Answered step by step

Verified Expert Solution

Question

1 Approved Answer

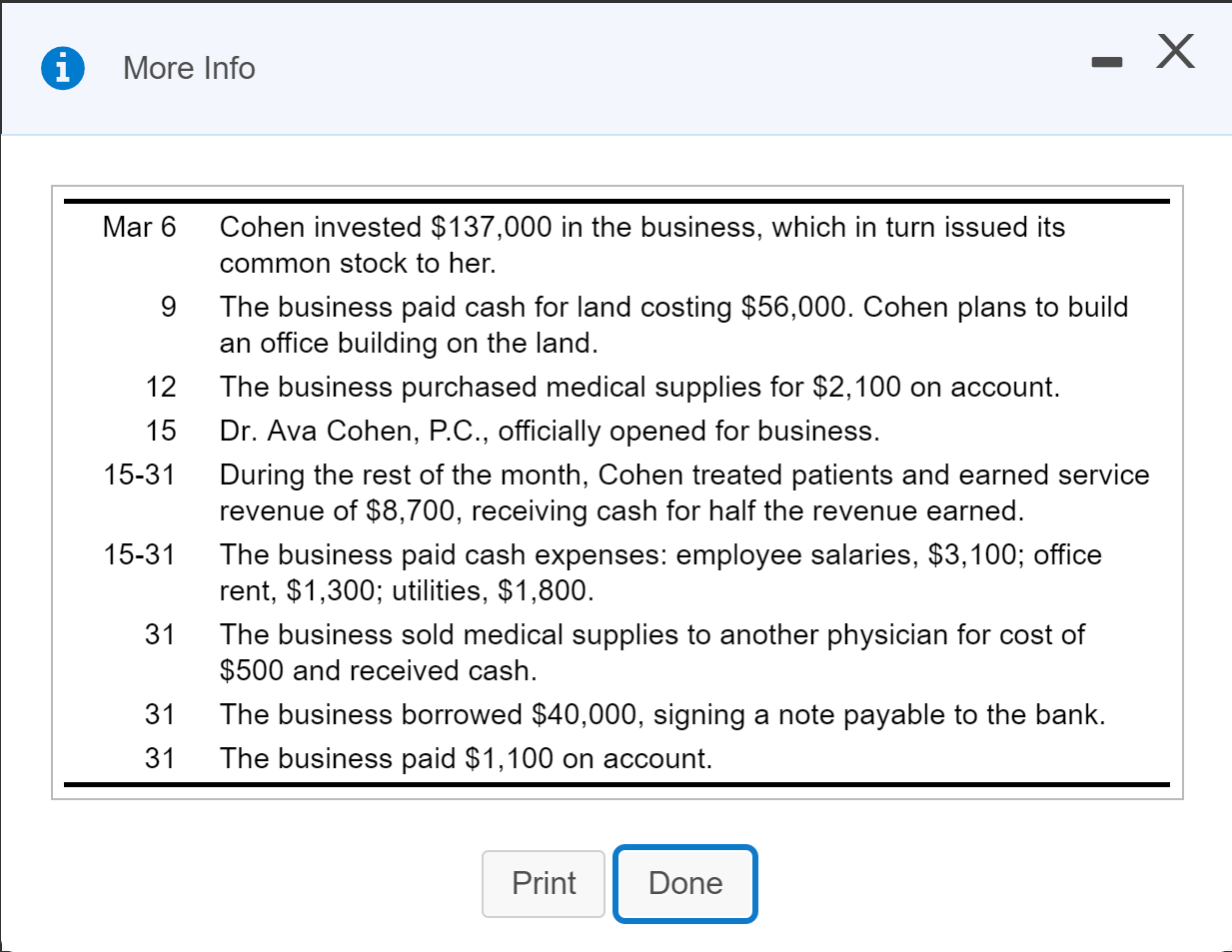

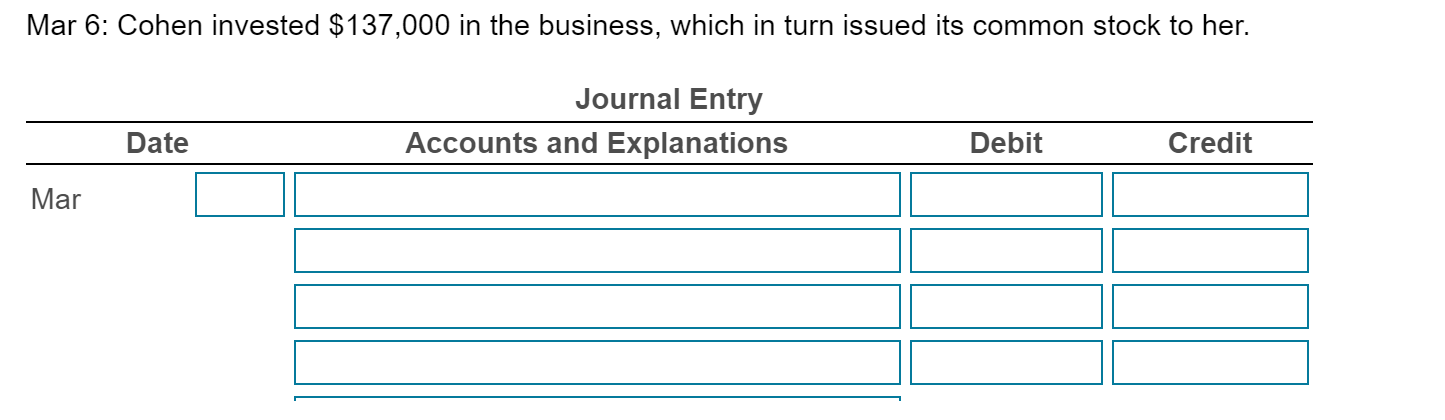

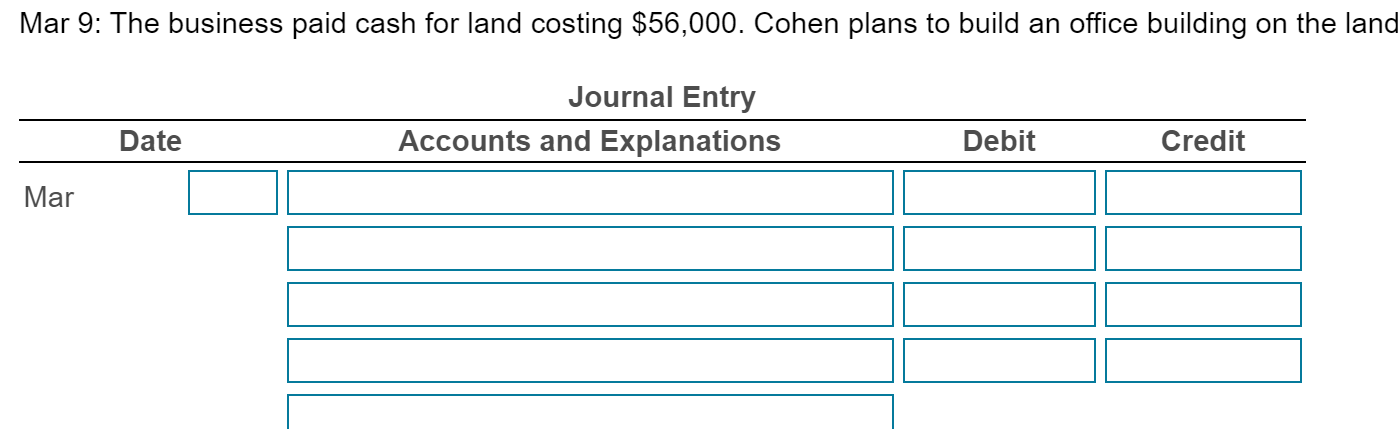

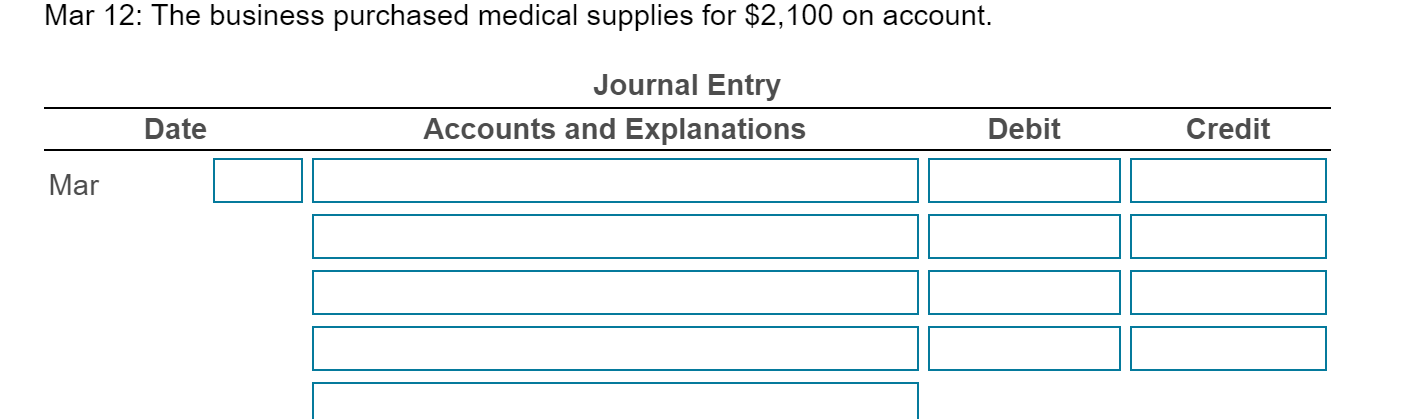

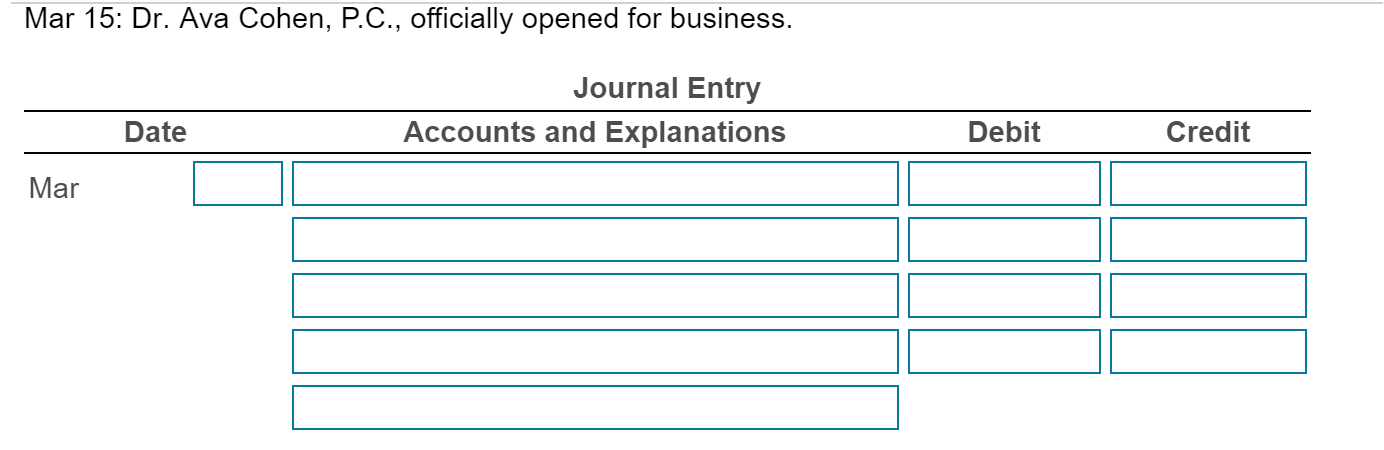

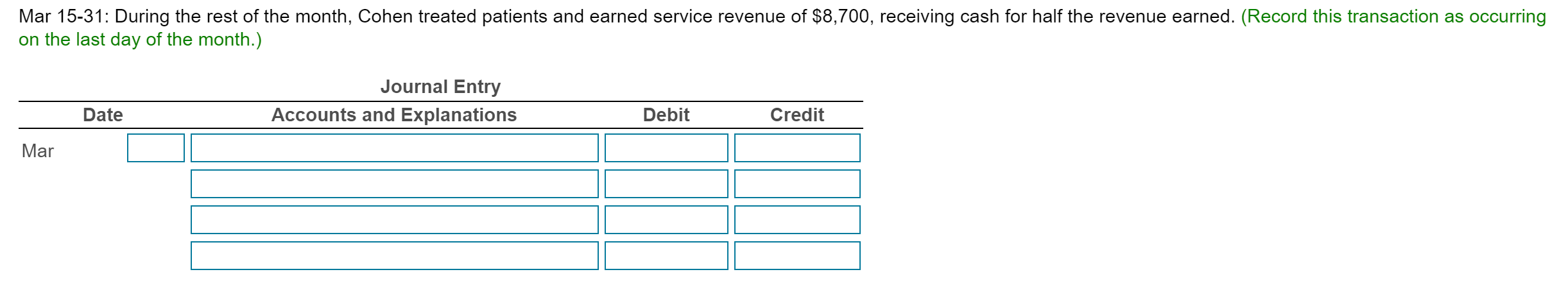

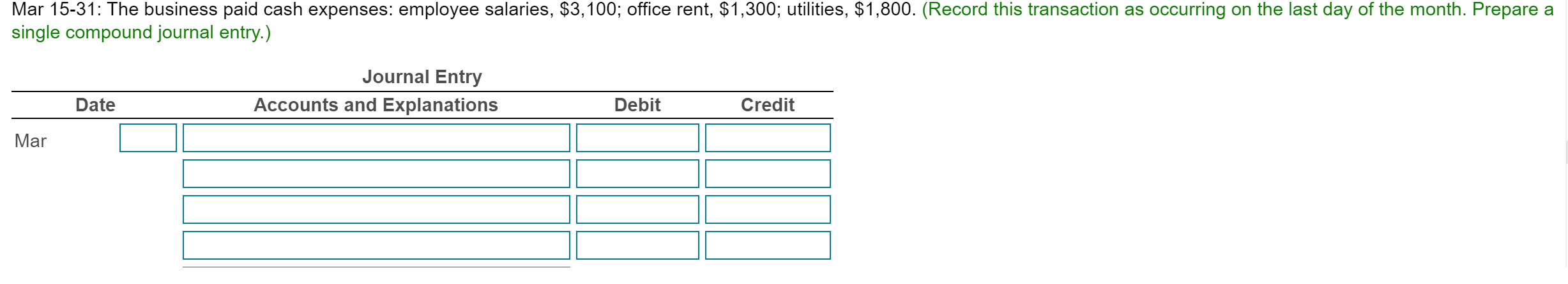

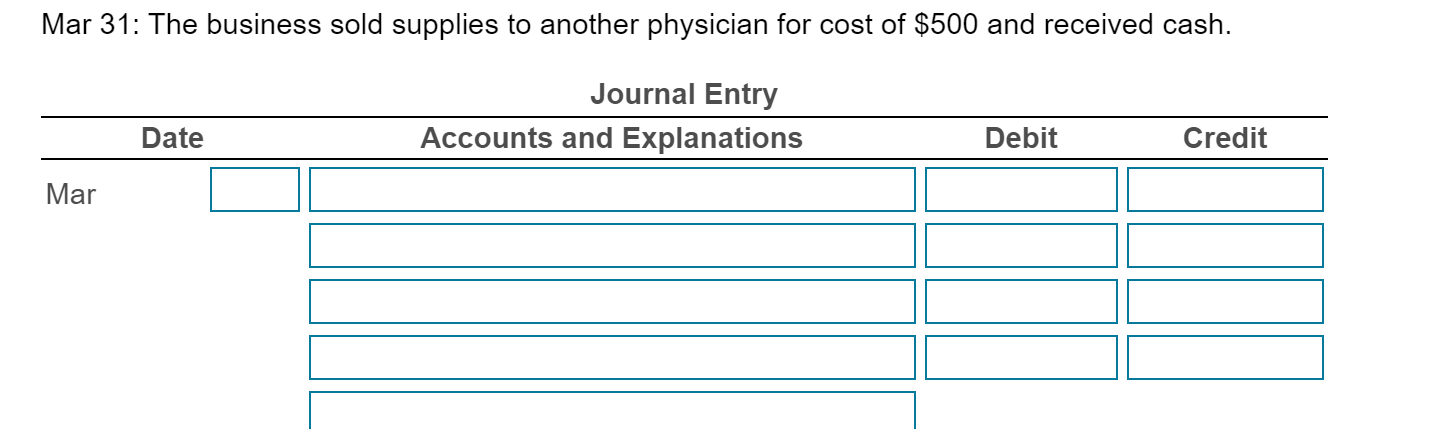

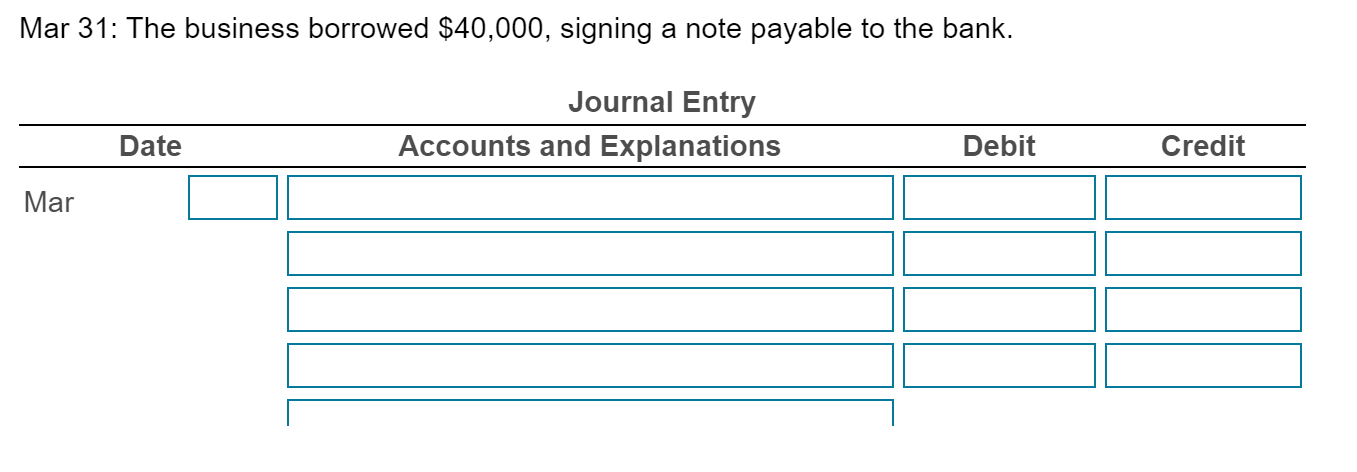

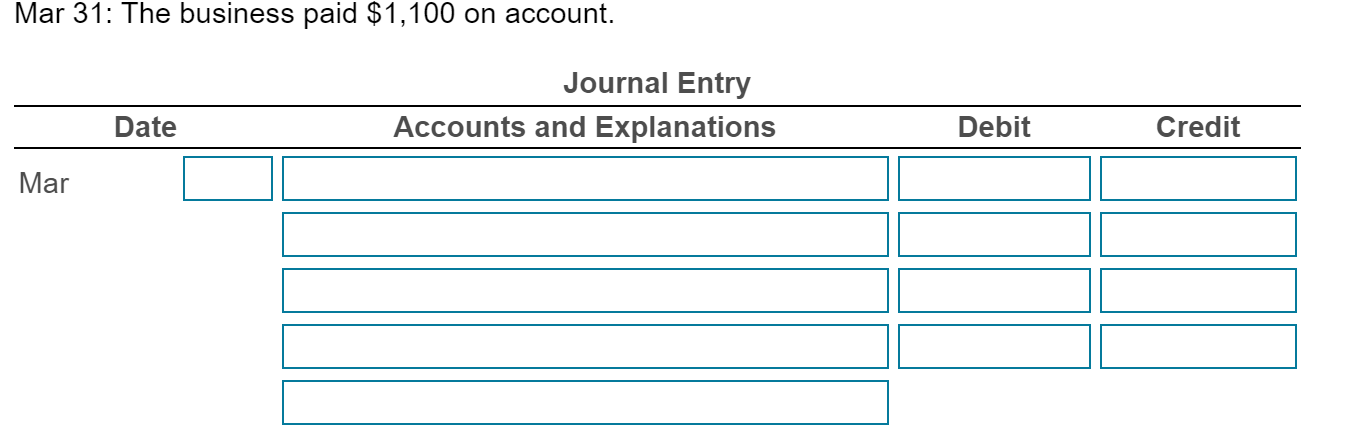

Dr. Ava Cohen opened a medical practice specializing in physical therapy. During the first month of operation (March), the business experienced the following events Requirement

Dr. Ava Cohen opened a medical practice specializing in physical therapy. During the first month of operation (March), the business experienced the following events

Requirement

| 1. | Record the transactions in the journal of Dr. Ava CohenDr. Ava Cohen, P.C. List the transactions by date and give an explanation for each transaction. (Record debits first, then credits. Select explanations on the last line of the journal entry table. If an entry is not required, select "No entry required" on the first line of the table and leave all other cells blank.) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started