Answered step by step

Verified Expert Solution

Question

1 Approved Answer

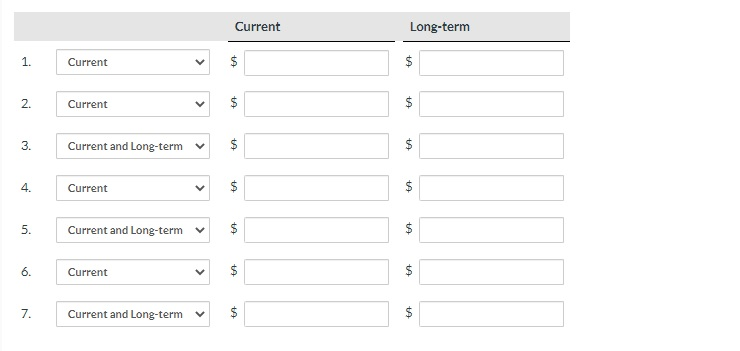

Dominique, the CFO for Trattoria Inc., asked you to classify the following liabilities for the December 31, 2020, statement of financial position: Identify each of

Dominique, the CFO for Trattoria Inc., asked you to classify the following liabilities for the December 31, 2020, statement of financial position: Identify each of the liabilities as current or non-current. (Note that some liabilities may be classified partially as current and partially as non-current.)

| 1. | Trattoria declared a dividend in 2020 of $26,000, which is payable on January 31, 2021. | |

| 2. | During the month of December, Trattoria settled warranty claims with customers by issuing in-store credit totalling $15,000. | |

| 3. | On August 1, 2020, Trattoria obtained a $10,800 five-year loan with annual equal principal repayments of $2,160 due on July 31. Interest at 10% per year is payable every six months on January 31 and July 31. | |

| 4. | In December, the company withheld deductions totalling $5,300 from its employees, which will be remitted on January 15, 2021. | |

| 5. | During 2020, customers purchased five-year extended warranty plans totalling $37,000. Management expects that claims under these warranties will be equal in each year of the warranty period. | |

| 6. | During the December holiday shopping period, the company sold $5,400 in gift cards. | |

| 7. | During 2020, Trattoria obtained a $5,400 loan with a three-year term from a bank. The loan contains a current ratio requirement, which the company breached on December 31. Breaching this requirement can trigger immediate repayment of the loan. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started