Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Does someone know how to do these? Please highlight answers thx Will rate thumb up for good response thanks so much 1. BTU Inc is

Does someone know how to do these? Please highlight answers thx

Will rate thumb up for good response thanks so much

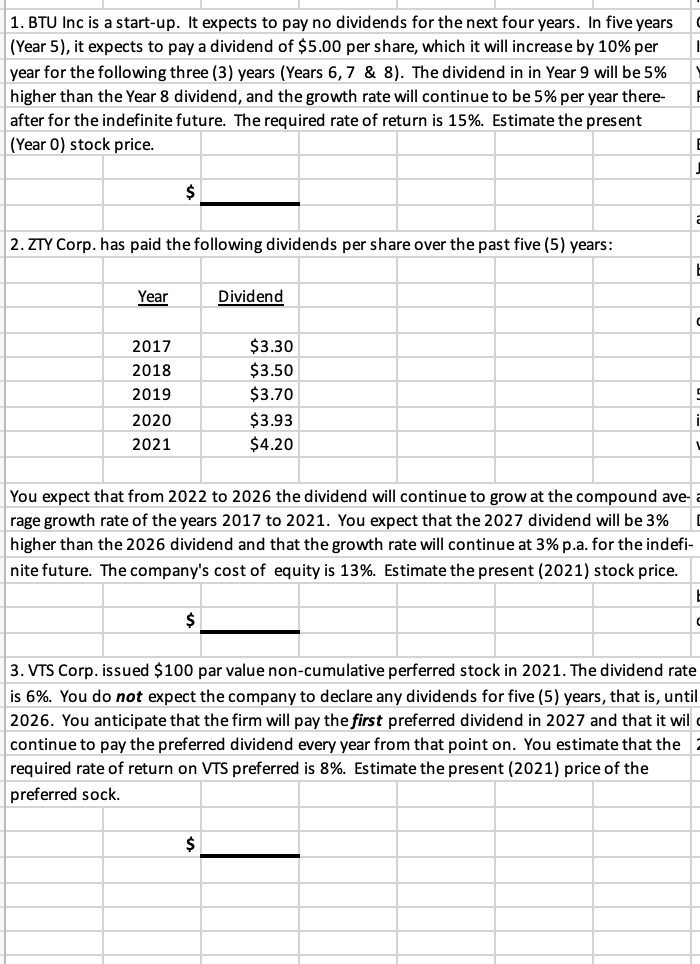

1. BTU Inc is a start-up. It expects to pay no dividends for the next four years. In five years (Year 5), it expects to pay a dividend of $5.00 per share, which it will increase by 10% per year for the following three (3) years (Years 6, 7 & 8). The dividend in in Year 9 will be 5% higher than the Year 8 dividend, and the growth rate will continue to be 5% per year there- after for the indefinite future. The required rate of return is 15%. Estimate the present (Year O) stock price. $ 2. ZTY Corp. has paid the following dividends per share over the past five (5) years: E Year Dividend d 2017 2018 2019 $3.30 $3.50 $3.70 $3.93 $4.20 2020 2021 You expect that from 2022 to 2026 the dividend will continue to grow at the compound ave- rage growth rate of the years 2017 to 2021. You expect that the 2027 dividend will be 3% higher than the 2026 dividend and that the growth rate will continue at 3% p.a. for the indefi- nite future. The company's cost of equity is 13%. Estimate the present (2021) stock price. $ 3. VTS Corp. issued $100 par value non-cumulative perferred stock in 2021. The dividend rate is 6%. You do not expect the company to declare any dividends for five (5) years, that is, until 2026. You anticipate that the firm will pay the first preferred dividend in 2027 and that it wil continue to pay the preferred dividend every year from that point on. You estimate that the required rate of return on VTS preferred is 8%. Estimate the present (2021) price of the preferred sock. $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started