplies. During the taking of its physical inventory on December 31, 20Y8, Madison incorrectly counted its inventory as $590,660 instead of the correct amount of $608,380. Enter all amounts as positive numbers. a. State the effects of the error on the December 31, 20Y8, balance sheet of Madison River Supply, Balance Sheet Items Understated/Overstated Amount Inventory 7. PR.06.02A Current Assets Total Assets Stockholders' Equity b. State the effects of the error on the income statement of Madison River Supply for the year ended December 31, 2018. Income Statement Items Overstated/Understated Amount Cost of Goods Sold Gross Profit Net Income c. If uncorrected, what would be the effects of the error on the 2049 income statement? Income Statement Items Overstated / Understated Amount Cost of Goods Sold Gross Profit $ Net Income $ d. If uncorrected, what would be the effects of the error on the December 31, 2019, balance sheet? 1. The balance sheet would be correct, because the 2048 inventory error reverses itself in 2019. 2. The income for 2049 would be understated. 3. The current assets in 2019 would be overstated. 4. The current assets in 2019 would be understated. Check My Work Previous Next Progress: 5/7 items Chapter 06 Homework (Application) 1. EX.06.07 Effect of Errors in Physical Inventory 2. EX.06.11 3. EX.06.12 EX.06.14 5. EX.06.17 ALGO 6. EX.06.18.ALGO Fonda Motorcycle Shop sells motorcycles, ATVs, and other related supplies and accessories. During the taking of its physical inventory on December 31, 20Y1, Fonda incorrectly counted its inventory as $268,030 instead of the correct amount of $257,310. Enter all amounts as positive numbers. a. State the effects of the error on the December 31, 20Y1, balance sheet of Fonda Motorcycle Shop. Balance Sheet Items Overstated/Understated Amount 7. PR.06.02A Inventory Current Assets Total Assets Stockholders' Equity b. State the effects of the error on the income statement of Fonda Motorcycle Shop for the year ended December 31, 20Y1. Income Statement Items Overstated/Understated Amount Cost of Goods Sold Gross Profit Net Income c. If uncorrected, what would be the effects of the error on the 20Y2 income statement? Income Statement Items Understated/Overstated Amount Cost of Goods Sold Gross Profit Net Income $ d. If uncorrected, what would be the effects of the error on the December 31, 20Y2, balance sheet? 1. The December 31, 2012, balance sheet would be correct, since the 20Y1 inventory error reverses itself in 2012. 2. In the December 31, 20Y2, balance sheet, inventory would be understated. 3. In the December 31, 20Y2, balance sheet, inventory would be overstated. 4. In the December 31, 20Y2, balance sheet, retained earnings would be understated. Check My Work Previous Next Progress: 6/7 items Chapter 06 Homework (Application) eBook Show Me How Calculator 1. EX 06.07 2. EX.06.11 3. EX.06.12 4. EX.06.14 5. EX.06.17 ALGO 6. EX 06.18 ALGO LIFO Perpetual Inventory The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending March 31 are as follows: Number Date Transaction of Units Per Unit Total Jan. 1 Inventory 7,500 $75.00 $562,500 10 Purchase 22.500 85.00 1,912,500 28 Sale 11.250 150.00 1,687,500 30 Sale 3,750 150.00 562,500 Feb. 5 Sale 1,500 150.00 225,000 10 Purchase 54,000 87.50 4,725,000 16 Sale 27,000 160.00 4,320,000 28 Sale 25.500 160.00 4,080,000 Mar. 5 Purchase 45,000 89.50 4,027,500 14 Sale 30,000 160.00 4,800,000 25 Purchase 7.500 90.00 675,000 30 Sale 26,250 160.00 4,200,000 Required: 7. PR 06 02A 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last- in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the cost of Goods Sold Chapter 06 Homework (Application) eBook Show Me How Calculator Co 1. EX.06.07 2. EX.06.11 3. EX.06.12 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last- in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Round unit cost to two decimal places, if necessary. Midnight Supplies Schedule of Cost of Goods Sold LIFO Method For the Three Months Ended March 31 Purchases Cost of Goods Sold Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost 4. EX.06.14 5. EX.06.17 ALGO 6. EX.06.18 ALGO Date Jan. 1 7. PR 06.02A Jan. 10 Jan. 28 Jan. 30 Feb. 5 Chapter 06 Homework (Application) eBook Calculator Show Me How C 1. EX.06.07 2. EX.06.11 Mar. 25 3. EX.06.12 4. EX.06.14 5. EX.06.17 ALGO 6. EX.06.18 ALGO Mar. 30 7. PR 06.02A Mar. 31 Balances P. Determine the total sales, the total cost of goods sold, and the gross profit from sales for the period. Total sales Total cost of goods sold Gross profit 3. Determine the ending inventory cost as of March 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts