Question

Life Insurance Needs for a Young Married Couple. Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently

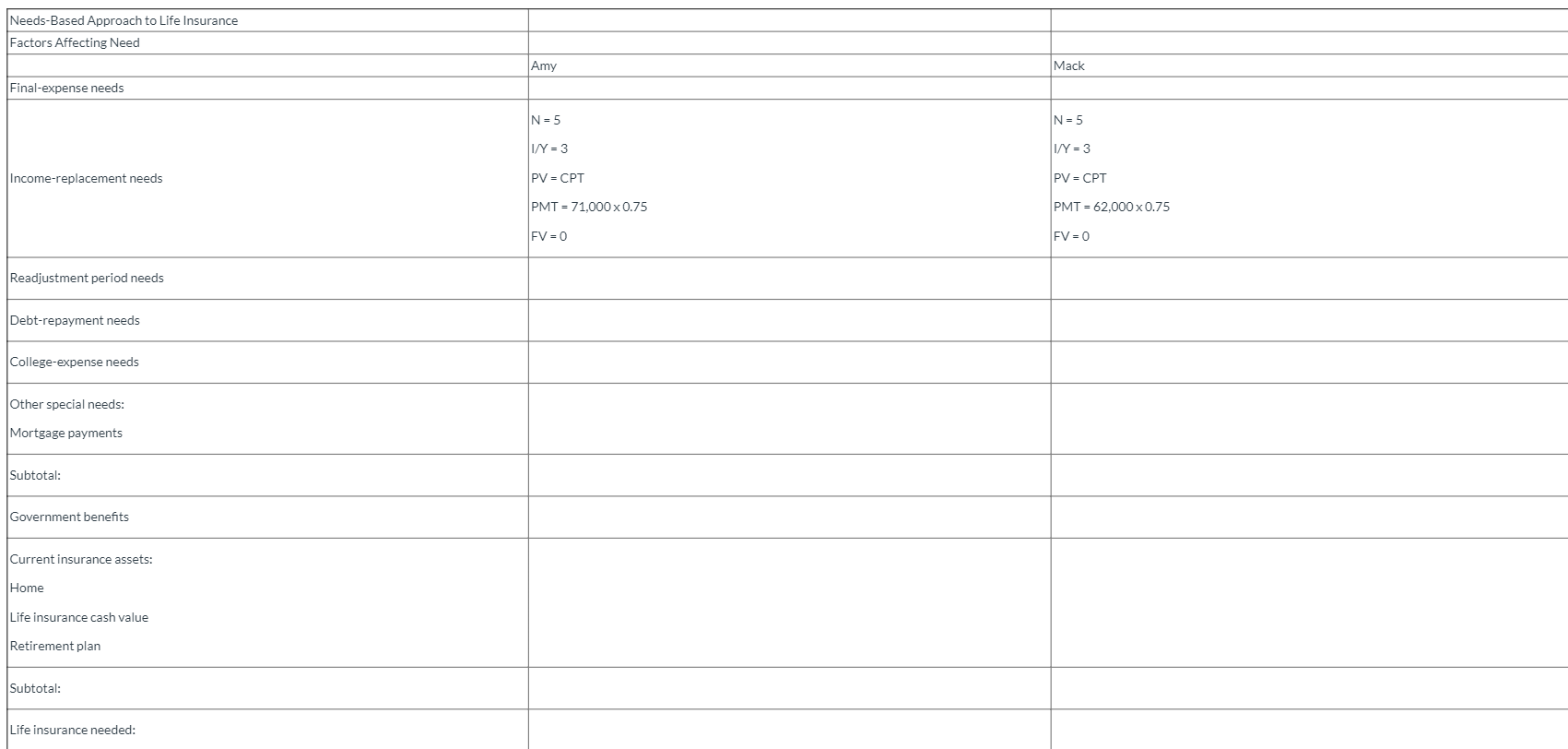

Life Insurance Needs for a Young Married Couple. Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $62,000 per year, and Amy earns $71,000. Each has a retirement plan valued at approximately $20,000. They recently received an offer in the mail from their mortgage lender for a mortgage life insurance policy of $190,000. Their only life insurance currently is a $20,000 cash-value survivorship joint life policy. They each would like to provide the other with support for at least five years if one of them should die.

(a) Assuming $15,000 in final expenses and $20,000 allocated to help make mortgage payments, calculate the amount of life insurance they should purchase using the needs-based approach.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started