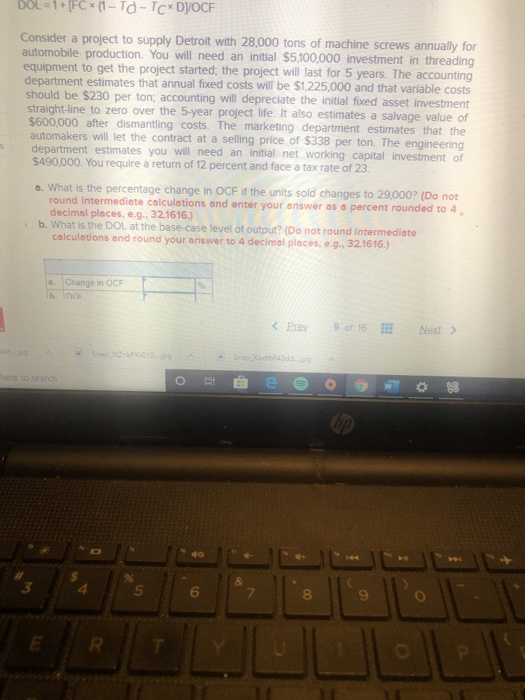

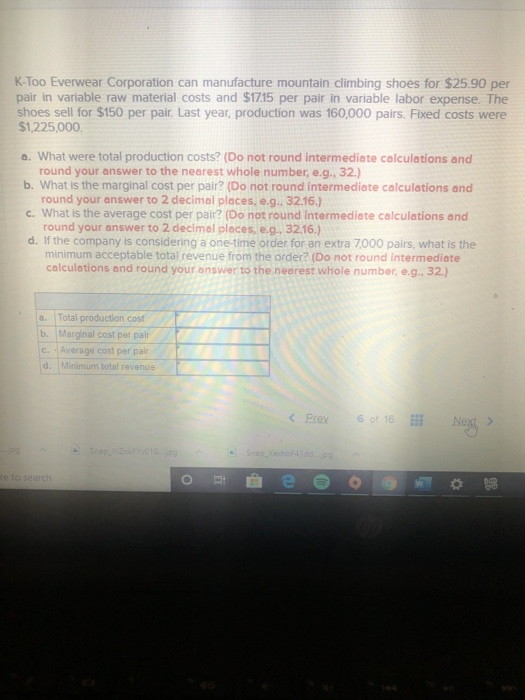

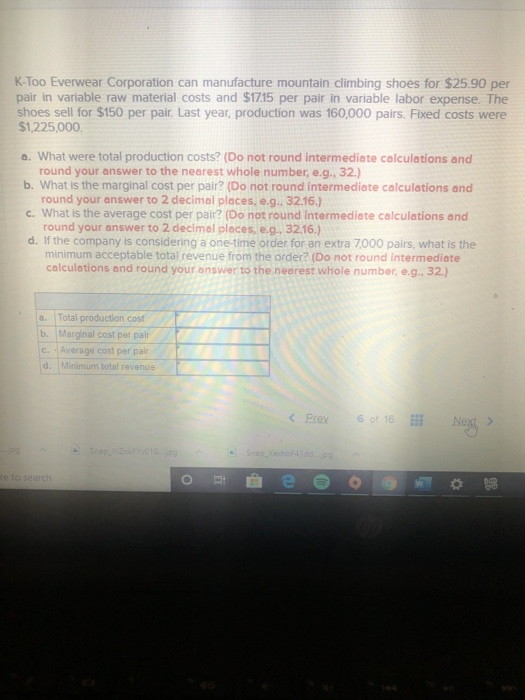

DOL = 1 + [FC *(1-TO-Tc* DYOCF Consider a project to supply Detroit with 28,000 tons of machine screws annually for automobile production. You will need an initial $5,100,000 investment in threading equipment to get the project started, the project will last for 5 years. The accounting department estimates that annual fixed costs will be $1,225,000 and that variable costs should be $230 per ton: accounting will depreciate the initial fixed asset investment straight-line to zero over the 5-year project life. It also estimates a salvage value of $600,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $338 per ton. The engineering department estimates you will need an initial networking capital investment of $490,000. You require a return of 12 percent and face a tax rate of 23. a. What is the percentage change in OCF if the units sold changes to 29.000? (Do not round intermediate calculations and enter your answer as a percent rounded to 4 decimal places, e... 32.1616. b. What is the DOL at the base-case level of output? (Do not round Intermediate calculations and round your answer to 4 decimal places, e... 32.1616.) Change in OCF a. in here to search K-Too Everwear Corporation can manufacture mountain climbing shoes for $25.90 per pair in variable raw material costs and $17.15 per pair in variable labor expense. The shoes sell for $150 per pair. Last year, production was 160,000 pairs. Fixed costs were $1,225,000. a. What were total production costs? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g. 32.) b. What is the marginal cost per pair? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) c. What is the average cost per pair? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. If the company is considering a one-time order for an extra 7,000 pairs, what is the minimum acceptable total revenue from the order? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) a Total production cost b. Marginal cost per pair C. Average cost per pair d. Minimum total revenue re to search