Answered step by step

Verified Expert Solution

Question

1 Approved Answer

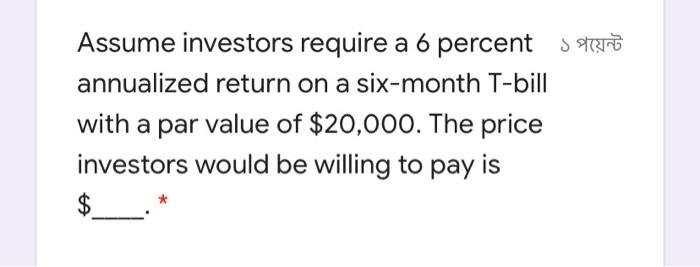

dont need to explain. just answer me. thanks Assume investors require a 6 percent store annualized return on a six-month T-bill with a par value

dont need to explain. just answer me. thanks

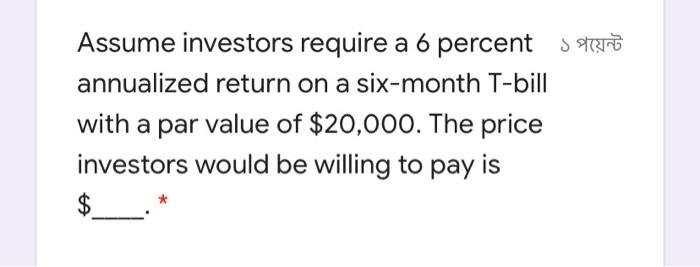

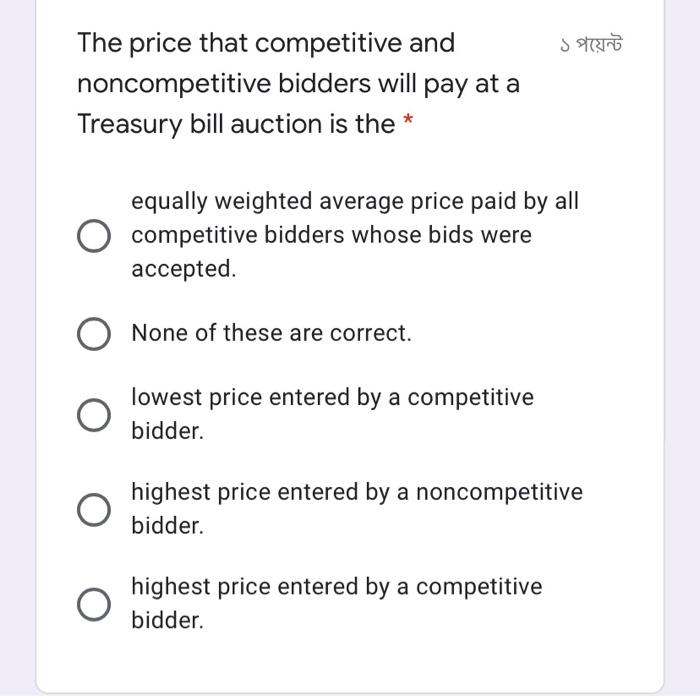

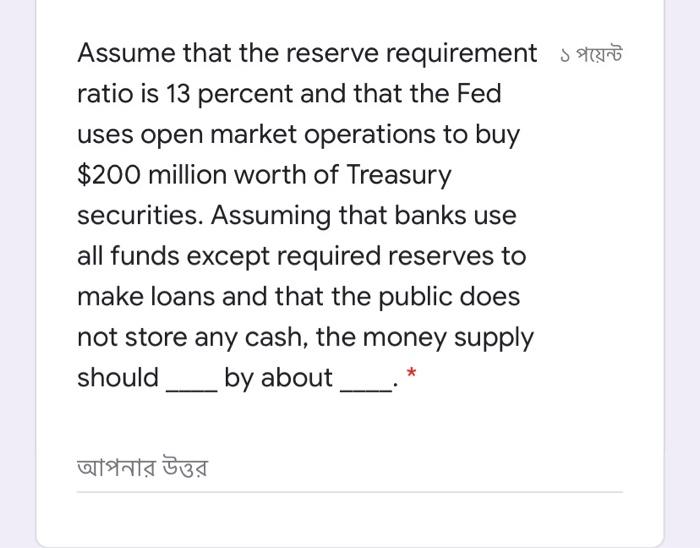

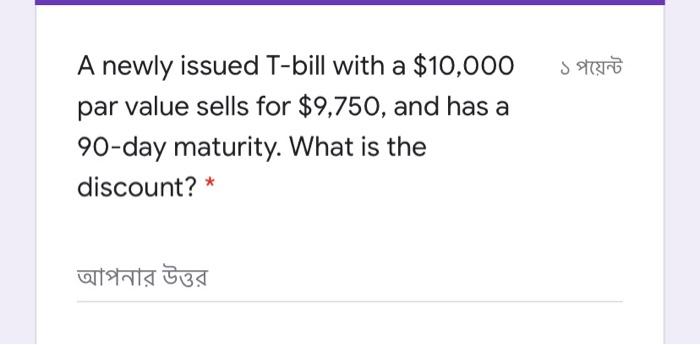

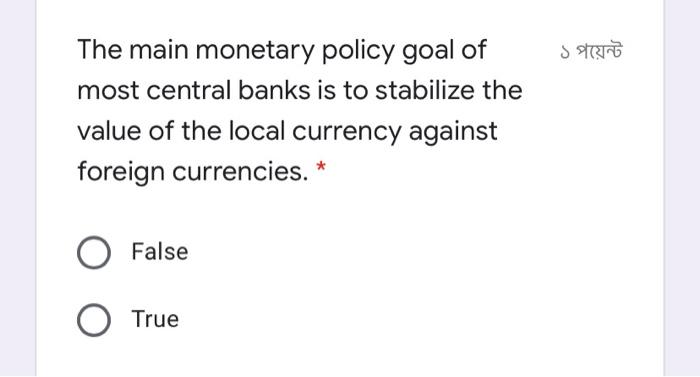

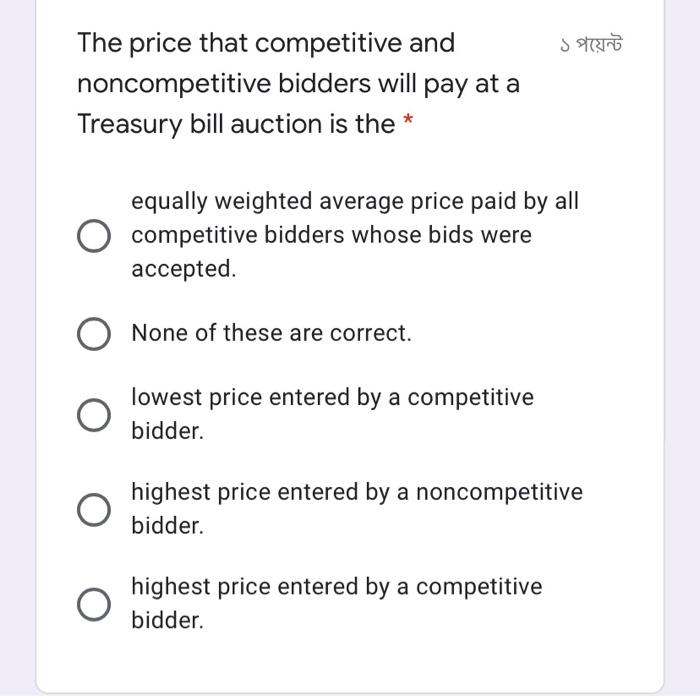

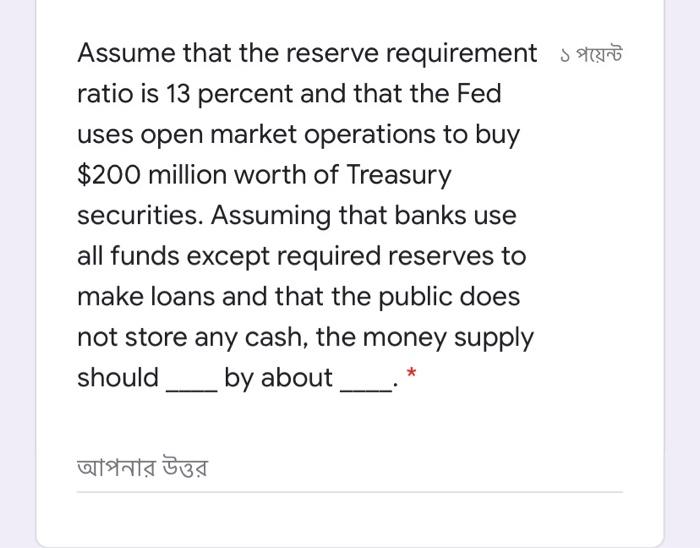

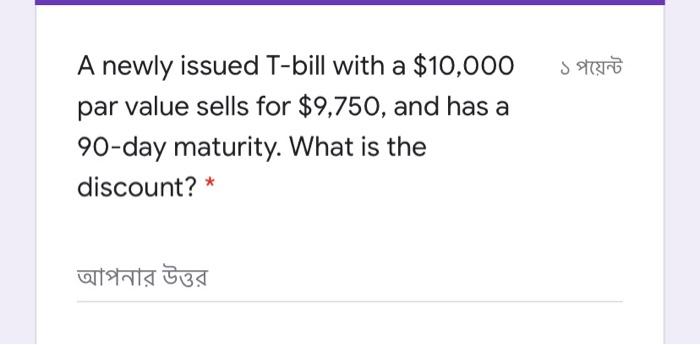

Assume investors require a 6 percent store annualized return on a six-month T-bill with a par value of $20,000. The price investors would be willing to pay is The main monetary policy goal of most central banks is to stabilize the value of the local currency against foreign currencies. * False O True The price that competitive and noncompetitive bidders will pay at a Treasury bill auction is the * equally weighted average price paid by all competitive bidders whose bids were accepted. None of these are correct. lowest price entered by a competitive bidder. highest price entered by a noncompetitive bidder. highest price entered by a competitive bidder. Assume that the reserve requirement samo ratio is 13 percent and that the Fed uses open market operations to buy $200 million worth of Treasury securities. Assuming that banks use all funds except required reserves to make loans and that the public does not store any cash, the money supply should by about A newly issued T-bill with a $10,000 par value sells for $9,750, and has a 90-day maturity. What is the discount?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started