Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DocuSign, Inc. Common Stock Dollar Tree Inc. Common Stock eBay Inc. Common Stock Electronic Arts Inc. Common Stock Exelon Corporation Common Stock Expedia Group, Inc.

| DocuSign, Inc. Common Stock | Dollar Tree Inc. Common Stock | eBay Inc. Common Stock | Electronic Arts Inc. Common Stock | Exelon Corporation Common Stock | Expedia Group, Inc. Common Stock | Tesla, Inc. Common Stock | Texas Instruments Incorporated Common Stock | The Kraft Heinz Company Common Stock | Trip.com Group Limited American Depositary Shares | |

| Stock price | $ 185.50 | $ 90.50 | $ 57.72 | $ 140.45 | $ 37.34 | $ 87.60 | $ 1,428.36 | $ 138.28 | $ 36.02 | $ 28.29 |

| Growth rate | 2.8% | 4.1% | 1.1% | 2.3% | 2.5% | 0.8% | 1.0% | 0.9% | 1.0% | 1.4% |

| DPS Dividend per share (just paid annual dividend) | $ 9.18 | $ 8.12 | $ 4.57 | $ 12.80 | $ 5.58 | $ 7.16 | $ 151.25 | $ 12.07 | $ 3.58 | $ 2.34 |

| EPS Earnings per share | $ 15.61 | $ 13.80 | $ 7.58 | $ 21.76 | $ 9.49 | $ 12.17 | $ 257.13 | $ 20.52 | $ 6.09 | $ 3.98 |

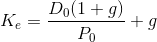

| Name of Company | Dividend Yield Dividend per share/Current Stock price*100 | Capital Gain yield I.e Growth rate | Required return on stock (based on Dividend growth model)

|

| Docusign inc. | $9.18/$185.50*100=4.95% | 2.8% | ={[9.18(1+2.8%)]/185.50}+2.8%=7.89% |

| Dollar tree inc. | $8.12/$90.50*100=8.97% | 4.1% | ={[8.12(1+4.1%)]/90.50}+4.1%=13.44% |

| eBay inc. | $4.57/$57.72*100=7.92% | 1.1% | ={[4.57(1+1.1%)]}/57.72}+1.1%=9.10% |

| Electronic Arts inc. | $12.80/$140.45*100=9.11% | 2.3% | ={[12.80(1+2.3%)]/140.45}+2.3%=9.54% |

| Exelon corporation | $5.58/$37.34*100=14.94% | 2.5% | ={[5.58(1+2.5%)]/37.34}+2.5%=17.82% |

| Expedia Group,inc. | $7.16/$87.60*100=8.17% | 0.8% | ={[7.16(1+0.8%)]/87.60}+0.8%=9.04% |

| Tesla, inc. | $151.25/$1428.36*100=10.59% | 1.0% | ={[151.25(1+1%)]/1428.36}+1%=11.69% |

| Texas instruments incorporated | $12.07/$138.28*100=8.73% | 0.9% | ={[12.07(1+0.9%)]/138.28}+0.9%=9.71% |

| The Kfraft Heinz company | $3.58/$36.02*100=9.94% | 1.0% | ={[3.58(1+1%)]/36.02}+1%=11.04% |

| Trip.com group limited | $2.34/$28.29*100=8.27% | 1.4% | ={[2.34(1+1.4%)]/28.29}+1.4%=9.79% |

| Best Company | Exelon corporation | Dollar Tree Inc. | Exelon corporation |

- What will be the share prices of the selected company in 4 years, considering the dividend growth model, if the required rate of return is 10%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started