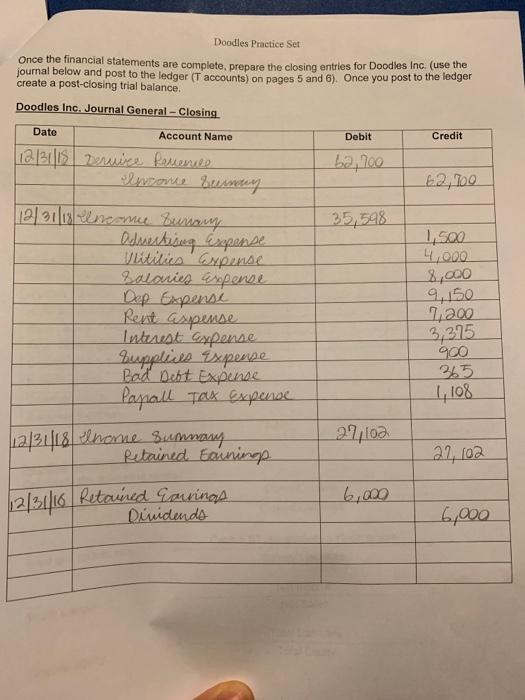

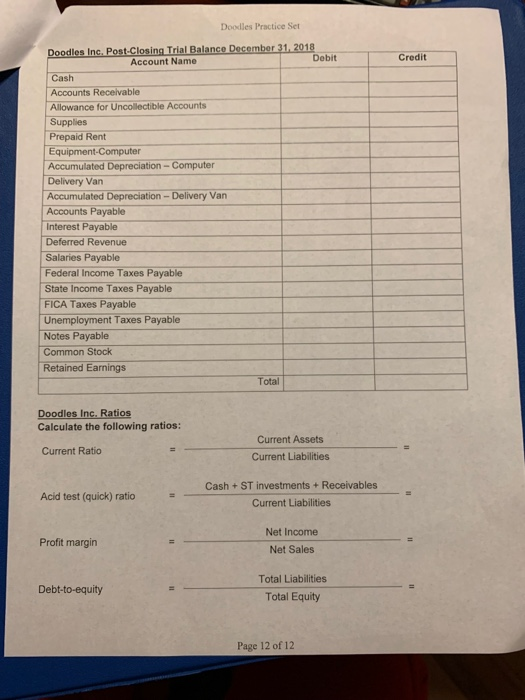

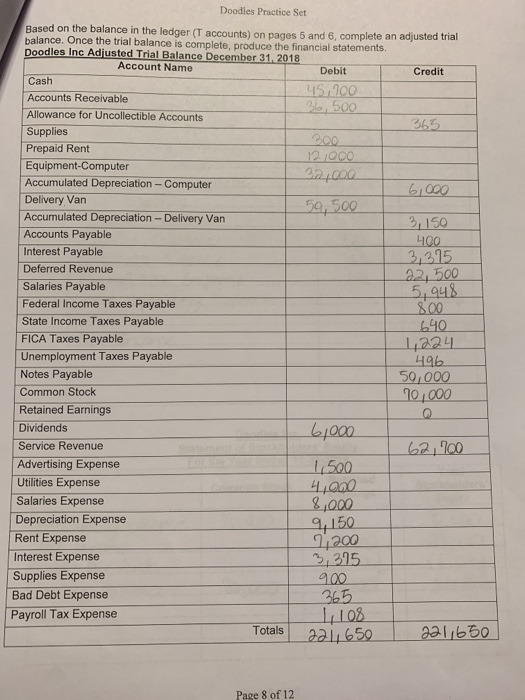

Doodles Practice Set Once the financial statements are complete, prepare the closing entries journal below and post to the ledger (T accounts) on pages 5 and 6). Once create a post-closing trial balance. for Doodles Inc. (use the you post to the ledger Doodles Inc, Journal General-Closing Date Account Name Credit Debit 62,100 Rest aspense Intraist Gxpense 3,215 2. 27 102 6,000 unnap ividurda Doodles Practice Set Doodles Inc. Post Closing Trial Balance December 31, 2018 Debit Credit Account Name Cash Accounts Receivable Allowance for Uncollectible Accounts Supplies Prepaid Rent Equipment-Computer Accumulated Depreciation-Computer Delivery Van Accumulated Depreciation-Delivery Van Accounts Payable Interest Payable Deferred Revenue Salaries Payable Federal Income Taxes Payable State Income Taxes Payable FICA Taxes Payable Unemployment Taxes Payable Notes Payable Common Stock Retained Earnings Total Doodles Inc, Ratios Calculate the following ratios: Current Assets Current Liabilities Current Ratio Cash + ST investments+ Receivables Current Liabilities Acid test (quick) ratio Net Income Profit margin Net Sales Total Liabilities Total Equity Debt-to-equity Page 12 of 12 Doodles Practice Set Based on the balance in the ledger (T accounts) on pages 5 and 6, complete an adjusted balance. Once the trial balance is complete, produce the financial statements. Doodles Inc Adiusted Trial Balance December 31.2018 Account Name Debit Credit Cash 151100 %, 500 Accounts Receivable Allowance for Uncollectible Accounts Supplies Prepaid Rent Equipment-Computer Accumulated Depreciation- Computer Delivery Va Accumulated Depreciation - Delivery Van Accounts Payable Interest Payable Deferred Revenue Salaries Payable Federal Income Taxes Payable State Income Taxes Payable FICA Taxes Payable Unemployment Taxes Payable Notes Payable Common Stock Retained Earnings Dividends 215 640 422L 50,000 Service Revenue Advertising Expense Utilities Expense Salaries Expense 2,000 Depreciation Expense Rent Expense Interest Expense Supplies Expense Bad Debt Expense Payroll Tax Expense 31215 365 Totals 20l4 650 Page 8 of 12