Answered step by step

Verified Expert Solution

Question

1 Approved Answer

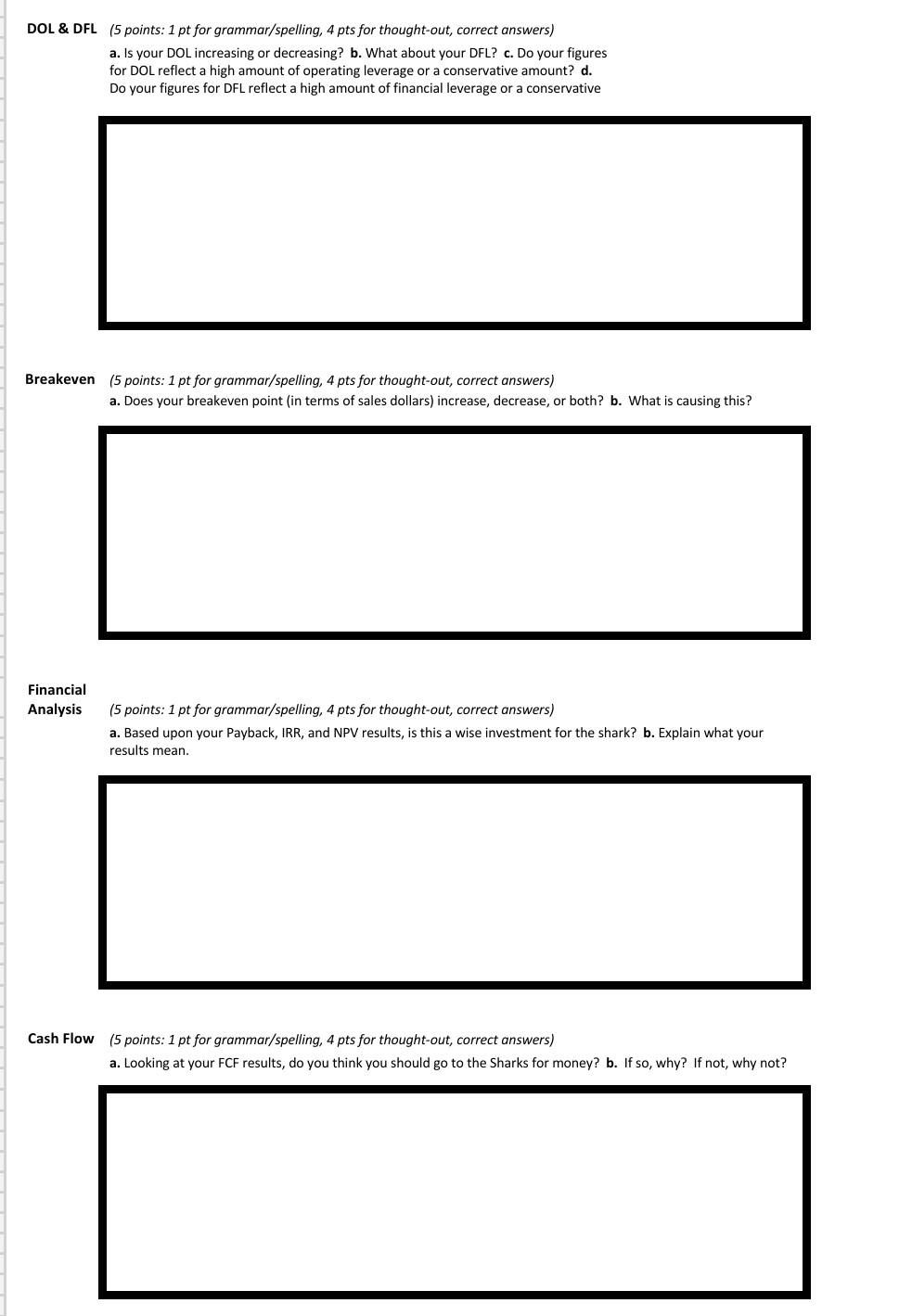

DOL & DFL (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Is your DOL increasing or decreasing? b. What about

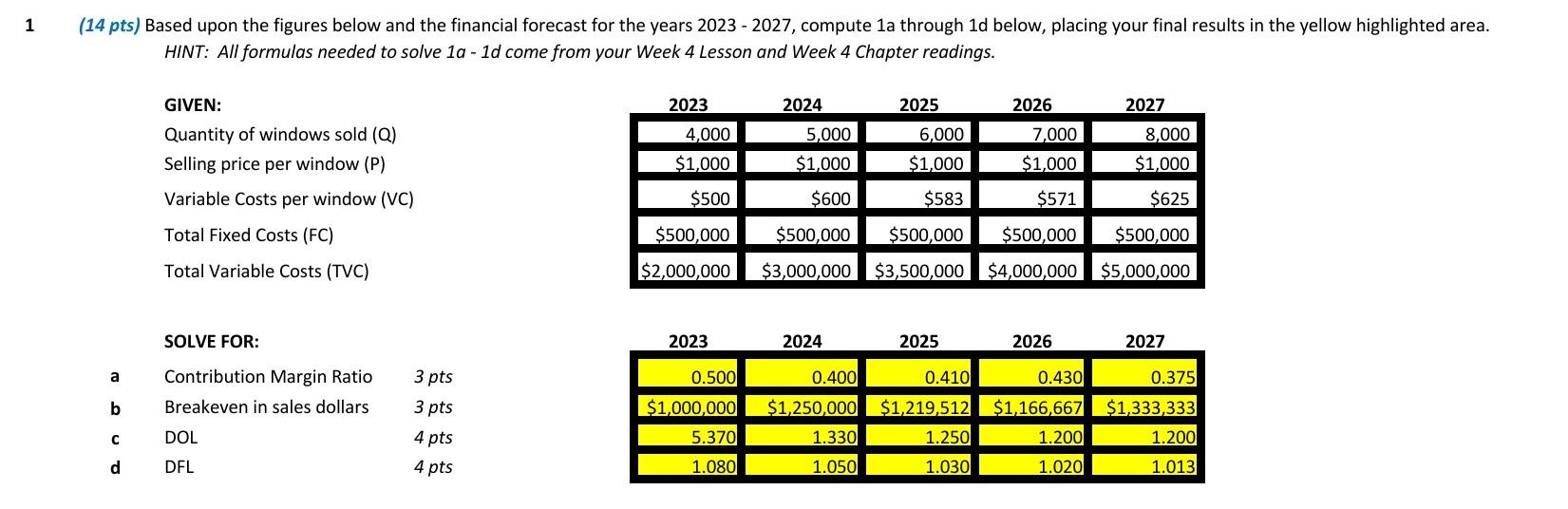

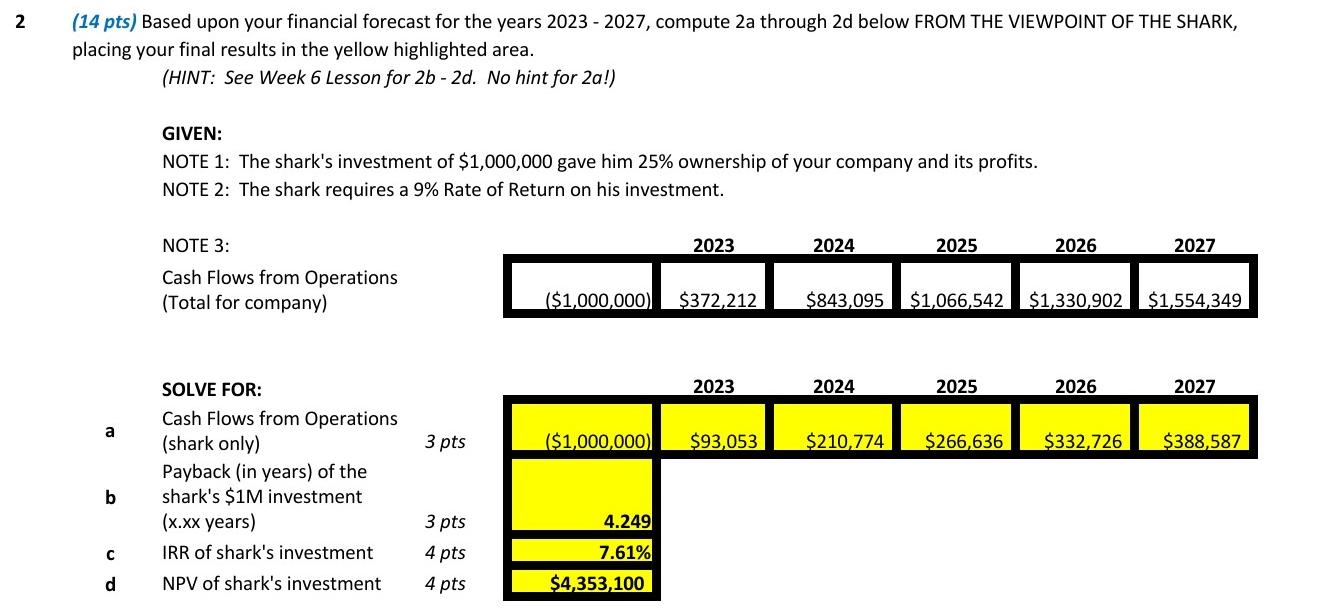

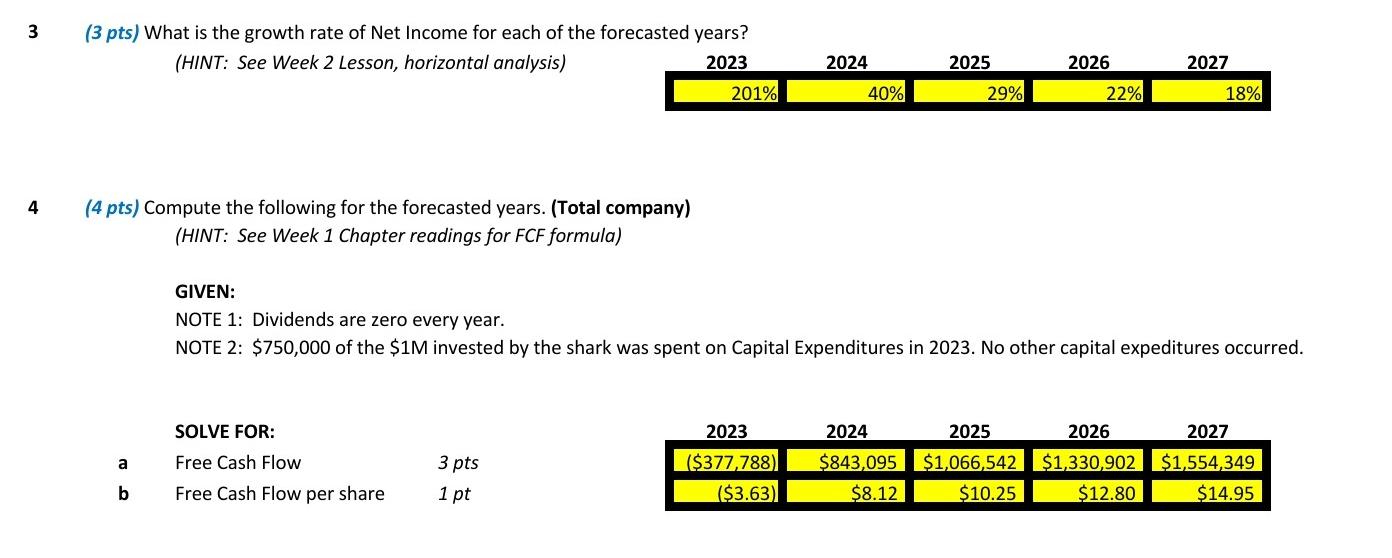

DOL \\& DFL (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Is your DOL increasing or decreasing? b. What about your DFL? c. Do your figures for DOL reflect a high amount of operating leverage or a conservative amount? \\( \\mathbf{d} \\). Do your figures for DFL reflect a high amount of financial leverage or a conservative 3reakeven (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Does your breakeven point (in terms of sales dollars) increase, decrease, or both? b. What is causing this? Financial Analysis (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Based upon your Payback, IRR, and NPV results, is this a wise investment for the shark? b. Explain what your results mean. Cash Flow (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Looking at your FCF results, do you think you should go to the Sharks for money? b. If so, why? If not, why not? (14 pts) Based upon the figures below and the financial forecast for the years 2023 - 2027, compute 1 a through \\( 1 \\mathrm{~d} \\) below, placing your final results in the yellow highlighted area. HINT: All formulas needed to solve \\( 1 a \\) - \\( 1 d \\) come from your Week 4 Lesson and Week 4 Chapter readings. (14 pts) Based upon your financial forecast for the years 2023 - 2027, compute \\( 2 a \\) through \\( 2 \\mathrm{~d} \\) below FROM THE VIEWPOINT OF THE SHARK, placing your final results in the yellow highlighted area. (HINT: See Week 6 Lesson for \\( 2 b-2 d \\). No hint for 2a!) GIVEN: NOTE 1: The shark's investment of \\( \\$ 1,000,000 \\) gave him \25 ownership of your company and its profits. NOTE 2: The shark requires a 9\\% Rate of Return on his investment. (4 pts) Compute the following for the forecasted years. (Total company) (HINT: See Week 1 Chapter readings for FCF formula) GIVEN: NOTE 1: Dividends are zero every year. NOTE 2: \\( \\$ 750,000 \\) of the \\( \\$ 1 \\mathrm{M} \\) invested by the shark was spent on Capital Expenditures in 2023. No other capital expeditures occurred. DOL \\& DFL (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Is your DOL increasing or decreasing? b. What about your DFL? c. Do your figures for DOL reflect a high amount of operating leverage or a conservative amount? \\( \\mathbf{d} \\). Do your figures for DFL reflect a high amount of financial leverage or a conservative 3reakeven (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Does your breakeven point (in terms of sales dollars) increase, decrease, or both? b. What is causing this? Financial Analysis (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Based upon your Payback, IRR, and NPV results, is this a wise investment for the shark? b. Explain what your results mean. Cash Flow (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Looking at your FCF results, do you think you should go to the Sharks for money? b. If so, why? If not, why not? (14 pts) Based upon the figures below and the financial forecast for the years 2023 - 2027, compute 1 a through \\( 1 \\mathrm{~d} \\) below, placing your final results in the yellow highlighted area. HINT: All formulas needed to solve \\( 1 a \\) - \\( 1 d \\) come from your Week 4 Lesson and Week 4 Chapter readings. (14 pts) Based upon your financial forecast for the years 2023 - 2027, compute \\( 2 a \\) through \\( 2 \\mathrm{~d} \\) below FROM THE VIEWPOINT OF THE SHARK, placing your final results in the yellow highlighted area. (HINT: See Week 6 Lesson for \\( 2 b-2 d \\). No hint for 2a!) GIVEN: NOTE 1: The shark's investment of \\( \\$ 1,000,000 \\) gave him \25 ownership of your company and its profits. NOTE 2: The shark requires a 9\\% Rate of Return on his investment. (4 pts) Compute the following for the forecasted years. (Total company) (HINT: See Week 1 Chapter readings for FCF formula) GIVEN: NOTE 1: Dividends are zero every year. NOTE 2: \\( \\$ 750,000 \\) of the \\( \\$ 1 \\mathrm{M} \\) invested by the shark was spent on Capital Expenditures in 2023. No other capital expeditures occurred

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started