Answered step by step

Verified Expert Solution

Question

1 Approved Answer

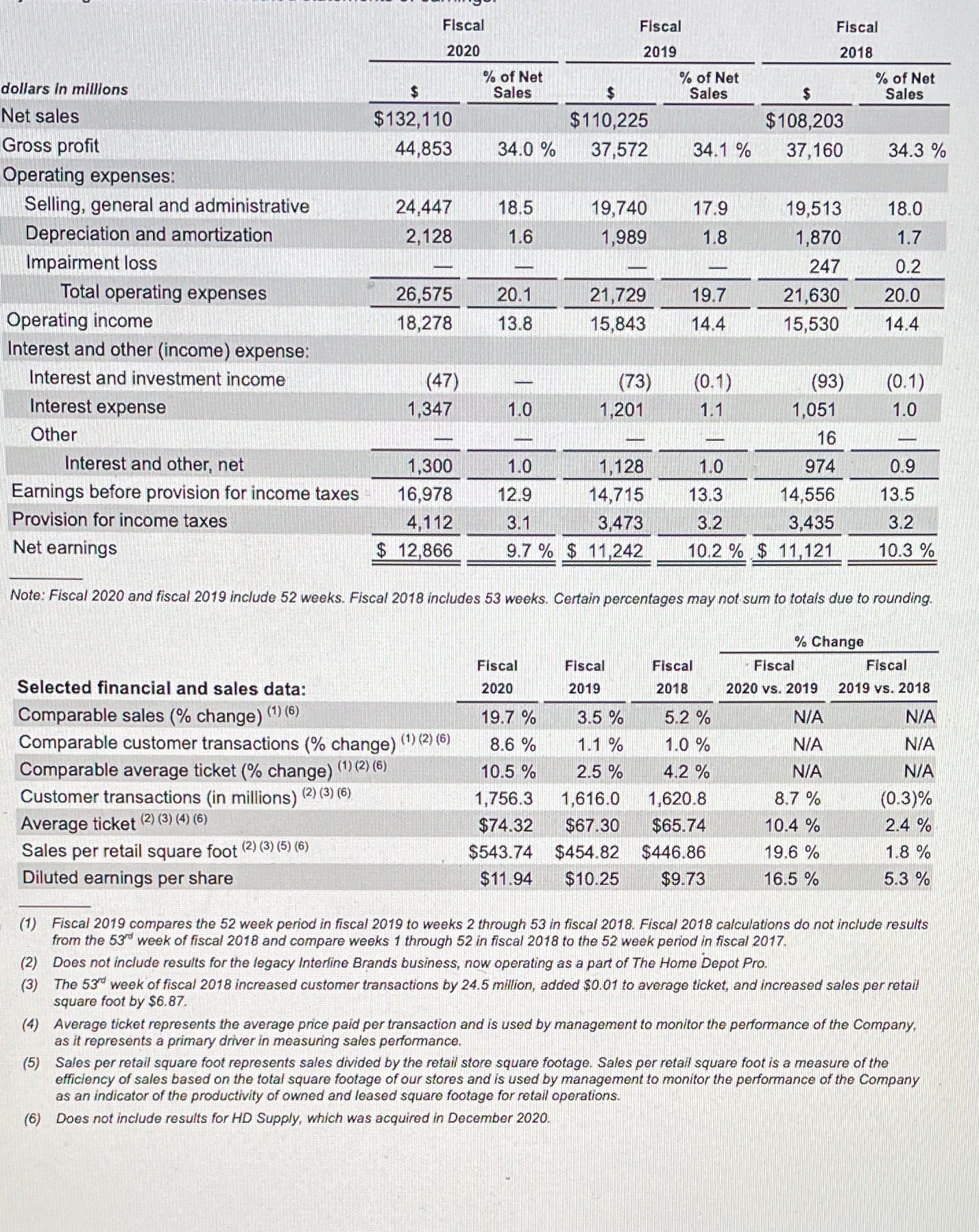

dollars in millions Net sales Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment loss Total operating expenses Operating income Interest

dollars in millions Net sales Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment loss Total operating expenses Operating income Interest and other (income) expense: Interest and investment income Interest expense Other Interest and other, net Earnings before provision for income taxes Provision for income taxes Net earnings Selected financial and sales data: Comparable sales (% change) (1) (6) Fiscal 2020 $ $132,110 44,853 Sales per retail square foot (2) (3) (5) (6) Diluted earnings per share 24,447 2,128 26,575 18,278 Comparable customer transactions (% change) Comparable average ticket (% change) (1) (2) (6) Customer transactions (in millions) (2) (3) (6) Average ticket (2) (3) (4) (6) (47) 1,347 1,300 16,978 4,112 $ 12,866 % of Net Sales (1) (2) (6) 34.0% 18.5 1.6 - 20.1 13.8 1.0 - $ $110,225 37,572 Fiscal 2019 19,740 1,989 21,729 15,843 (73) 1,201 - 1.0 1,128 14,715 12.9 3.1 3,473 9.7% $11,242 Fiscal 2019 % of Net Sales 34.1 % 17.9 1.8 - 19.7 14.4 (0.1) 1.1 - Fiscal 2018 Fiscal 2020 19.7 % 3.5% 5.2% 8.6 % 1.1% 1.0 % 10.5 % 2.5% 4.2 % 1,756.3 1,616.0 1,620.8 $74.32 $67.30 $65.74 $543.74 $454.82 $446.86 $11.94 $10.25 $9.73 $ $108,203 37,160 19,513 1,870 247 21,630 15,530 1.0 13.3 3.2 10.2 % $11,121 Fiscal 2018 (93) 1,051 16 974 14,556 D 3,435 Note: Fiscal 2020 and fiscal 2019 include 52 weeks. Fiscal 2018 includes 53 weeks. Certain percentages may not sum to totals due to rounding. % Change Fiscal 2020 vs. 2019 N/A N/A N/A 8.7 % 10.4 % 19.6 % 16.5 % % of Net Sales 34.3 % 18.0 1.7 0.2 20.0 14.4 (0.1) 1.0 - 0.9 13.5 3.2 10.3 % Fiscal 2019 vs. 2018 N/A N/A N/A (0.3)% 2.4 % 1.8 % 5.3% (1) Fiscal 2019 compares the 52 week period in fiscal 2019 to weeks 2 through 53 in fiscal 2018. Fiscal 2018 calculations do not include results from the 53rd week of fiscal 2018 and compare weeks 1 through 52 in fiscal 2018 to the 52 week period in fiscal 2017. (2) Does not include results for the legacy Interline Brands business, now operating as a part of The Home Depot Pro. (3) The 53 week of fiscal 2018 increased customer transactions by 24.5 million, added $0.01 to average ticket, and increased sales per retail square foot by $6.87. (4) Average ticket represents the average price paid per transaction and is used by management to monitor the performance of the Company, as it represents a primary driver in measuring sales performance. (5) Sales per retail square foot represents sales divided by the retail store square footage. Sales per retail square foot is a measure of the efficiency of sales based on the total square footage of our stores and is used by management to monitor the performance of the Company as an indicator of the productivity of owned and leased square footage for retail operations. (6) Does not include results for HD Supply, which was acquired in December 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the key metrics for The Home Depot for fiscal years 2020 2019 and 2018 Net sales increased ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started