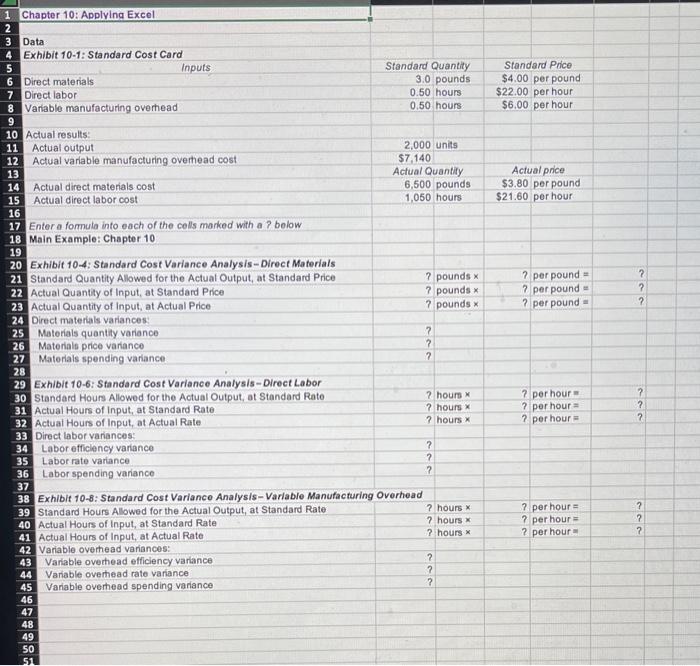

Downioad the Applying Excel form and enter formulas in all cells that contain question marks. For example; in colt D21 enter the formula "= D6" Notes: In the text, variances ate always displayed as positive numbers. To accomplish this, you can use the ABs0 function in Excel. For example, the formula in cell B25 would be =ABS(F21F22)" - Celis C25 through C27, C34 through C36, and C43 through C45 already contain formulas to compute and display whether variances are Favoroble or Unfovorable. Do not enter datin of formulas into those cells - 1 you do, you will overwite these formulat. - After entering facmulas in alf of the cells thet contained question matks, verity that the amounts match the numbers in the example in the text. Check your worksheet by changing the direct materials standard quantity in cell 86102.9 pounds, the direct lobor standard quantity in cell B7 to 0.6 hours, and the variabie manufacturing overhead in cell 89 to 0.6 hours. The materials spending variance should now be $1,500U, the labor spending variance should now be $3.720F, and the variable overbead spending variance should now be \$60 F. If you do not get these answers, find the errors in your warksheet and correct them. Save your completed Applying Excel form to your computer and then upload it hete by clicking "Browse." Next, cllick "Save." You will use this worksheet to answer the questions in Part 2. downiosd referense tile opiosd o responte tile (1SMB mas) Nia fac hoom 1 Chapter 10:Applying Excel \begin{tabular}{c|} \hline 2 \\ \hline 3 \\ \hline 4 \\ \hline 5 \\ \hline 6 \\ \hline 7 \\ \hline 8 \\ 9 \\ 10 \\ 11 \\ \hline 12 \\ \hline 13 \\ 14 \\ \hline 15 \\ \hline 16 \\ \hline 17 \end{tabular} Data Exhibit 10-1: Standard Cost Card Direct materials inputs \begin{tabular}{c|r} \hline Standard Quantity & Standard Price \\ \hline 3.0 pounds & $4.00 per pound \\ \hline 0.50 hours & $22.00 per hour \\ \hline 0.50 hours & $6.00 per hour \end{tabular} Direct labor Variable manufacturing overinead 2,000 units Actual output Actual variable manufacturing overhead cost $7,140 Actual Quantify Actual price Actual direct materials cost Actual direct labor cost \begin{tabular}{|lr|} \hline 6,500 pounds & $3.80 per pound \\ \hline 1,050 hours & $21.60 per hour \end{tabular} Enter a fomula into each of the cells marked with a ? bolow Main Example: Chapter 10 Exhibit 10-4: Standard Cost Variance Analysis-Direct Materials 21 Standard Quantity Allowed for the Actual Output, at Standard Price 22 Actual Quantity of Input, at Standard Price 23 Actual Quantity of input, at Actual Price 24 Direct materials variances: 25 Matorials quantity variance Materiale price varianco Materials spending variance Exhibit 10-6: Standard Cost Variance Analysis - Direct Labor 30 Standard Hours Allowed for the Actual Output, at Standard Rate 31 Actual Hours of Input, at Standard Rate 32 Actual Hours of Input, at Actual Rate 33 Direct labor variances: 34 Labor efficiency variance Labor rate variance Labor spending variance ? ? 7 35 36 37 38 Exhibit 10-8: Standard Cost Variance Analysis - Varlable Manufacturing Overhead 39 Standard Hours Allowed for the Actual Output, at Standard Rate 40 Actual Hours of Input, at Standard Rate 41 Actual Hours of Input, at Actual Rate ?hoursx?hoursx?hoursx?perhour=?perhour=?perhour=??? 42 Variable overhead variances: 43 Variable overtiead efficiency variance Variable overhead rate variance Variable overhead spending variance ?hoursx?hoursx?hoursx?perhour=?perhour=?perhour=??? \begin{tabular}{l} 4645 \\ \hline 47 \\ \hline 48 \\ \hline 49 \\ \hline 50 \\ \hline 51 \end{tabular}