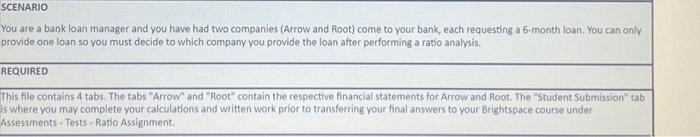

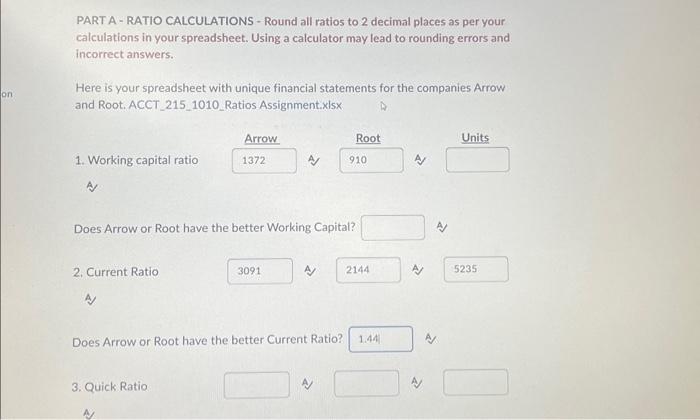

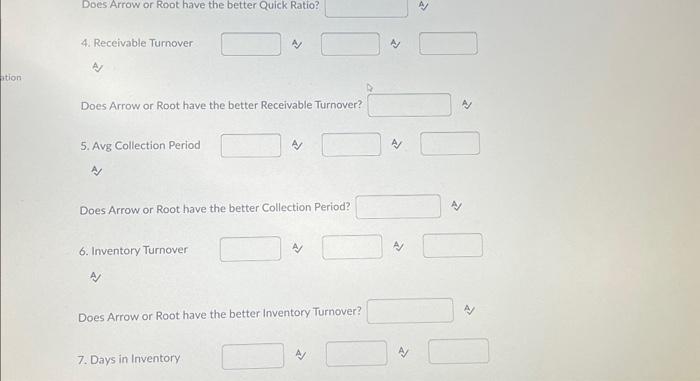

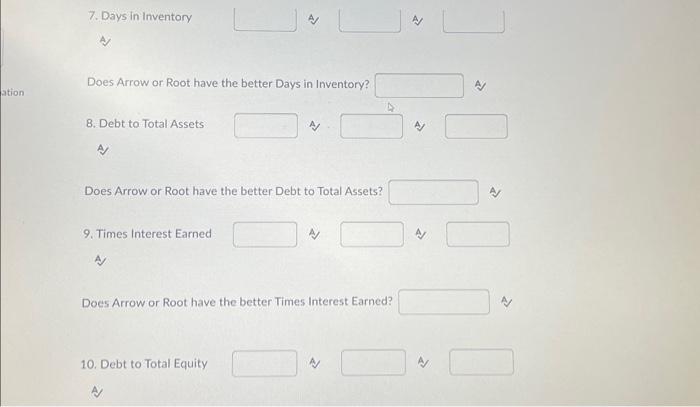

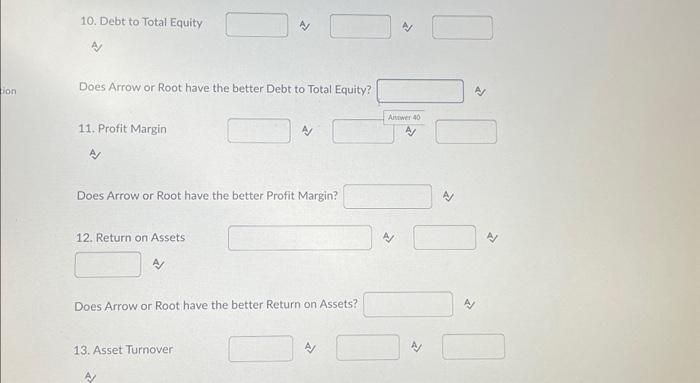

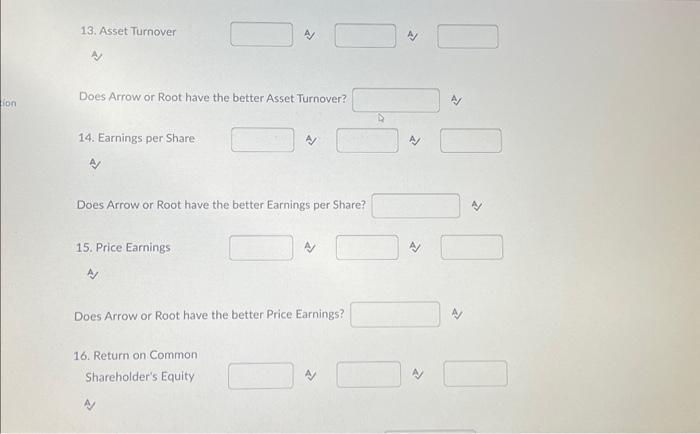

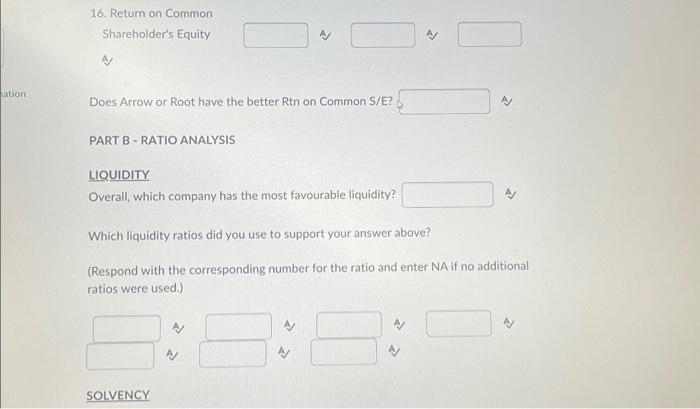

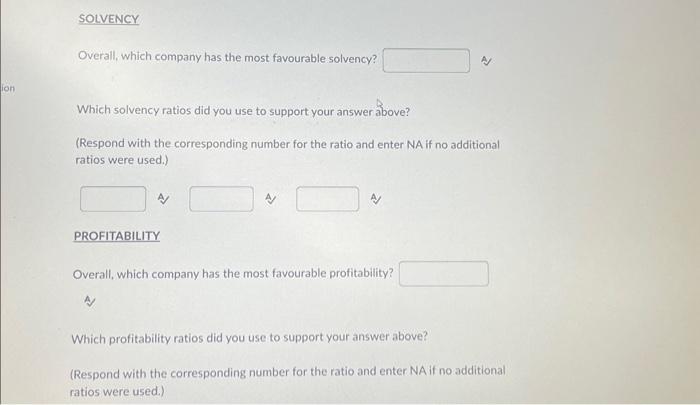

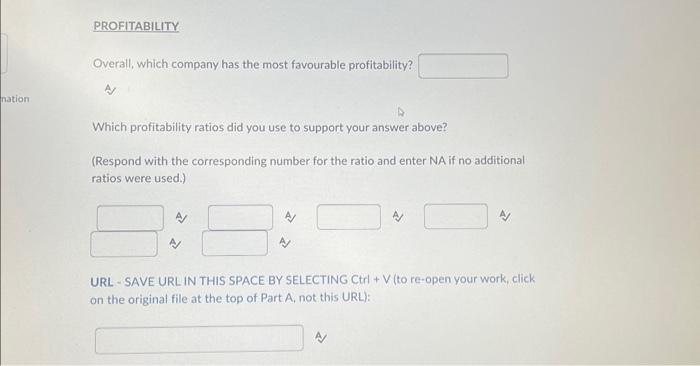

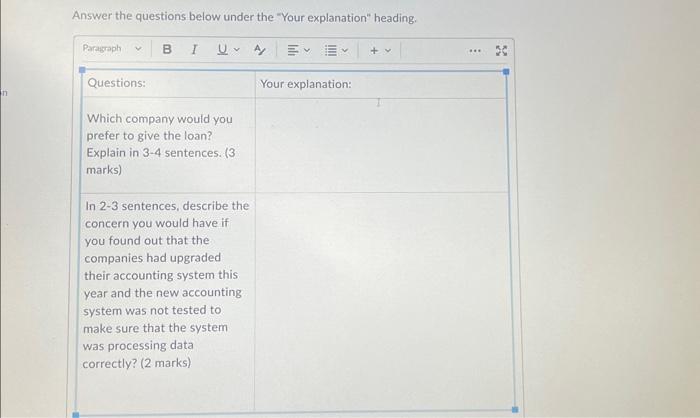

Does Arrow or Root have the better Quick Ratio? 4. Receivable Turnover A Does Arrow or Root have the better Receivable Turnover? 5. Avg Collection Period A Does Arrow or Root have the better Collection Period? 6. Inventory Turnover A Does Arrow or Root have the better Inventory Turnover? 7. Days in Inventory Does Arrow or Root have the better Days in Inventory? 8. Debt to Total Assets Does Arrow or Root have the better Debt to Total Assets? 9. Times Interest Earned A. Does Arrow or Root have the better Times Interest Earned? 10. Debt to Total Equity Does Arrow or Root have the better Debt to Total Equity? 11. Profit Margin A Does Arrow or Root have the better Profit Margin? 12. Return on Assets Does Arrow or Root have the better Return on Assets? PART A - RATIO CALCULATIONS - Round all ratios to 2 decimal places as per your calculations in your spreadsheet. Using a calculator may lead to rounding errors and incorrect answers. Here is your spreadsheet with unique financial statements for the companies Arrow and Root. ACCT_215_1010_Ratios Assignment.xisx Does Arrow or Root have the better Working Capital? 2. Current Ratio A Overall, which company has the most favourable solvency? Which solvency ratios did you use to support your answer above? (Respond with the corresponding number for the ratio and enter NA if no additional ratios were used.) PROFITABILITY Overall, which company has the most favourable profitability? A Which profitability ratios did you use to support your answer above? (Respond with the corresponding number for the ratio and enter NA if no additional ratios were used.) 13. Asset Turnover 4 Does Arrow or Root have the better Asset Turnover? 14. Earnings per Share A Does Arrow or Root have the better Earnings per Share? A 15. Price Earnings A Does Arrow or Root have the better Price Earnings? 16. Return on Common Shareholder's Equity Answer the questions below under the "Your explanation" heading. Overall, which company has the most favourable profitability? 8 Which profitability ratios did you use to support your answer above? (Respond with the corresponding number for the ratio and enter NA if no additional ratios were used.) URL - SAVE URL IN THIS SPACE BY SELECTING Ctrl + V (to re-open your work, click on the original file at the top of Part A, not this URL): Does Arrow or Root have the better Rtn on Common S/E? PART B - RATIO ANALYSIS LIQUIDITY Overall, which company has the most favourable liquidity? Which liquidity ratios did you use to support your answer above? (Respond with the corresponding number for the ratio and enter NA if no additional ratios were used.) You are a bank loan manager and you have had two companies (Arrow and Root) come to your bank, each requesting a 6-month loan. You can only provide one loan so you must decide to which company you provide the loan after performing a ratio analysis. REQUIRED This file contains 4 tabs. The tabs "Arrow" and "Root" contain the respective financial statements for Arrow and Root. The "Student Submission" tab is where you may complete your calculations and written work prior to transferring your final answers to your Brightspace course under Assessments - Tests - Ratio Assignment