Question

Dollar General's disclosures below. (multiple choice) (all numbers in the exhibits and in $,000) Based on the information above, how much tax does Dollar General

Dollar General's disclosures below. (multiple choice)

(all numbers in the exhibits and in $,000)

- Based on the information above, how much tax does Dollar General have to pay in 2015?

1) $12,125 2) $700,069 3) $687,944 4) $675,819

2.Based on the information above, what's the tax expense that Dollar General reports on its income statement (financial accounting) in 2015?

1) $687,944 2) $700,069 3) $12,125 4) $675,819

3.Based on the information above, which of the following statements is true?

1) In FY 2014, deferred tax assets decrease by $10,634 (or deferred tax liabilities increase by $ 10,634).

2) In FY 2014, the company paid $615,516 in taxes.

3) In FY 2014, the effective tax rate is lower than the statutory tax rate.

4) In FY 2014, deferred tax assets increase by $10,634 (or deferred tax liabilities decrease by $ 10,634).

For questions 4-6, please use the information for the depreciation policies by Hansen Corp. below.

Question 4. Hansen Corp. is a US publicly listed company that follows US GAAP. On January 1, 2013, Hansen Corp. acquired a new equipment that cost $200,000 paying cash. The fair value of this equipment was $230,000. Hansen Corp. uses the straight-line depreciation method. The company sets the useful life at 10 years and estimates a salvage value of $0. How much is the annual depreciation expense?

1) $10,000 2) $18,000 3) $20,000 4) $23,000

Question 5.

On January 1, 2014, Hansen Corp. revises the useful life of all its tangible assets to 5 years in total and revises the estimated salvage value to 10% of the original acquisition cost. Under the new assumptions and assuming no other changes during 2014, what is the depreciation expense of the equipment recorded for the fiscal year ended December 31, 2014?

1) $40,000 2)$45,000 3)$36,000 4) $50,000

Question 6.

On January 1, 2016, Hansen Corp. sold the equipment for cash and records a loss from these sales of $20,000. How much cash did the company receive from selling the equipment?

1) $120,000 2) $80,000 3) $100,000 4) $60,000

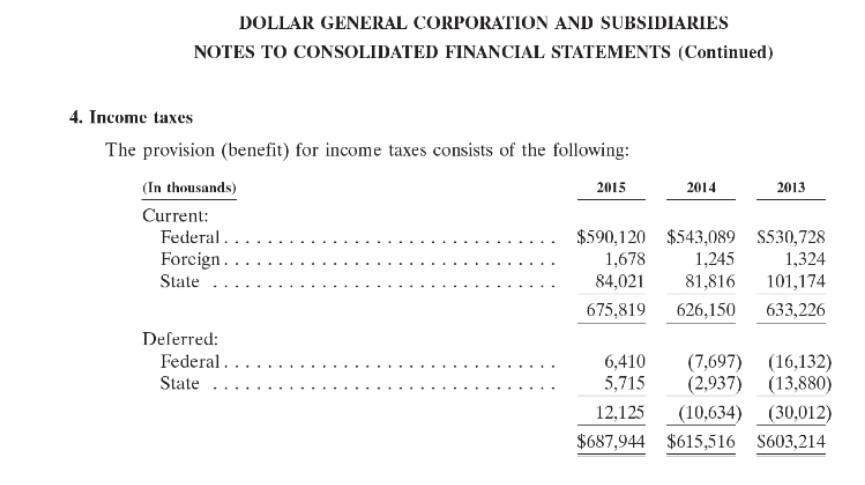

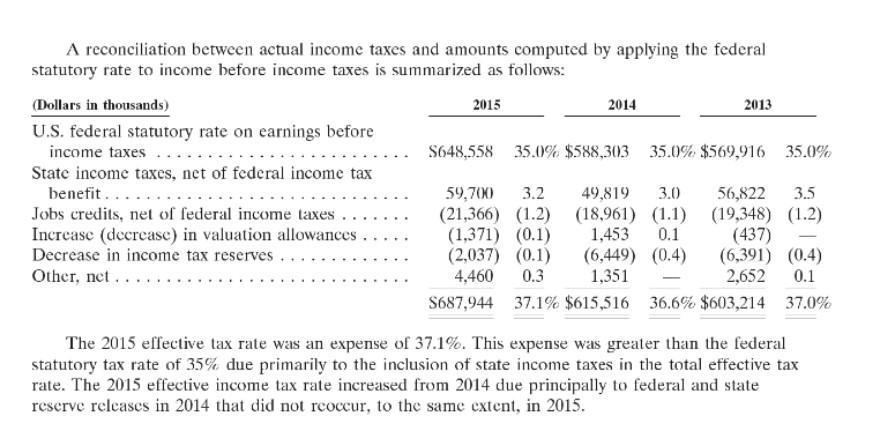

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 4. Income taxes The provision (benefit) for income taxes consists of the following: (In thousands) 2015 2014 2013 Current: Federal.. $590,120 $543,089 $530,728 Foreign .. 1,678 1,245 1,324 State 84,021 81,816 101,174 675,819 626,150 633,226 Deferred: Federal.. 6,410 (7,697) (16,132) State 5,715 (2,937) (13,880) 12,125 (10,634) (30,012) $687,944 $615,516 S603,214 A reconciliation between actual income taxes and amounts computed by applying the federal statutory rate to income before income taxes is summarized as follows: (Dollars in thousands) 2015 2014 2013 U.S. federal statutory rate on earnings before income taxes S648,558 35.0% $588,303 35.0% $569,916 35.0% State income taxes, net of federal income tax benefit... 59,700 3.2 49,819 3.0 56,822 3.5 Jobs credits, net of federal income taxes (21,366) (1.2) (18,961) (1.1) (19,348) (1.2) Incrcase (decrease) in valuation allowances .. (1,371) (0.1) 1,453 0.1 (437) Decrease in income tax reserves (2,037) (0.1) (6,449) (0.4) (6,391) (0.4) Other, net.... 4,460 0.3 1,351 2,652 0.1 S687,944 37.1% $615,516 36.6% $603,214 37.0% The 2015 effective tax rate was an expense of 37.1%. This expense was greater than the federal statutory tax rate of 35% due primarily to the inclusion of state income taxes in the total effective tax rate. The 2015 effective income tax rate increased from 2014 due principally to federal and state reserve releases in 2014 that did not rcoccur, to the same extent, in 2015. DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 4. Income taxes The provision (benefit) for income taxes consists of the following: (In thousands) 2015 2014 2013 Current: Federal.. $590,120 $543,089 $530,728 Foreign .. 1,678 1,245 1,324 State 84,021 81,816 101,174 675,819 626,150 633,226 Deferred: Federal.. 6,410 (7,697) (16,132) State 5,715 (2,937) (13,880) 12,125 (10,634) (30,012) $687,944 $615,516 S603,214 A reconciliation between actual income taxes and amounts computed by applying the federal statutory rate to income before income taxes is summarized as follows: (Dollars in thousands) 2015 2014 2013 U.S. federal statutory rate on earnings before income taxes S648,558 35.0% $588,303 35.0% $569,916 35.0% State income taxes, net of federal income tax benefit... 59,700 3.2 49,819 3.0 56,822 3.5 Jobs credits, net of federal income taxes (21,366) (1.2) (18,961) (1.1) (19,348) (1.2) Incrcase (decrease) in valuation allowances .. (1,371) (0.1) 1,453 0.1 (437) Decrease in income tax reserves (2,037) (0.1) (6,449) (0.4) (6,391) (0.4) Other, net.... 4,460 0.3 1,351 2,652 0.1 S687,944 37.1% $615,516 36.6% $603,214 37.0% The 2015 effective tax rate was an expense of 37.1%. This expense was greater than the federal statutory tax rate of 35% due primarily to the inclusion of state income taxes in the total effective tax rate. The 2015 effective income tax rate increased from 2014 due principally to federal and state reserve releases in 2014 that did not rcoccur, to the same extent, in 2015Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started