Does anyone have the Systems Understanding Aid 9th Edition Transaction List A Balance Sheet and Income Statement? This would be the December 2017 entries.

Does anyone have the Systems Understanding Aid 9th Edition Transaction List A Balance Sheet and Income Statement? This would be the December 2017 entries.

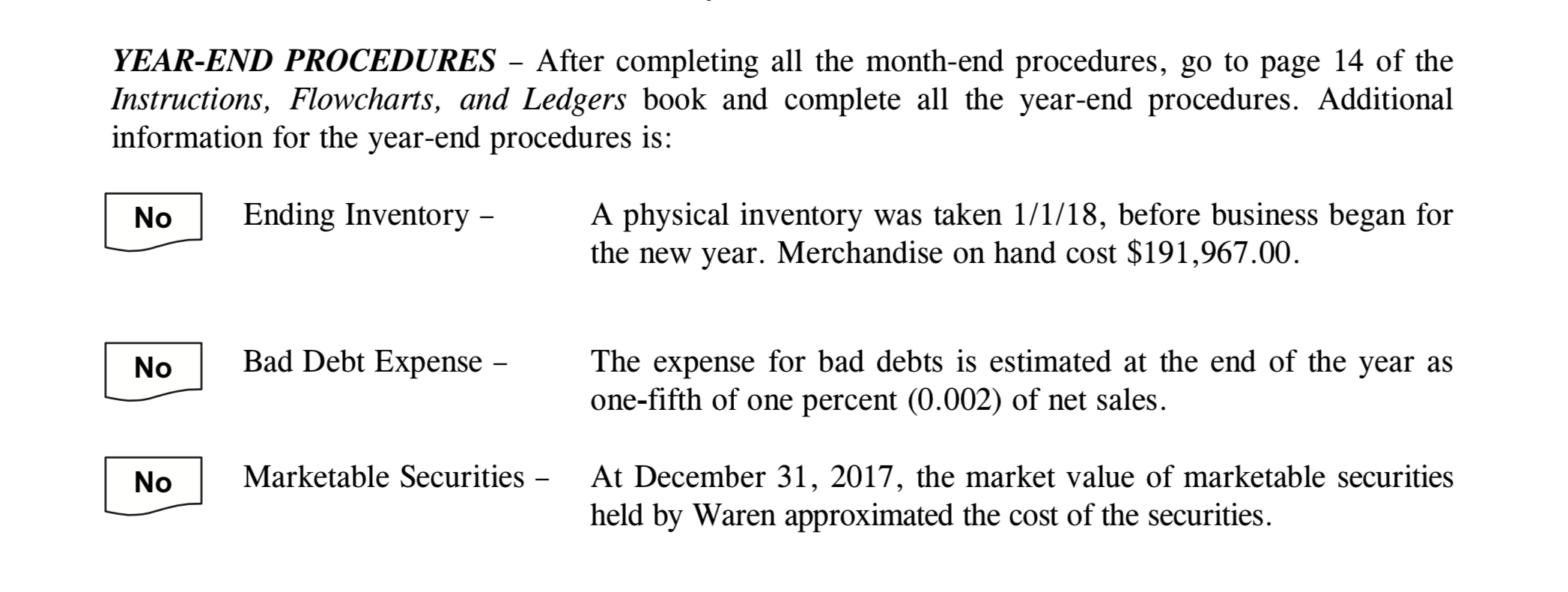

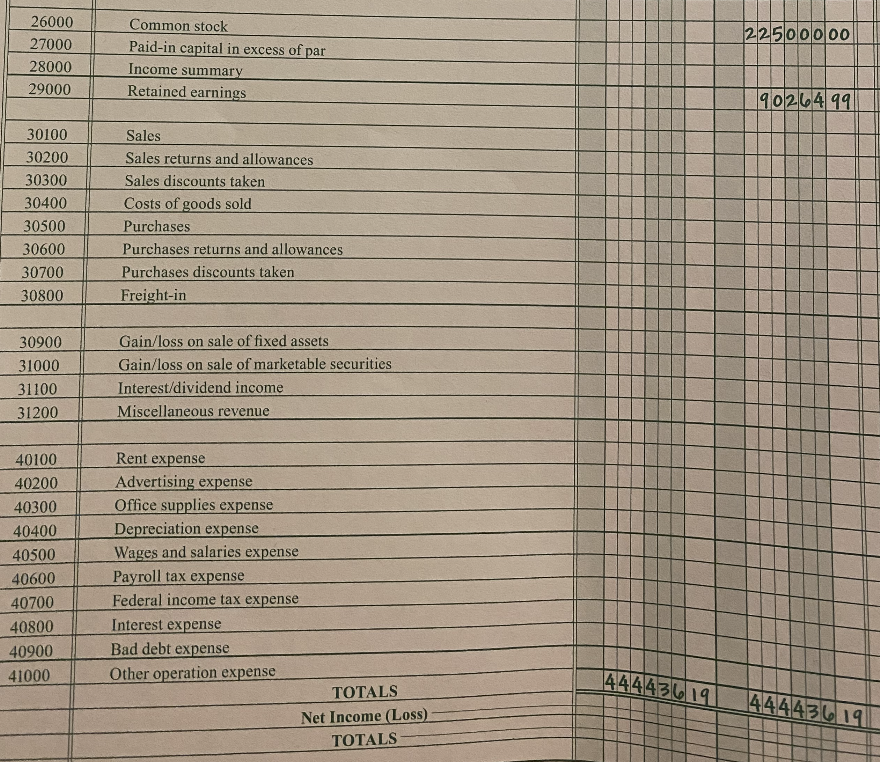

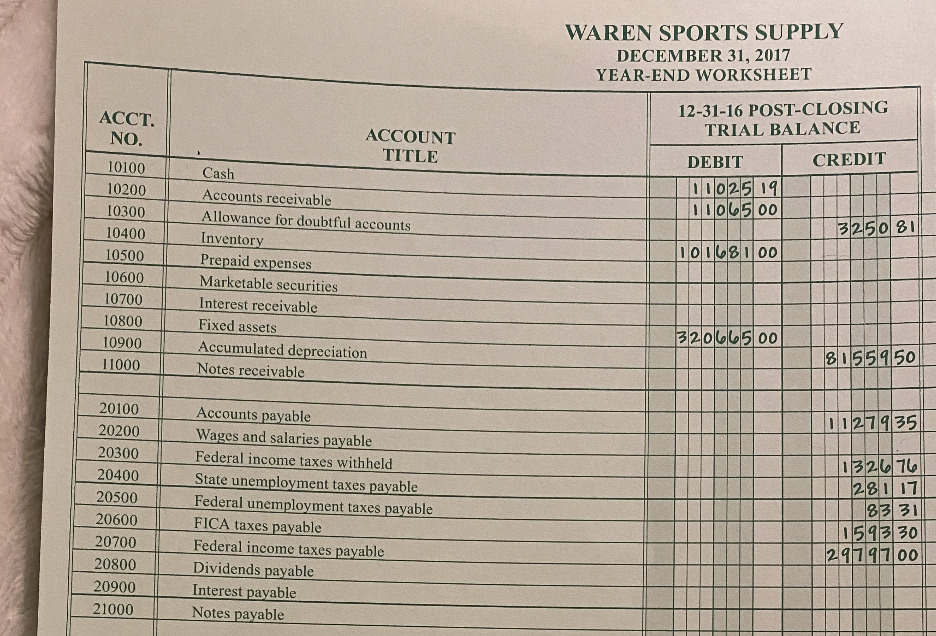

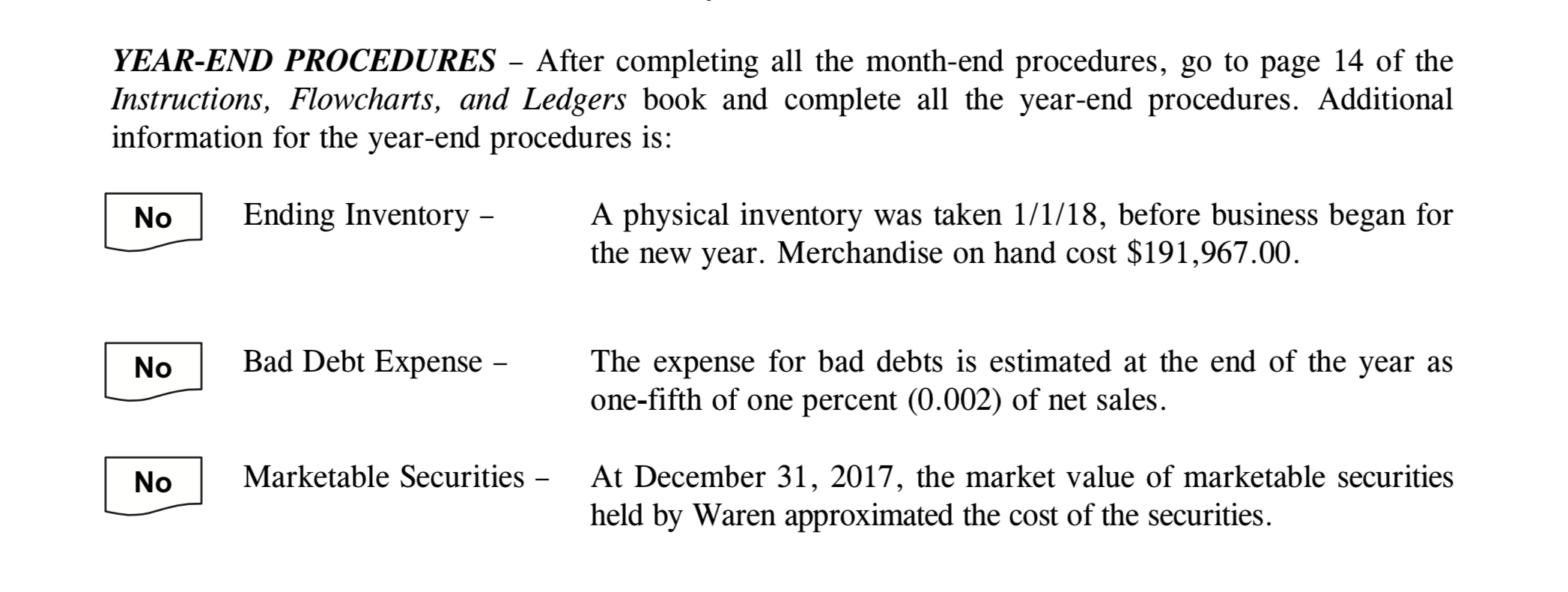

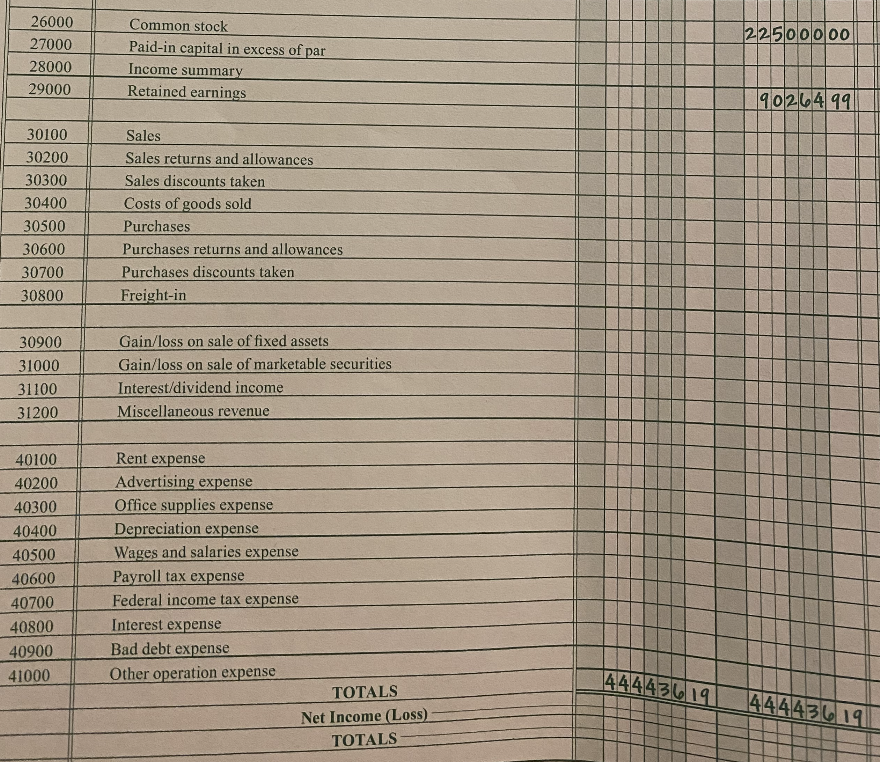

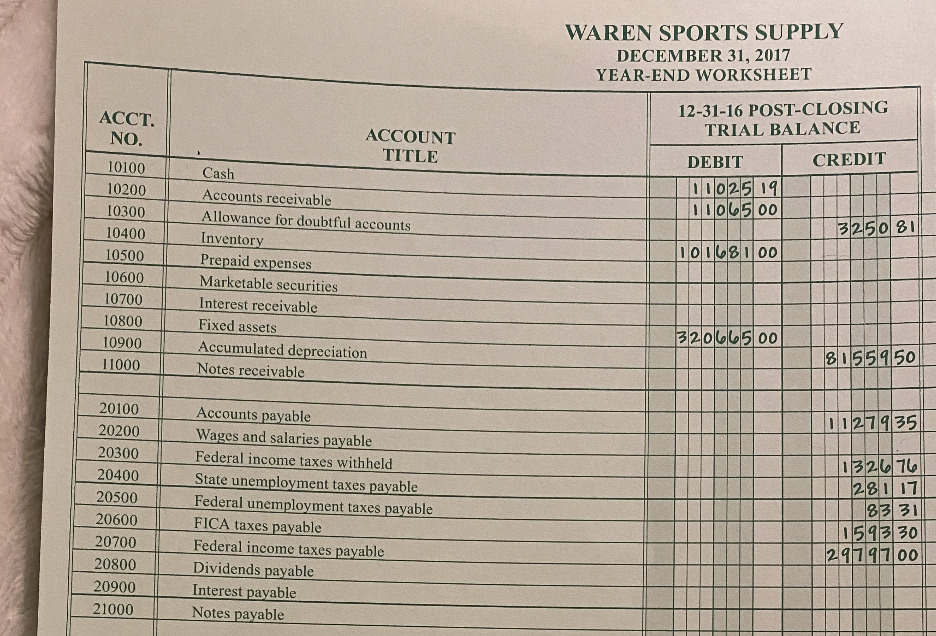

2250 00 00 26000 27000 28000 290001 Common stock Paid-in capital in excess of par Income summary Retained earnings 9026499 30100 30200 30300 30400 30500 30600 30700 30800 Sales Sales returns and allowances Sales discounts taken Costs of goods sold Purchases Purchases returns and allowances Purchases discounts taken Freight-in 30900 31000 31100 31200 Gain/loss on sale of fixed assets Gain/loss on sale of marketable securities Interest/dividend income Miscellaneous revenue 40100 40200 40300 40400 40500 40600 40700 40800 40900 41000 Rent expense Advertising expense Office supplies expense Depreciation expense Wages and salaries expense Payroll tax expense Federal income tax expense Interest expense Bad debt expense Other operation expense TOTALS Net Income (Loss) TOTALS 44443619 44443619 WAREN SPORTS SUPPLY DECEMBER 31, 2017 YEAR-END WORKSHEET ACCT. NO. 12-31-16 POST-CLOSING TRIAL BALANCE CREDIT DEBIT 0002519 00500 325081 ACCOUNT TITLE Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Marketable securities Interest receivable Fixed assets Accumulated depreciation Notes receivable 10100 10200 10300 10400 10500 10600 10700 10800 10900 11000 10168100 32066500 8055 950 1127935|| 1326 76 28017|| 20100 20200 20300 20400 20500 20600 20700 20800 20900 21000 Accounts payable Wages and salaries payable Federal income taxes withheld State unemployment taxes payable Federal unemployment taxes payable FICA taxes payable Federal income taxes payable Dividends payable Interest payable Notes payable 1592 30 29797.00 YEAR-END PROCEDURES After completing all the month-end procedures, go to page 14 of the Instructions, Flowcharts, and Ledgers book and complete all the year-end procedures. Additional information for the year-end procedures is: No Ending Inventory A physical inventory was taken 1/1/18, before business began for the new year. Merchandise on hand cost $191,967.00. No Bad Debt Expense The expense for bad debts is estimated at the end of the year as one-fifth of one percent (0.002) of net sales. No Marketable Securities - At December 31, 2017, the market value of marketable securities held by Waren approximated the cost of the securities. 2250 00 00 26000 27000 28000 290001 Common stock Paid-in capital in excess of par Income summary Retained earnings 9026499 30100 30200 30300 30400 30500 30600 30700 30800 Sales Sales returns and allowances Sales discounts taken Costs of goods sold Purchases Purchases returns and allowances Purchases discounts taken Freight-in 30900 31000 31100 31200 Gain/loss on sale of fixed assets Gain/loss on sale of marketable securities Interest/dividend income Miscellaneous revenue 40100 40200 40300 40400 40500 40600 40700 40800 40900 41000 Rent expense Advertising expense Office supplies expense Depreciation expense Wages and salaries expense Payroll tax expense Federal income tax expense Interest expense Bad debt expense Other operation expense TOTALS Net Income (Loss) TOTALS 44443619 44443619 WAREN SPORTS SUPPLY DECEMBER 31, 2017 YEAR-END WORKSHEET ACCT. NO. 12-31-16 POST-CLOSING TRIAL BALANCE CREDIT DEBIT 0002519 00500 325081 ACCOUNT TITLE Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Marketable securities Interest receivable Fixed assets Accumulated depreciation Notes receivable 10100 10200 10300 10400 10500 10600 10700 10800 10900 11000 10168100 32066500 8055 950 1127935|| 1326 76 28017|| 20100 20200 20300 20400 20500 20600 20700 20800 20900 21000 Accounts payable Wages and salaries payable Federal income taxes withheld State unemployment taxes payable Federal unemployment taxes payable FICA taxes payable Federal income taxes payable Dividends payable Interest payable Notes payable 1592 30 29797.00 YEAR-END PROCEDURES After completing all the month-end procedures, go to page 14 of the Instructions, Flowcharts, and Ledgers book and complete all the year-end procedures. Additional information for the year-end procedures is: No Ending Inventory A physical inventory was taken 1/1/18, before business began for the new year. Merchandise on hand cost $191,967.00. No Bad Debt Expense The expense for bad debts is estimated at the end of the year as one-fifth of one percent (0.002) of net sales. No Marketable Securities - At December 31, 2017, the market value of marketable securities held by Waren approximated the cost of the securities

Does anyone have the Systems Understanding Aid 9th Edition Transaction List A Balance Sheet and Income Statement? This would be the December 2017 entries.

Does anyone have the Systems Understanding Aid 9th Edition Transaction List A Balance Sheet and Income Statement? This would be the December 2017 entries.