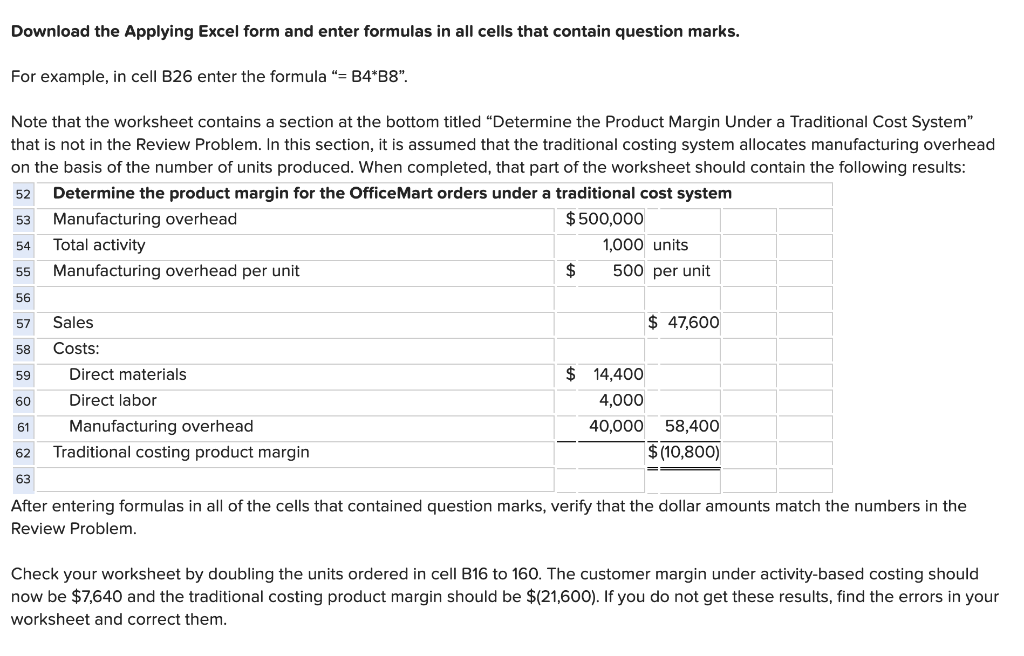

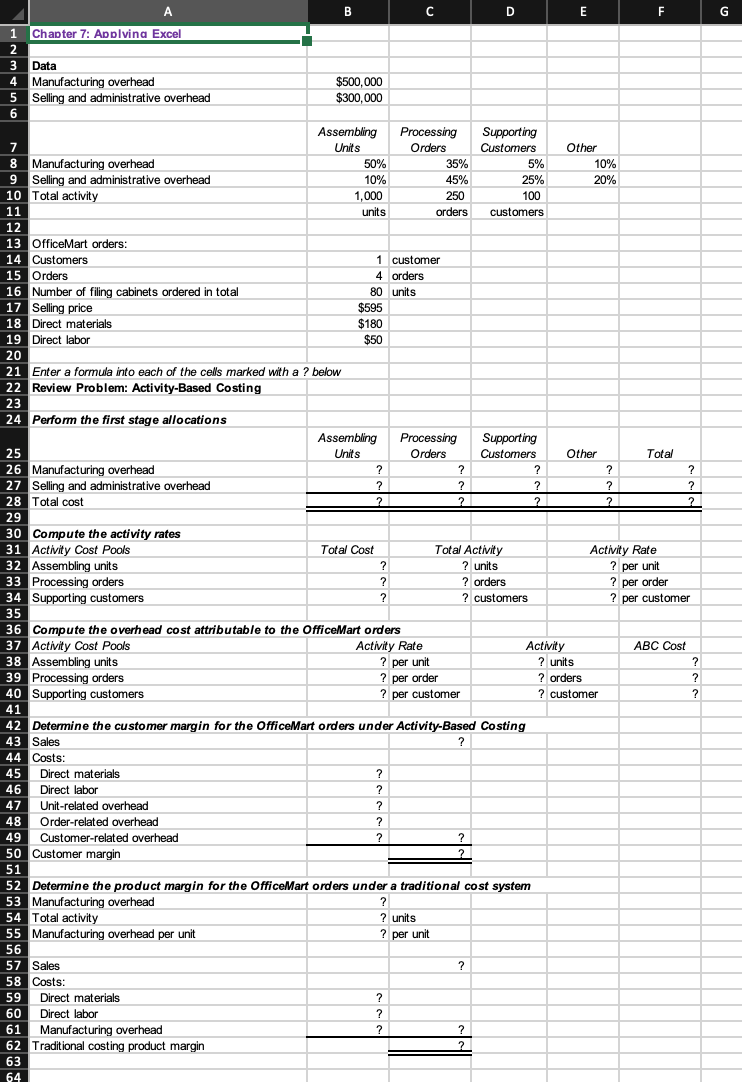

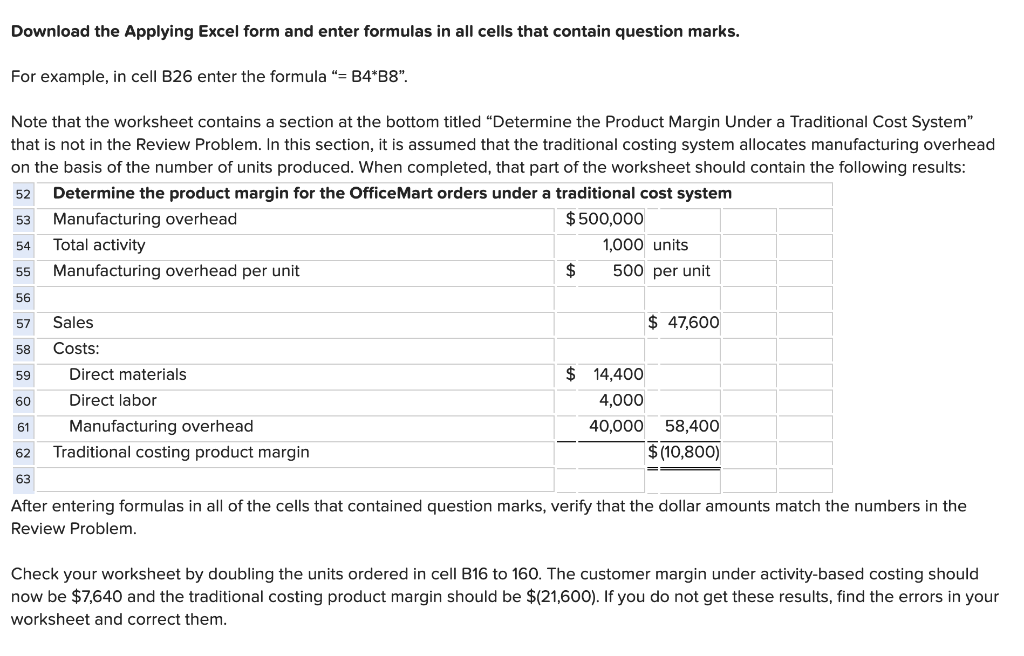

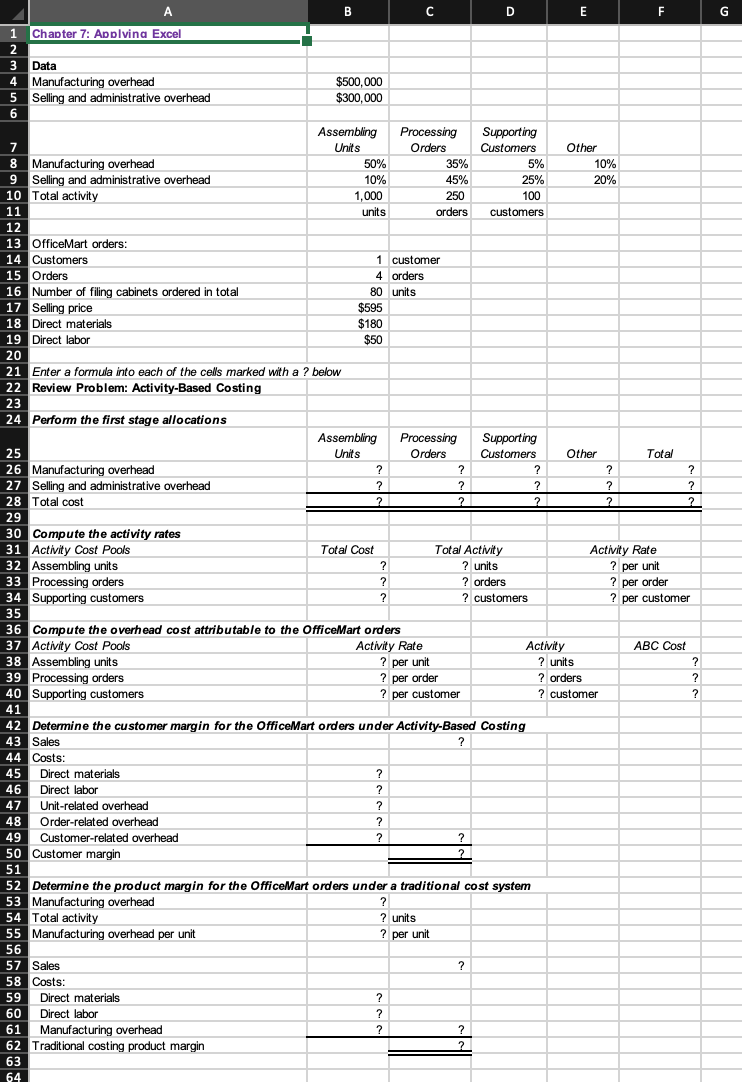

Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B26 enter the formula "=B4*B8". Note that the worksheet contains a section at the bottom titled "Determine the Product Margin Under a Traditional Cost System" that is not in the Review Problem. In this section, it is assumed that the traditional costing system allocates manufacturing overhead on the basis of the number of units produced. When completed, that part of the worksheet should contain the following results: 52 Determine the product margin for the OfficeMart orders under a traditional cost system Manufacturing overhead $ 500,000 54 Total activity 1,000 units 55 Manufacturing overhead per unit $ 500 per unit 53 56 57 Sales $ 47,600 58 59 60 Costs: Direct materials Direct labor Manufacturing overhead Traditional costing product margin $ 14,400 4,000 40,000 58,400 $(10,800) 61 62 63 After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the numbers in the Review Problem. Check your worksheet by doubling the units ordered in cell B16 to 160. The customer margin under activity-based costing should now be $7,640 and the traditional costing product margin should be $(21,600). If you do not get these results, find the errors in your worksheet and correct them. G C D E F 1 Chapter 7: Applvina Excel 2 3 Data 4 Manufacturing overhead $500,000 5 Selling and administrative overhead $300,000 6 Assembling Processing Supporting 7 Units Orders Customers Other 8 Manufacturing overhead 50% 35% 5% 10% 9 Selling and administrative overhead 10% 45% 25% 20% 10 Total activity 1,000 250 100 11 units orders customers 12 13 OfficeMart orders: 14 Customers 1 customer 15 Orders 4 orders a 16 Number of filing cabinets ordered in total 80 units 17 Selling price $595 18 Direct materials $180 19 Direct labor $50 20 21 Enter a formula into each of the cells marked with a ? below 22 Review Problem: Activity-Based Costing 23 24 Perform the first stage allocations Assembling Processing Supporting 25 Units Orders Customers Other Total 26 Manufacturing overhead ? ? ? ? ? 27 Selling and administrative overhead ? ? ? ? ? ? 28 Total cost 2 ? 2 ? ? 29 30 Compute the activity rates 31 Activity Cost Pools Total Cost Total Activity Activity Rate 32 Assembling units ? ? units ? per unit 33 Processing orders ? ? orders ? per order 34 Supporting customers ? ? customers ? per customer 20 35 36 Compute the overhead cost attributable to the OfficeMart orders 37 Activity Cost Pools Activity Rate Activity ABC Cost 38 Assembling units ? per unit ? units ? 39 Processing orders ? per order ? orders ? A 40 Supporting customers ? per customer ? customer ? 41 42 Determine the customer margin for the OfficeMart orders under Activity-Based Costing 43 Sales ? 44 Costs: 45 Direct materials ? 46 Direct labor ? 47 Unit-related overhead ? 48 Order-related overhead ? 49 Customer-related overhead ? ? 50 Customer margin ? 51 52 Determine the product margin for the OfficeMart orders under a traditional cost system 53 Manufacturing overhead ? 54 Total activity ? units 55 Manufacturing overhead per unit ? per unit 56 57 Sales ? 58 Costs: 59 Direct materials ? 60 Direct labor ? 61 Manufacturing overhead ? ? 62 Traditional costing product margin 2 63 64