Question

Download the spreadsheet Assignment1_Data from Moodle. Consider an investor who instructs her broker to sell (short) two gold futures contracts that expires in 3 months.

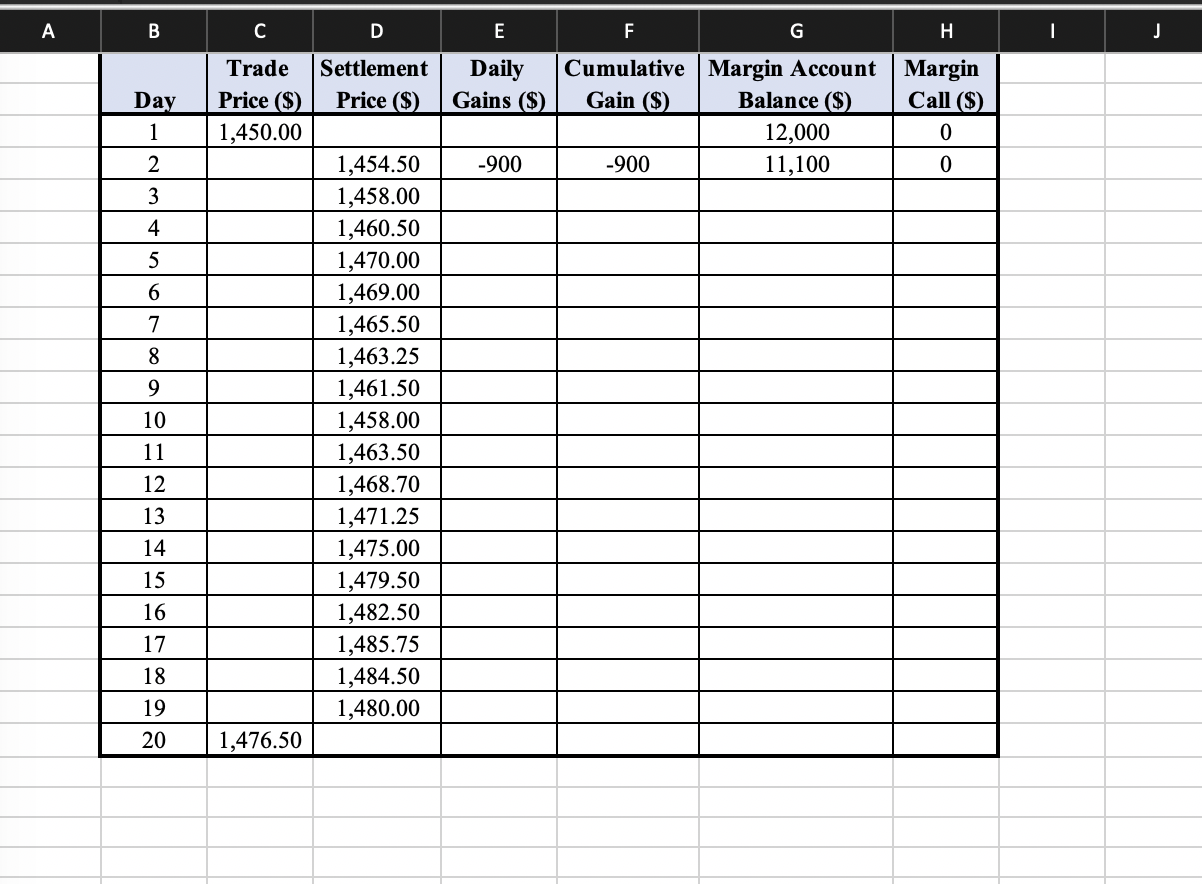

Download the spreadsheet Assignment1_Data from Moodle. Consider an investor who instructs her broker to sell (short) two gold futures contracts that expires in 3 months. The transaction is completed on day 1 and the position is closed out on day 20. The transaction prices for these two days are provided in the column titled Trade Price. The daily futures prices are provided in the column titled Settlement Price. Each contract is for 100 ounces of gold. The initial and maintenance margins for each contract are $6,000 and $4,500 respectively. Complete the table and answer the following questions. Please note that the column Margin Call would reflect a zero value if the investor does not receive a margin call. In case the investor does receive a margin call, the corresponding cell should reflect the necessary amount needed to top up the margin account.

A. What is the net gain/loss for the investor from the futures position during the 20day period?

B. How many times, if any, did the investor receive a margin call? On which day(s) did the investor receive the margin calls, and what were the amount(s) that the investor had to pay to top up the margin account?

C. Investors can withdraw money from the margin account that are in excess of the initial margin. Although it is generally assumed that investors do not withdraw anything from the margin amount, what would be the maximum amount, if any, that the investor can withdraw from the margin account during the 20-day period, and on what day?

(10 points)

1 2. The spot price of silver is currently $1,350 per ounce. The forward price for delivery in one year is $1,460 per ounce. An arbitrageur can borrow money at 4% per annum. Is the forward price too high or low? Are there arbitrage opportunities? What strategy can an arbitrageur use to earn riskless profits? Be very precise in outlining the steps. Assume that the cost of storing silver is zero and that silver provides no income. (10 points)

3. Your company has a portfolio of stocks that is currently worth $150 million. The beta of the portfolio is 1.3. The company would like to use CME futures on the S&P 500 to immune the portfolio from systematic risk. The index is currently 1,200, and each contract is on $250 times the index. What position (long/short and the number of contracts) should the company take in the futures market? How would the strategy change, if instead, the company decided to increase its exposure to systematic risk and change the beta to 1.9? (10 points)

4. You are investing in an options strategy that involves buying a call option with a strike price of $30, selling two call options with a strike price of $35, and buying another call option with a strike price of $40. Use an excel spreadsheet to figure out what the resultant strategy payout looks like. Hint: Use stock price range between $20 and $50 with increments of $2.5 to generate the payout. How would the shape of the strategy payout change, if at all, if you used put options instead of calls?

A B D E F G H J Trade Price ($) 1,450.00 Settlement Price (S) Daily Gains ($) Day 1 Cumulative Margin Account Margin Gain (S) Balance ($) Call ($) 12,000 0 -900 11,100 0 2 -900 3 4 5 6 7 8 9 10 1,454.50 1,458.00 1,460.50 1,470.00 1,469.00 1,465.50 1,463.25 1,461.50 1,458.00 1,463.50 1,468.70 1,471.25 1,475.00 1,479.50 1,482.50 1,485.75 1,484.50 1,480.00 11 12 13 14 15 16 17 18 19 20 1,476.50 A B D E F G H J Trade Price ($) 1,450.00 Settlement Price (S) Daily Gains ($) Day 1 Cumulative Margin Account Margin Gain (S) Balance ($) Call ($) 12,000 0 -900 11,100 0 2 -900 3 4 5 6 7 8 9 10 1,454.50 1,458.00 1,460.50 1,470.00 1,469.00 1,465.50 1,463.25 1,461.50 1,458.00 1,463.50 1,468.70 1,471.25 1,475.00 1,479.50 1,482.50 1,485.75 1,484.50 1,480.00 11 12 13 14 15 16 17 18 19 20 1,476.50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started