Answered step by step

Verified Expert Solution

Question

1 Approved Answer

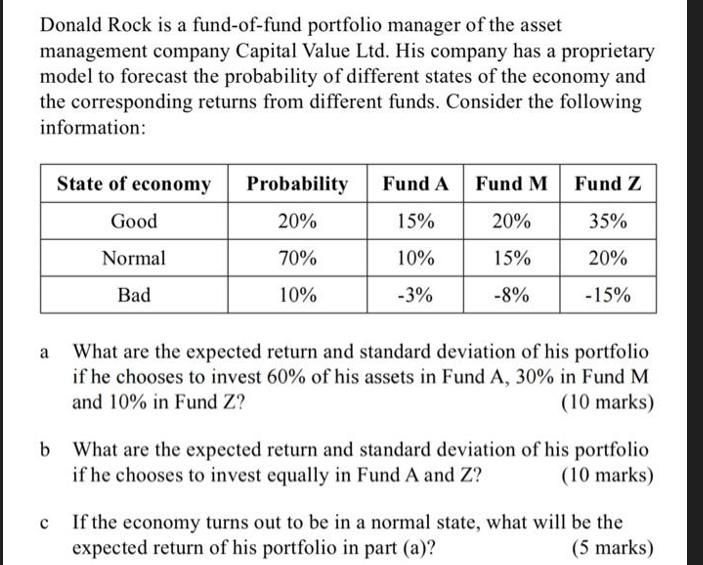

Donald Rock is a fund-of-fund portfolio manager of the asset management company Capital Value Ltd. His company has a proprietary model to forecast the

Donald Rock is a fund-of-fund portfolio manager of the asset management company Capital Value Ltd. His company has a proprietary model to forecast the probability of different states of the economy and the corresponding returns from different funds. Consider the following information: State of economy Good Normal Bad Probability 20% 70% 10% Fund A 15% 10% -3% Fund M 20% 15% -8% Fund Z 35% 20% -15% What are the expected return and standard deviation of his portfolio if he chooses to invest 60% of his assets in Fund A, 30% in Fund M and 10% in Fund Z? (10 marks) b What are the expected return and standard deviation of his portfolio if he chooses to invest equally in Fund A and Z? (10 marks) If the economy turns out to be in a normal state, what will be the expected return of his portfolio in part (a)? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This scenario involves calculating expected returns and the standard deviation of a portfolio under certain economic conditions To answer these questi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started