Answered step by step

Verified Expert Solution

Question

1 Approved Answer

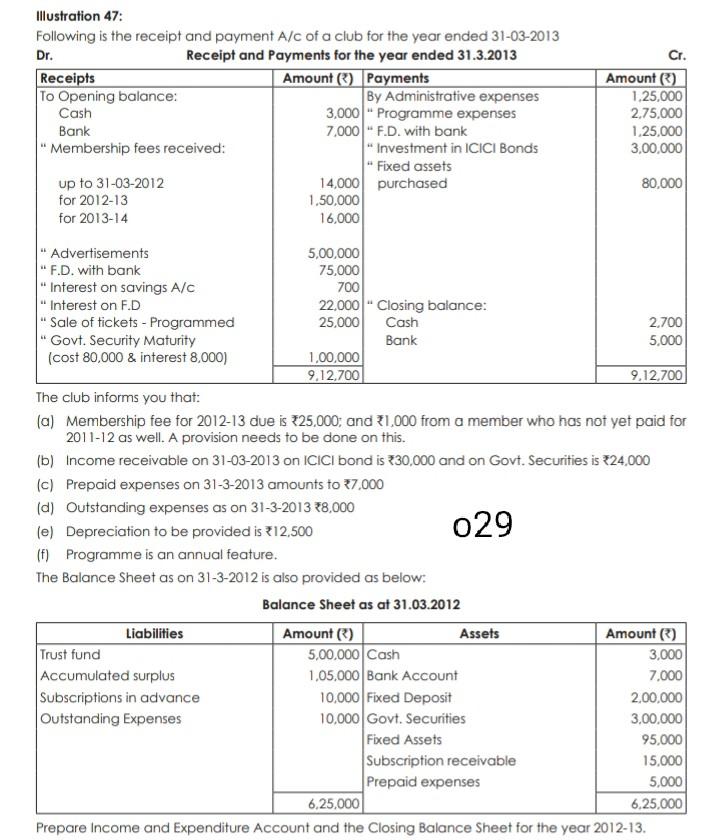

Dr. Illustration 47: Following is the receipt and payment A/c of a club for the year ended 31-03-2013 Receipt and Payments for the year ended

Dr. Illustration 47: Following is the receipt and payment A/c of a club for the year ended 31-03-2013 Receipt and Payments for the year ended 31.3.2013 Receipts Amount Payments To Opening balance: By Administrative expenses Cash 3,000 "Programme expenses Bank 7,000" F.D. with bank Membership fees received: "Investment in ICICI Bonds Fixed assets up to 31-03-2012 14,000 purchased for 2012-13 1.50,000 for 2013-14 16,000 Cr. Amount () 1,25,000 2.75,000 1.25,000 3,00,000 80,000 Advertisements 5,00,000 F.D. with bank 75,000 Interest on savings A/C 700 Interest on F.D 22,000 Closing balance: "Sale of tickets - Programmed 25,000 Cash 2.700 Govt. Security Maturity Bank 5.000 (cost 80,000 & interest 8,000) 1,00,000 9.12.700 9.12.700 The club informs you that: (a) Membership fee for 2012-13 due is 525,000; and 31.000 from a member who has not yet paid for 2011-12 as well. A provision needs to be done on this. (b) Income receivable on 31-03-2013 on ICICI bond is 30,000 and on Govt. Securities is 24.000 (c) Prepaid expenses on 31-3-2013 amounts to 87,000 (d) Outstanding expenses as on 31-3-2013 78,000 le) Depreciation to be provided is 12,500 029 (h) Programme is an annual feature. The Balance Sheet as on 31-3-2012 is also provided as below: Balance Sheet as at 31.03.2012 Liabilities Amount() Assets Amount() Trust fund 5,00.000 Cash 3,000 Accumulated surplus 1,05,000 Bank Account 7,000 Subscriptions in advance 10,000 Fixed Deposit 2,00.000 Outstanding Expenses 10,000 Govt. Securities 3.00.000 Fixed Assets 95,000 Subscription receivable 15,000 Prepaid expenses 5,000 6,25,000 6,25,000 Prepare Income and Expenditure Account and the Closing Balance Sheet for the year 2012-13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started