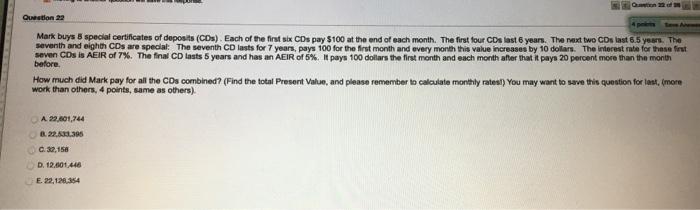

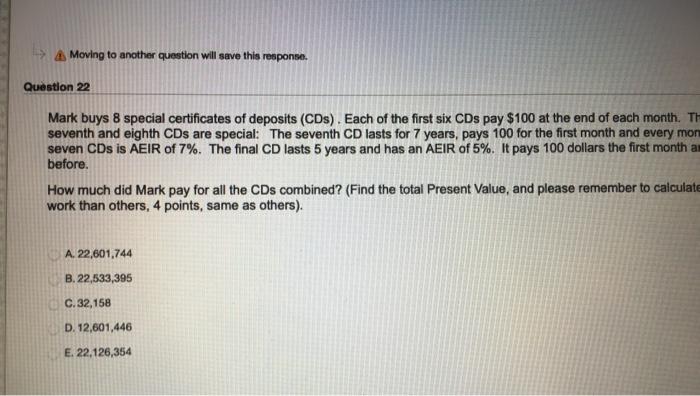

Question 29 Mark buys 8 special certificates of deposits (CDs). Each of the first six CDs pay $100 at the end of each month. The first four CDs last 6 years. The next two CDs last 65 year. The seventh and eighth CDs are special: The seventh CD lasts for 7 years, pays 100 for the first month and every month this value increases by 10 dollars. The interest rate for these first seven CDs is AEIR of 7%. The final CD lasts 5 years and has an AEIR of 5%. It pays 100 dollars the first month and each month after that it pays 20 percent more than the month before How much did Mark pay for all the CDs combined? (Find the total Present Value, and please remember to calculate monthly rates) You may want to save this question for last, more work than others, 4 points, same as others) A 22.601,744 B.22.611395 G. 32,158 D. 12.001.446 E. 22.128.354 Moving to another question will save this response. Question 22 Mark buys 8 special certificates of deposits (CDs). Each of the first six CDs pay $100 at the end of each month. Th seventh and eighth CDs are special: The seventh CD lasts for 7 years, pays 100 for the first month and every mon seven CDs is AEIR of 7%. The final CD lasts 5 years and has an AEIR of 5%. It pays 100 dollars the first month a before. How much did Mark pay for all the CDs combined? (Find the total Present Value, and please remember to calculate work than others, 4 points, same as others). A. 22,601,744 B.22,533,395 C.32,158 D. 12,601,446 E. 22.126,354 Question 22 of 26 4 points Save Answo pay $100 at the end of each month. The first four CDs last 6 years. The next two CDs last 6.5 years. The "s 100 for the first month and every month this value increases by 10 dollars. The interest rate for these first 2%. It pays 100 dollars the first month and each month after that it pays 20 percent more than the month alue, and please remember to calculate monthly rates!) You may want to save this question for last, (more Question 29 Mark buys 8 special certificates of deposits (CDs). Each of the first six CDs pay $100 at the end of each month. The first four CDs last 6 years. The next two CDs last 65 year. The seventh and eighth CDs are special: The seventh CD lasts for 7 years, pays 100 for the first month and every month this value increases by 10 dollars. The interest rate for these first seven CDs is AEIR of 7%. The final CD lasts 5 years and has an AEIR of 5%. It pays 100 dollars the first month and each month after that it pays 20 percent more than the month before How much did Mark pay for all the CDs combined? (Find the total Present Value, and please remember to calculate monthly rates) You may want to save this question for last, more work than others, 4 points, same as others) A 22.601,744 B.22.611395 G. 32,158 D. 12.001.446 E. 22.128.354 Moving to another question will save this response. Question 22 Mark buys 8 special certificates of deposits (CDs). Each of the first six CDs pay $100 at the end of each month. Th seventh and eighth CDs are special: The seventh CD lasts for 7 years, pays 100 for the first month and every mon seven CDs is AEIR of 7%. The final CD lasts 5 years and has an AEIR of 5%. It pays 100 dollars the first month a before. How much did Mark pay for all the CDs combined? (Find the total Present Value, and please remember to calculate work than others, 4 points, same as others). A. 22,601,744 B.22,533,395 C.32,158 D. 12,601,446 E. 22.126,354 Question 22 of 26 4 points Save Answo pay $100 at the end of each month. The first four CDs last 6 years. The next two CDs last 6.5 years. The "s 100 for the first month and every month this value increases by 10 dollars. The interest rate for these first 2%. It pays 100 dollars the first month and each month after that it pays 20 percent more than the month alue, and please remember to calculate monthly rates!) You may want to save this question for last, (more