Question

Doaktown Products manufactures fishing equipment for recreational uses. The Miramichi plant produces the companys two versions of a special reel used for river fishing. The

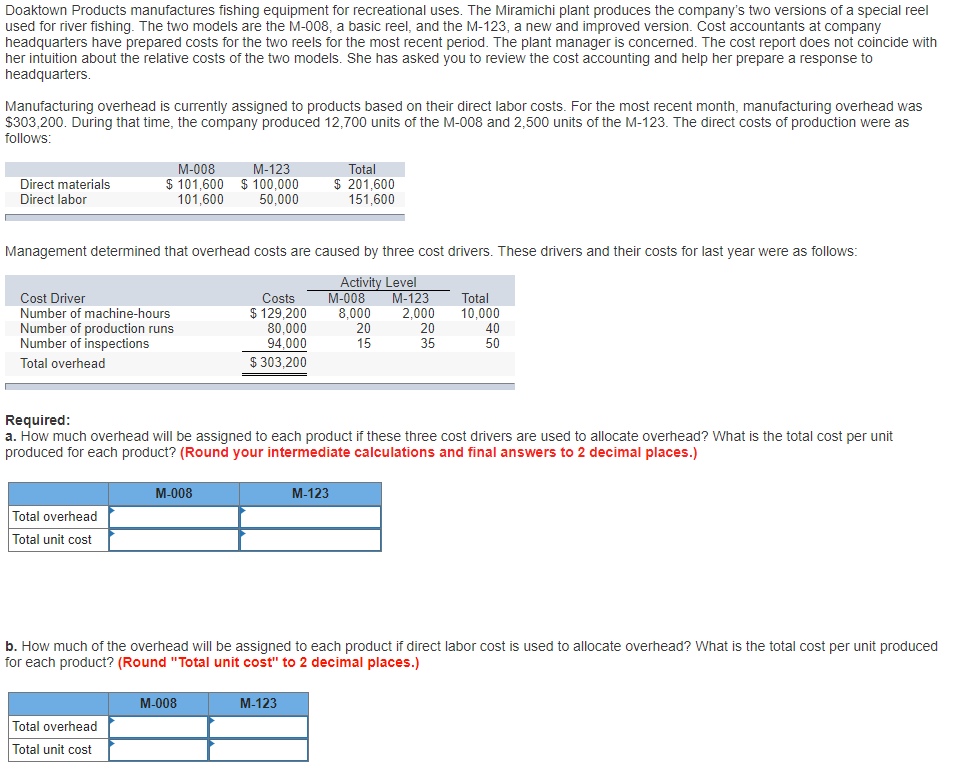

Doaktown Products manufactures fishing equipment for recreational uses. The Miramichi plant produces the companys two versions of a special reel used for river fishing. The two models are the M-008, a basic reel, and the M-123, a new and improved version. Cost accountants at company headquarters have prepared costs for the two reels for the most recent period. The plant manager is concerned. The cost report does not coincide with her intuition about the relative costs of the two models. She has asked you to review the cost accounting and help her prepare a response to headquarters.

Manufacturing overhead is currently assigned to products based on their direct labor costs. For the most recent month, manufacturing overhead was $303,200. During that time, the company produced 12,700 units of the M-008 and 2,500 units of the M-123. The direct costs of production were as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started