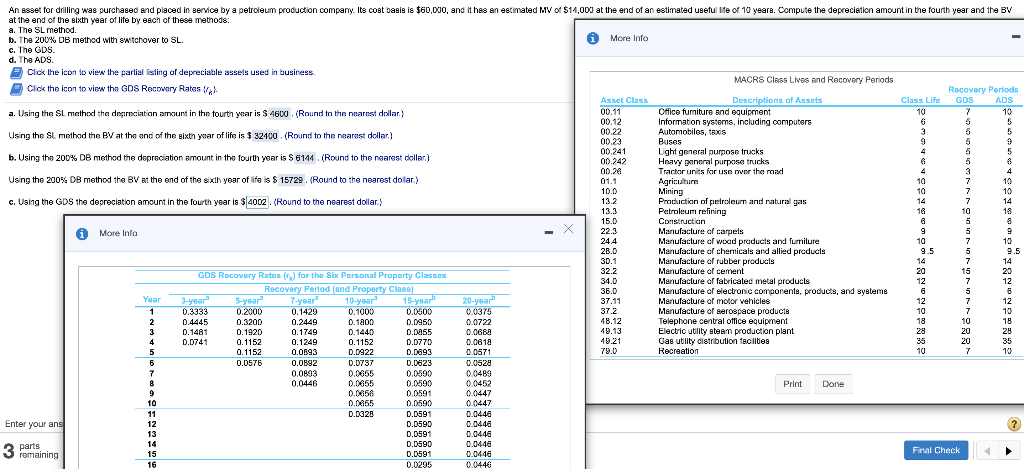

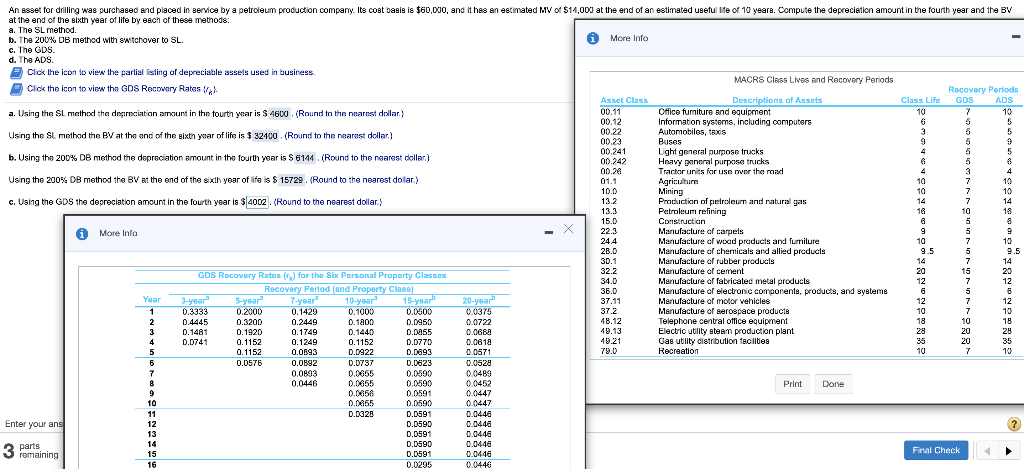

DOW 01.1 13.2 13.3 An esset for drilling was purchased and placed in service by a petroleum production company. Its cost basis is $60,000, and it has an estimated MV of $14,000 at the end of an estimated useful life of 10 years. Compute the depreciation amount in the fourth year and the BV at the end of the sixth year of life by each of these methods: a. The SL method. b. The 200% D5 method with switchover to SL. i More Info c. The GDS. d. The ADS Click the icon to view the parlial listing of depreciable assets used in business MACRS Class Lives and Recovery Periods Click the icon to view the GDS Recovery Rates Recovery Periods Asset Class Descriptions of Assets Class Life GDS ADS a. Using the SL method the depreciation amount in the fourth year is $4600 . (Round to the nearest dollar. 00.11 Office furniture and equipment 00.12 Informaton systems, including computers Using the SL method the BV at the end of the sixth year of life is $ 32400 (Round to the nearest dollar) 00 22 Automobiles, taxis 00.23 Puses 00.241 Light general purpose trucks b. Using the 200% DB method the depreciation amount in the fourth year is S 6144. (Round to the nearest doller) OD 242 Heavy peneral purpose trucks 00.26 Tractor units for use on the road Using the 200% DB method the BV at the end of the sixth year of life is $ 15729. (Round to the nearest dolar) Agriculture 10.0 Mining c. Using the GDS the depreciation amount in the fourth year is $4002.(Round to the nearest dollar) Production of petroleum and natural gas Petroleum refining 15.0 Constructian i More Info 22.3 Manufacture of carpels 244 Manufacture of wood products and furniture Manufacture of chernicals and allied products 9.5 Manufacture of rubber products Menulaclure of cement GDS Recovery Rates (r) for the Six Personal Property Classes 20 34.0 Manufacture of fabricated metal products Recovery Period (and Property Class) Manufacture of electronic components, products, and systems Year 3-year 5-year 7-year 10-year 15-year 2 0-year 37.11 Manufacture of motor vehicles 0.3333 0.2000 0.1429 0.1000 0.0500 0.0375 37.2 Manufacture of serospace products 0.4445 0.3200 0.2449 0.1200 0.0950 0.0722 48.12 Telephone central office equipment 0.1481 0. 1920 0.1749 0.1440 0.0055 0.088 49.13 Electric utility steam production plant 0.0741 0.1152 0.1249 0.1152 0.0770 0.0618 49.21 Gas utility distribution faclities 0.1152 0.0893 0.0022 0.0893 0.0671 79.0 Recreation 0.0576 0.0892 0.0737 0.0623 0.0528 0.0893 0.00055 1.09 00489 0.0446 0.0055 0.0590 0.0452 0.0058 0.0591 00447 0.0855 0.0590 00447 D.0328 0.0591 0.0448 Enter your ans D.0590 0.0446 0.0591 0.0446 0.0590 0.0446 remaining 0.0591 0.0146 Final Check 0.0295 28.0 30.1 32.2 14 36.D 10 Print Done 3 parts