Question

Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2018, 480 shares of

Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2018, 480 shares of preferred stock and 5,800 shares of common stock have been issued. The following transactions affect stockholders equity during 2018:

March 1 Issues 2,900 shares of common stock for $60 per share.

May 15 Purchase 580 shares of treasury stock for $53 per share.

July 10 Reissues 380 shares of treasury stock purchased on May 15 for $58 per share.

October 15 Issues 380 shares of preferred stock for $63 per share.

December 1 Declare a cash dividend on both common and preferred stock of $2.30 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.)

December 31 Pay the cash dividends declared on December 1.

Donnie Hilfiger has the following beginning balances in its stockholders equity accounts on January 1, 2018: Preferred Stock, $480; Common Stock, $58; Additional Paid-in Capital, $85,000; and Retained Earnings, $34,100. Net income for the year ended December 31, 2018, is $14,400.

Required:

1. Record each of these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

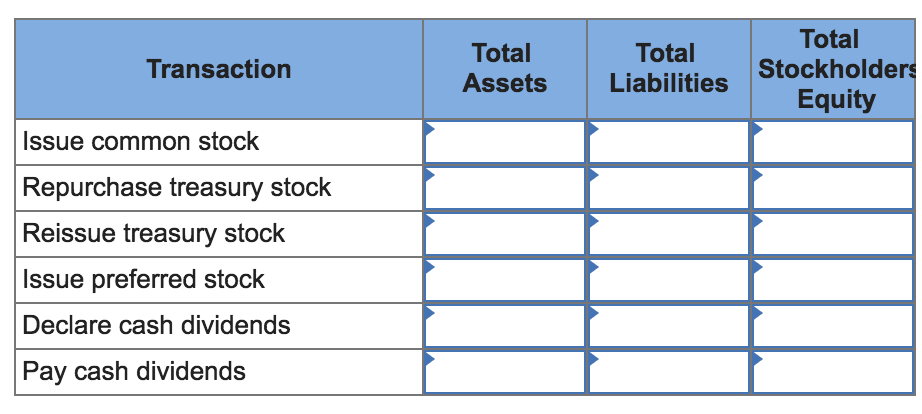

2. Select whether each of the following transactions increases ( + ) or decreases ( - ) total assets, total liabilities, and total stockholders' equity by completing the following table. (If none of the categories apply for a particular item, leave the cell blank.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started