Answered step by step

Verified Expert Solution

Question

1 Approved Answer

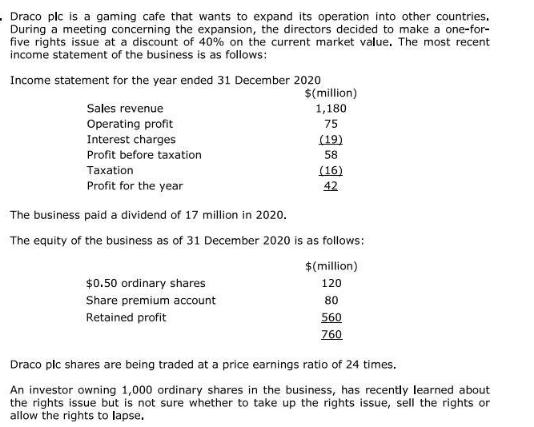

Draco plc is a gaming cafe that wants to expand its operation into other countries. During a meeting concerning the expansion, the directors decided

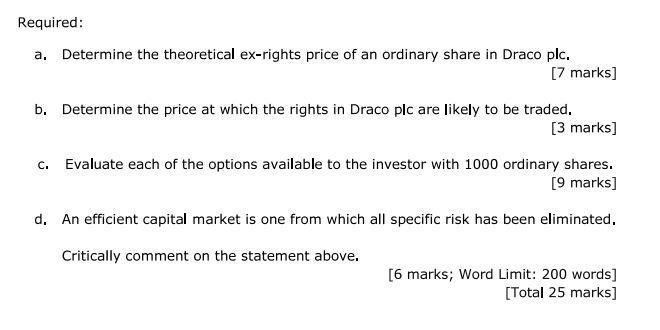

Draco plc is a gaming cafe that wants to expand its operation into other countries. During a meeting concerning the expansion, the directors decided to make a one-for- five rights issue at a discount of 40% on the current market value. The most recent income statement of the business is as follows: Income statement for the year ended 31 December 2020 Sales revenue Operating profit Interest charges Profit before taxation Taxation Profit for the year $(million) 1,180 75 (19) 58 $0.50 ordinary shares Share premium account Retained profit (16) 42 The business paid a dividend of 17 million in 2020. The equity of the business as of 31 December 2020 is as follows: $(million) 120 80 560 760 Draco plc shares are being traded at a price earnings ratio of 24 times. An investor owning 1,000 ordinary shares in the business, has recently learned about the rights issue but is not sure whether to take up the rights issue, sell the rights or allow the rights to lapse. Required: a. Determine the theoretical ex-rights price of an ordinary share in Draco plc. [7 marks] b. Determine the price at which the rights in Draco plc are likely to be traded. [3 marks] c. Evaluate each of the options available to the investor with 1000 ordinary shares. [9 marks] d. An efficient capital market is one from which all specific risk has been eliminated. Critically comment on the statement above. [6 marks; Word Limit: 200 words] [Total 25 marks]

Step by Step Solution

★★★★★

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started