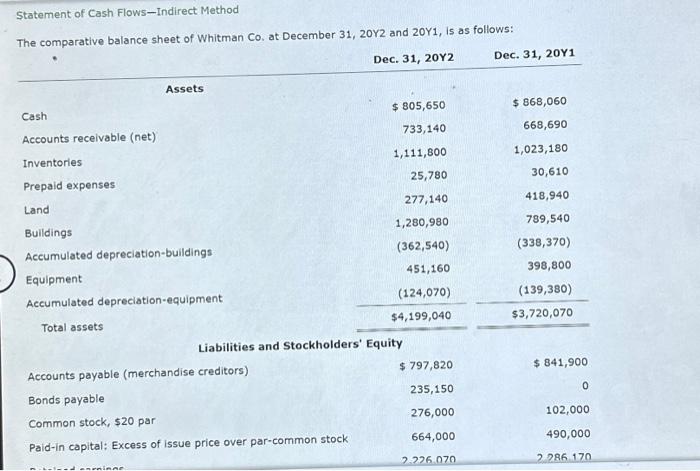

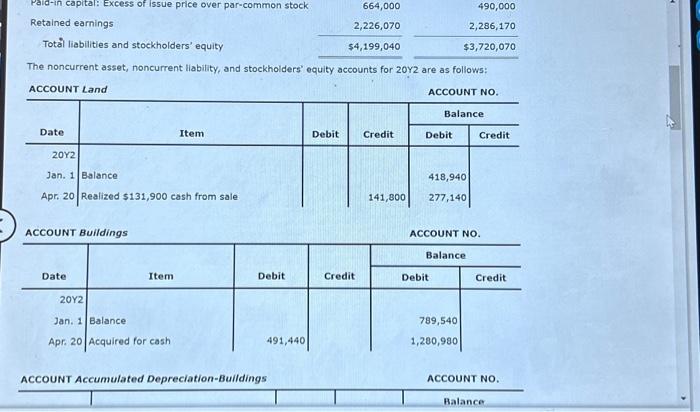

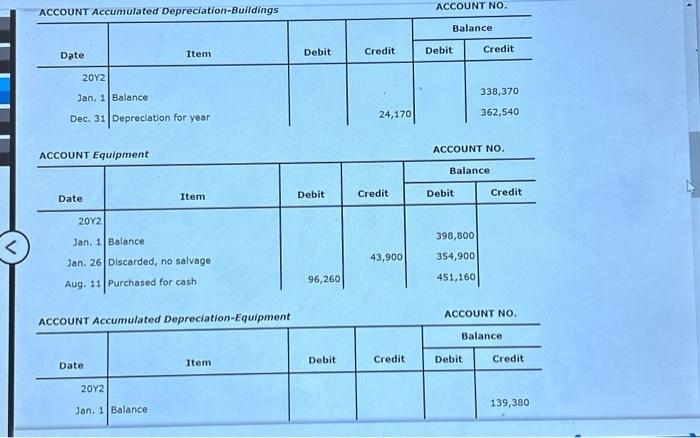

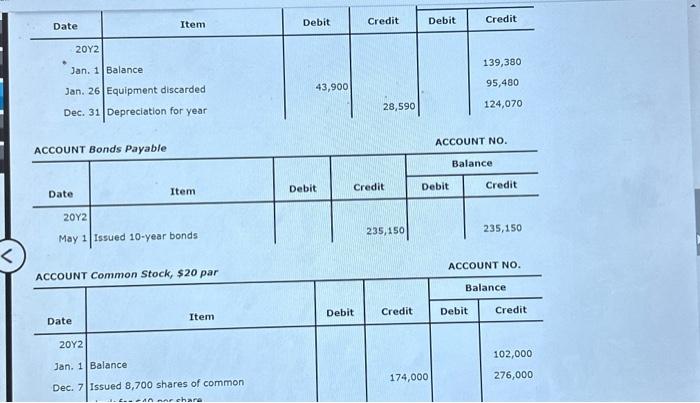

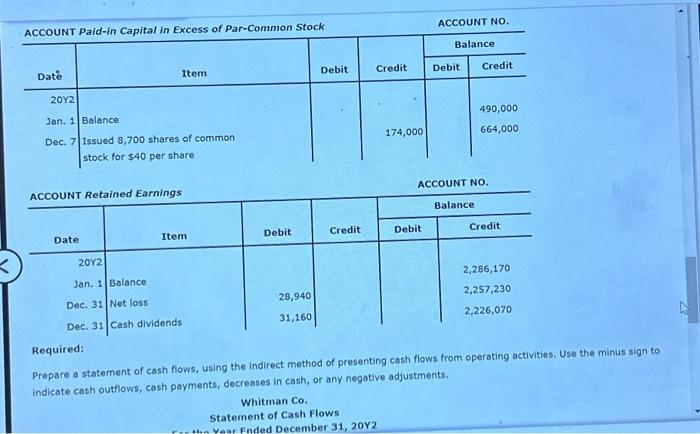

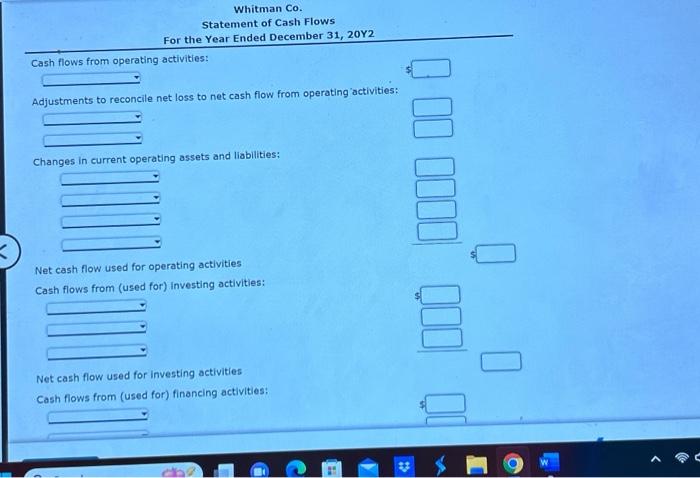

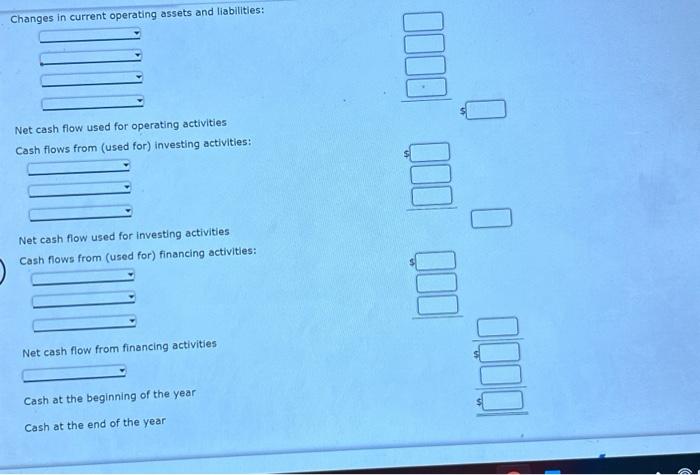

Required: ACCOUNT NO. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities, Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Whitman Co. Statement of Cash Flows AcCOUNT Bonds Payable ACCOUNT NO. \begin{tabular}{r|r|r|r|r|r} \hline \multirow{2}{*}{ Date } & Item & & & \multicolumn{2}{|c}{ Balance } \\ \cline { 4 - 5 } & & Debit & Credit & Debit & Credit \\ \hline May 1 & Issued 10-year bonds & & & & 235,150 \end{tabular} ACCOUNT Common Stock, $20 par ACCOUNT NO. Whitman Co. Statement of Cash Flows For the Year Ended December 31, 20 Y2 Cash flows from operating activities: Adjustments to reconcile net loss to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow used for operating activities Cash flows from (used for) investing activities: Net cash flow used for investing activities Cash flows from (used for) financing activities: \begin{tabular}{|c|c|c|} \hline ald-in capital: Excess of issue price over par-common stock & 664,000 & 490,000 \\ \hline Retained earnings & 2,226,070 & 2,286,170 \\ \hline Totl liabilities and stockholders' equity & $4,199,040 & $3,720,070 \\ \hline \end{tabular} The noncurrent asset, noncurrent liability, and stockholders' equity accounts for 20Y2 are as follows: ACCOUNT Land ACCOUNT Buildings ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO. Balance ACCOUNT Accumulated Depreciation-Buildings ACCOUNT NO. ACCOUNT Equipment ACCOUNT NO. \begin{tabular}{r|r|r|r|r|r} \multicolumn{1}{r|}{ Item } & & & \multicolumn{2}{|c}{ Balance } \\ \cline { 4 - 6 } Date & & Debit & Credit & Debit & Credit \\ \hline Jan. 1 & Balance & & & & \\ Jan. 26 & Discarded, no salvage & & & 398,800 & \\ Aug. 11 & Purchased for cash & & 43,900 & 354,900 & \\ & & 96,260 & & 451,160 & \end{tabular} ACcOUNT Accumulated Depreciation-Equipment ACCOUNT NO. \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Date } & & \multirow[b]{2}{*}{ Item } & \multirow[b]{2}{*}{ Debit } & \multirow[b]{2}{*}{ Credit } & \multicolumn{2}{|c|}{ Balance } \\ \hline & & & & & Debit & Credit \\ \hline & & & & & & \\ \hline Jan. 1 & Balance & & & & & 139,380 \\ \hline \end{tabular} Changes in current operating assets and liabilities: Net cash flow used for operating activities Cash flows from (used for) investing activities: Net cash flow used for investing activities Cash flows from (used for) financing activities: Net cash flow from financing activities Cash at the beginning of the year Cash at the end of the year Statement of Cash Flows - Indirect Method