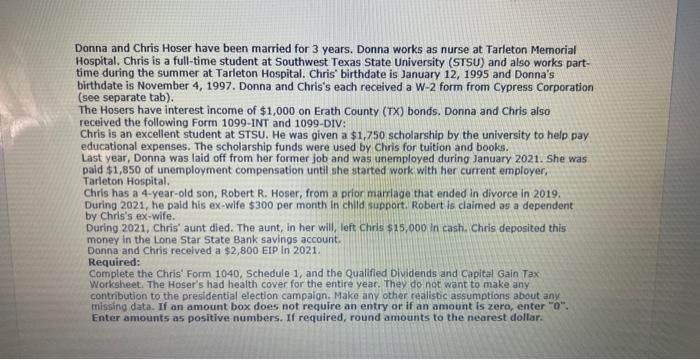

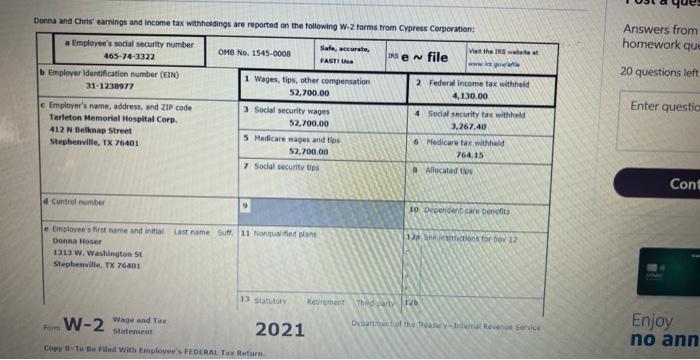

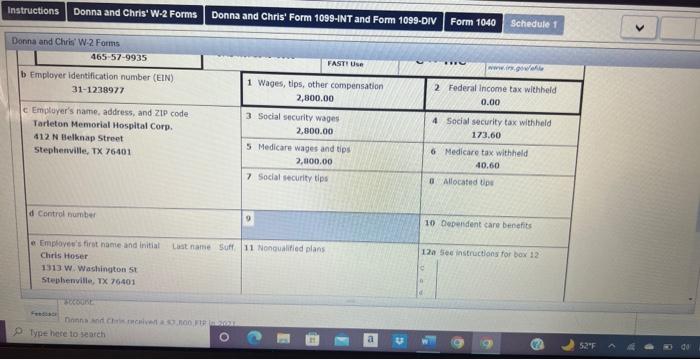

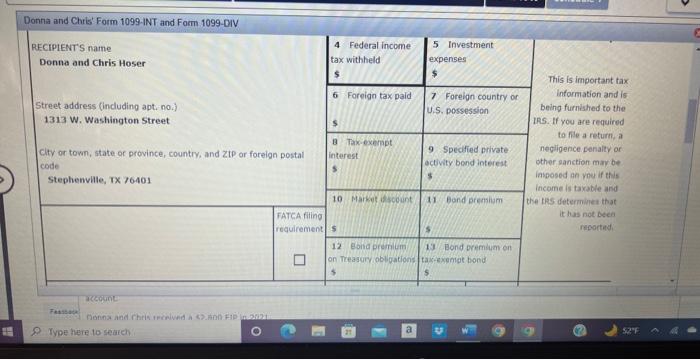

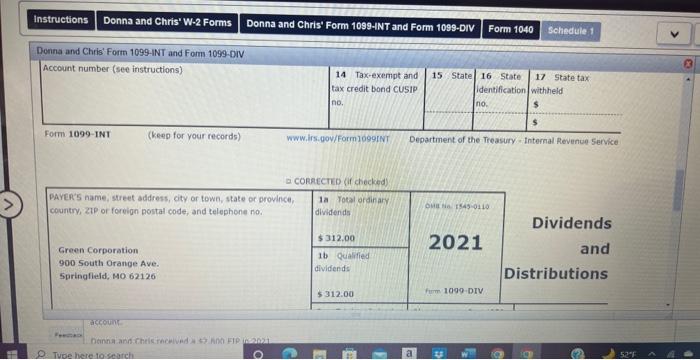

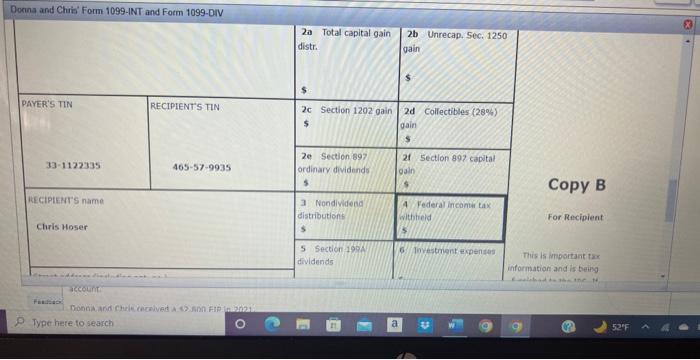

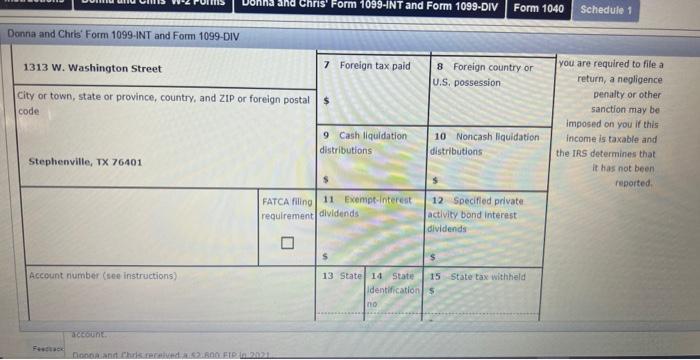

Donna and Chris Hoser have been married for 3 years. Donna works as nurse at Tarleton Memorial Hospital. Chris is a full-time student at Southwest Texas State University (STSU) and also works parttime during the summer at Tarleton Hospital. Chris' birthdate is January 12, 1995 and Donna's birthdate is November 4, 1997. Donna and Chris's each received a W-2 form from Cypress Corporation (see separate tab). The Hosers have interest income of $1,000 on Erath County (TX) bonds. Donna and Chris also received the following Form 1099-INT and 1099-DIV: Chris is an excellent student at STSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Chris for tuition and books. Last year, Donna was laid off from her former job and was unemployed during January 2021. She was paid $1,850 of unemployment compensation until she started work with her current employer, Tarleton Hospital. Chris has a 4-year-old son, Robert R. Hoser, from a prior marrlage that ended in divorce in 2019. During 2021, he paid his ex-wife $300 per month in child support, Robert is claimed as a dependent by Chris's ex-wife. During 2021, Chris' aunt died. The aunt, in her will, left Chris $15,000 in cash. Chris deposited this money in the Lone Star State Bank savings account. Donna and Chris received a $2,800 EIP in 2021. Required: Complete the Chris' Form 1040, Schedule 1, and the Qualified Dividends and Capital Gain Tax Worksheet. The Hoser's had health cover for the entire year. They do not want to make any contribution to the presidential election campaion. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or if an amount is zero, enter " 0". Enter amounts as positive numbers. If required, round amounts to the nearest dollar. Answers from homework qui 20 questions left Donna and Chris received the following Form 1099-1NT and Form 1099-DTV: Donna and Chris' Form 1099-INT and Form 1099-DIV Form 1099-1NT (Keep for your records) Www.irs.gov/Form10991NT Department of the Treasury - Internal Revenue service a corsteme (if checked) Dorina and Chisis' Form 1099-1NT and Fotm 1099-DIV Donna and Chrts' Form 1099-INT and Form 1099-DIV Donna and Chris Hoser have been married for 3 years. Donna works as nurse at Tarleton Memorial Hospital. Chris is a full-time student at Southwest Texas State University (STSU) and also works parttime during the summer at Tarleton Hospital. Chris' birthdate is January 12, 1995 and Donna's birthdate is November 4, 1997. Donna and Chris's each received a W-2 form from Cypress Corporation (see separate tab). The Hosers have interest income of $1,000 on Erath County (TX) bonds. Donna and Chris also received the following Form 1099-INT and 1099-DIV: Chris is an excellent student at STSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Chris for tuition and books. Last year, Donna was laid off from her former job and was unemployed during January 2021. She was paid $1,850 of unemployment compensation until she started work with her current employer, Tarleton Hospital. Chris has a 4-year-old son, Robert R. Hoser, from a prior marrlage that ended in divorce in 2019. During 2021, he paid his ex-wife $300 per month in child support, Robert is claimed as a dependent by Chris's ex-wife. During 2021, Chris' aunt died. The aunt, in her will, left Chris $15,000 in cash. Chris deposited this money in the Lone Star State Bank savings account. Donna and Chris received a $2,800 EIP in 2021. Required: Complete the Chris' Form 1040, Schedule 1, and the Qualified Dividends and Capital Gain Tax Worksheet. The Hoser's had health cover for the entire year. They do not want to make any contribution to the presidential election campaion. Make any other realistic assumptions about any missing data. If an amount box does not require an entry or if an amount is zero, enter " 0". Enter amounts as positive numbers. If required, round amounts to the nearest dollar. Answers from homework qui 20 questions left Donna and Chris received the following Form 1099-1NT and Form 1099-DTV: Donna and Chris' Form 1099-INT and Form 1099-DIV Form 1099-1NT (Keep for your records) Www.irs.gov/Form10991NT Department of the Treasury - Internal Revenue service a corsteme (if checked) Dorina and Chisis' Form 1099-1NT and Fotm 1099-DIV Donna and Chrts' Form 1099-INT and Form 1099-DIV