Question

Does NPV decrease over time? If considering a single project, I get that as the discount rate increases, the present value of future cash flows

Does NPV decrease over time? If considering a single project, I get that as the discount rate increases, the present value of future cash flows decreases, leading to a lower NPV.

Am I correct in thinking that If the the period of time was increased and the cash flows remained the same, they are spread over a longer period of time, so the NPV would decrease? Because the longer the period of time until payment is made, the lower the present value, as money loses value over time?

What if the cash flows continued at the same rate as the last few years? Then as time goes on, it looks like the NPV could increase? Does the effect of n on NPV therefore depend on whether cash flows stay the same spread over a longer period, or if they continue to produce the same amount over a longer period of time?

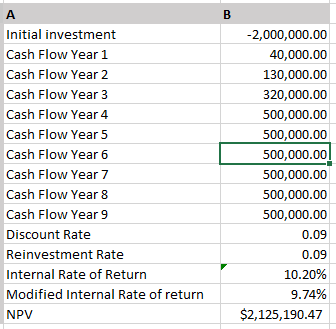

\begin{tabular}{|l|r|} \hline A & B \\ \hline Initial investment & 2,000,000.00 \\ \hline Cash Flow Year 1 & 40,000.00 \\ \hline Cash Flow Year 2 & 130,000.00 \\ \hline Cash Flow Year 3 & 320,000.00 \\ \hline Cash Flow Year 4 & 500,000.00 \\ \hline Cash Flow Year 5 & 500,000.00 \\ \hline Cash Flow Year 6 & 500,000.00 \\ \hline Cash Flow Year 7 & 500,000.00 \\ \hline Cash Flow Year 8 & 500,000.00 \\ \hline Cash Flow Year 9 & 500,000.00 \\ \hline Discount Rate & 0.09 \\ \hline Reinvestment Rate & 0.09 \\ \hline Internal Rate of Return & 10.20% \\ \hline Modified Internal Rate of return & 9.74% \\ \hline NPV & $2,125,190.47 \\ \hline \end{tabular}

\begin{tabular}{|l|r|} \hline A & B \\ \hline Initial investment & 2,000,000.00 \\ \hline Cash Flow Year 1 & 40,000.00 \\ \hline Cash Flow Year 2 & 130,000.00 \\ \hline Cash Flow Year 3 & 320,000.00 \\ \hline Cash Flow Year 4 & 500,000.00 \\ \hline Cash Flow Year 5 & 500,000.00 \\ \hline Cash Flow Year 6 & 500,000.00 \\ \hline Cash Flow Year 7 & 500,000.00 \\ \hline Cash Flow Year 8 & 500,000.00 \\ \hline Cash Flow Year 9 & 500,000.00 \\ \hline Discount Rate & 0.09 \\ \hline Reinvestment Rate & 0.09 \\ \hline Internal Rate of Return & 10.20% \\ \hline Modified Internal Rate of return & 9.74% \\ \hline NPV & $2,125,190.47 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started