Question

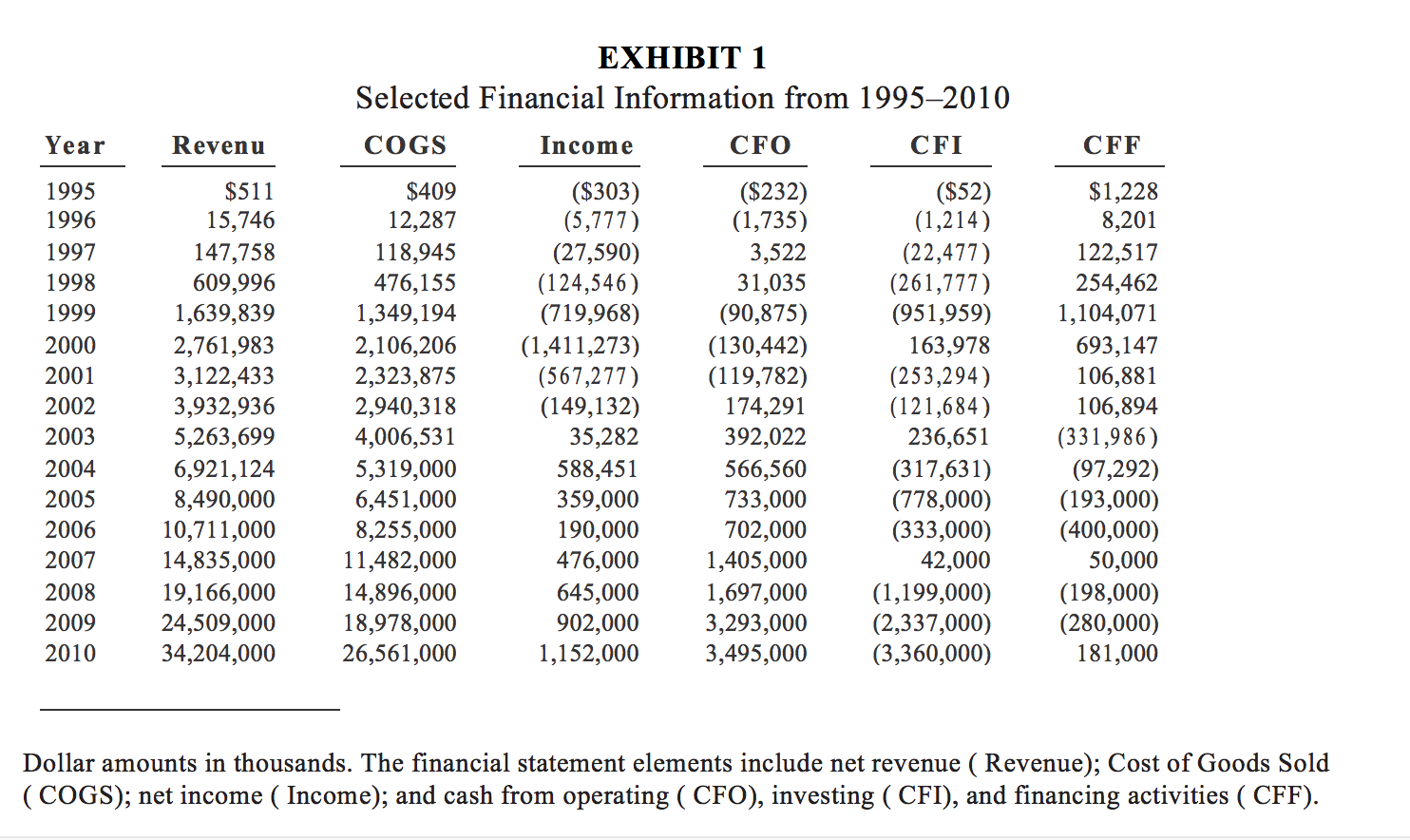

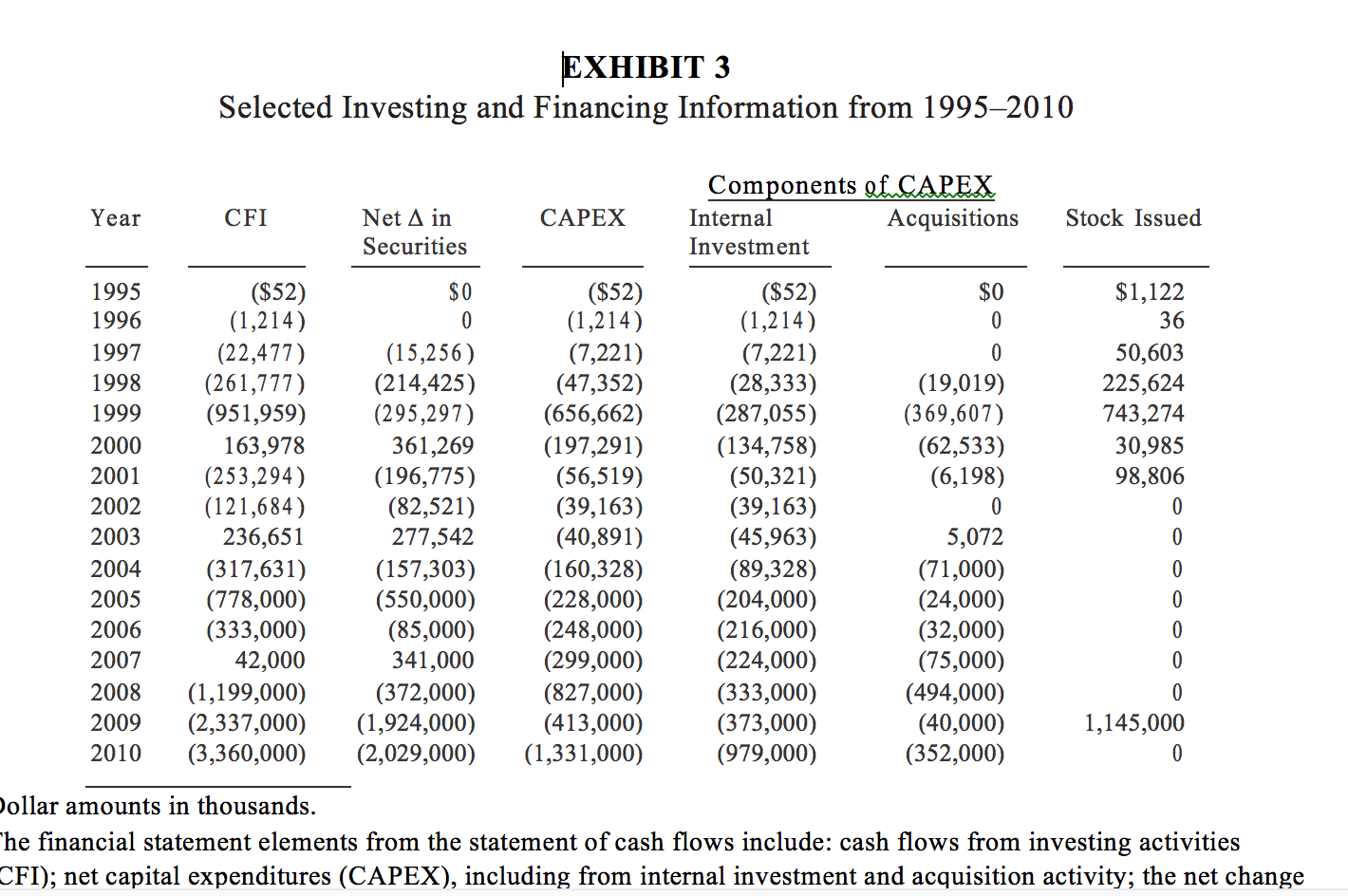

Dollar amounts in thousands. The financial statement elements from the statement of cash flows include: cash flows from investing activities (CFI); net capital expenditures (CAPEX),

Dollar amounts in thousands.

The financial statement elements from the statement of cash flows include: cash flows from investing activities (CFI); net capital expenditures (CAPEX), including from internal investment and acquisition activity; the net change in marketable securities (Net Change in Securities).

The dollar amount of stock issued in connection with acquisition activity (Stock Issued) as reported on the statement of stockholders equity. Note that stock issued in 1997 is primarily related to the initial public offering (IPO). Stock issued before 1997 is for investments by Jeff Bezos and others before the IPO. Stock issued after 1997 is primarily related to acquisition activity.

EXHIBIT 4

Descriptions of Life Cycle Stages

Introduction is characterized by small firms in the midst of defining their product, strategy, and market. Firms in this stage are typically unprofitable, have low revenues, and require continued funding to remain viable.

Growth is characterized by firms that emerge from introduction with a defined product and strategy, and growing market share. The focus is more on continued product development and increasing market share, and less on efficiency. Revenue growth is exponential, but the firm is likely unprofitable and still requires funding for daily operations and capital investment.

Maturity is characterized by firms that have refined their product, developed their strategy, and established stable revenues and market share. Firms have reached profitability and generate enough cash flow to fund capital investment, repay debt, and possibly begin paying dividends to shareholders. Firms begin to focus more on efficiency.

Decline is characterized by firms producing goods or providing services for which demand is decreasing, often using outdated technology. Revenues begin to decline, and investment is significantly reduced.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started