Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dragon Ltd Dragon Ltd has an accounting reference date of 31 March. For the year ended 31 March 2023, the company made a trading profit

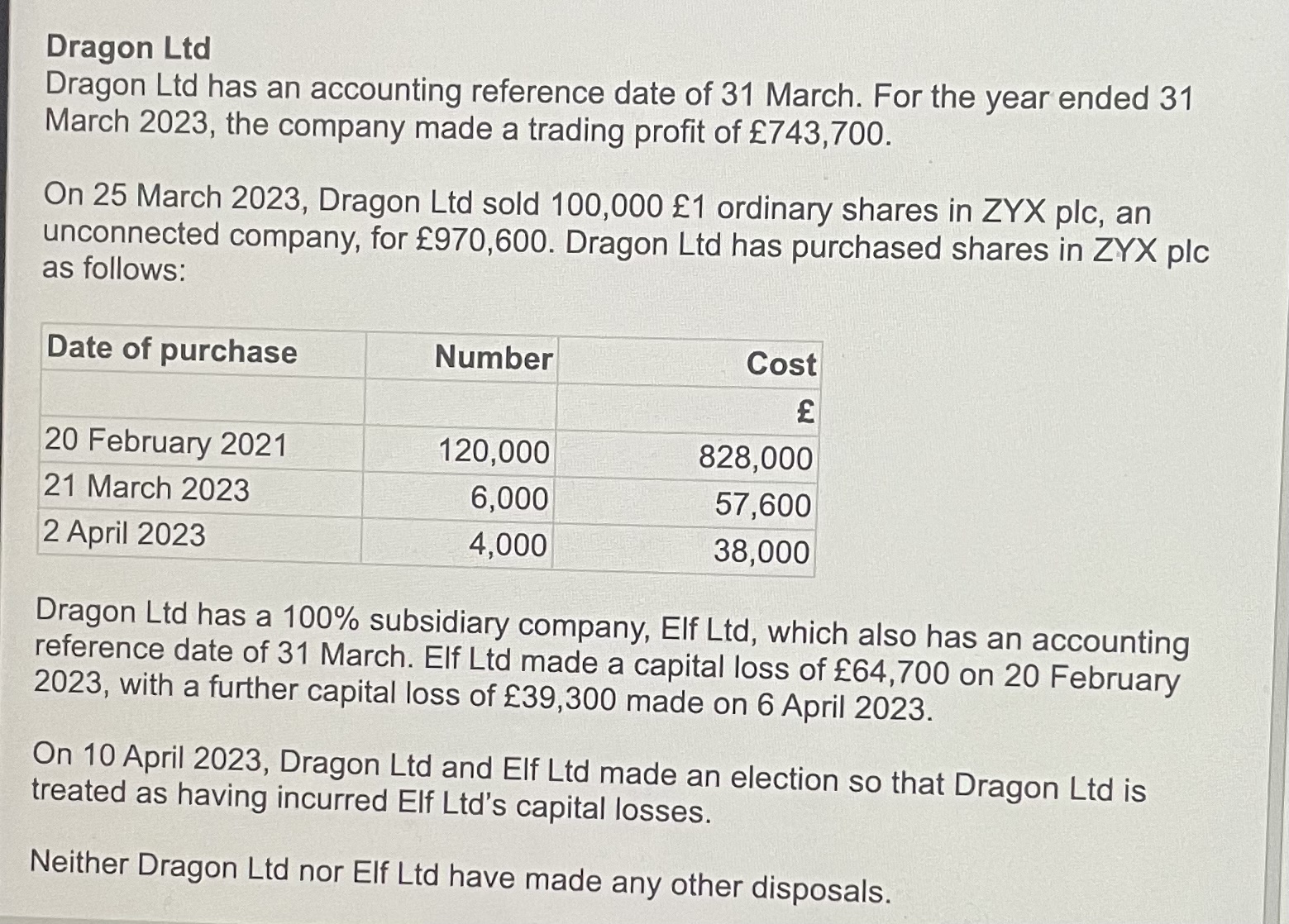

Dragon Ltd Dragon Ltd has an accounting reference date of 31 March. For the year ended 31 March 2023, the company made a trading profit of 743,700. On 25 March 2023, Dragon Ltd sold 100,000 1 ordinary shares in ZYX plc, an unconnected company, for 970,600. Dragon Ltd has purchased shares in ZYX plc as follows: Dragon Ltd has a 100% subsidiary company, Elf Ltd, which also has an accounting reference date of 31 March. Elf Ltd made a capital loss of 64,700 on 20 February 2023, with a further capital loss of 39,300 made on 6 April 2023. On 10 April 2023, Dragon Ltd and Elf Ltd made an election so that Dragon Ltd is treated as having incurred Elf Ltd's capital losses. Neither Dragon Ltd nor Elf Ltd have made any other disposals. (c) Calculate Dragon Ltd's taxable total profits for the year ended 31 March 2023

Dragon Ltd Dragon Ltd has an accounting reference date of 31 March. For the year ended 31 March 2023, the company made a trading profit of 743,700. On 25 March 2023, Dragon Ltd sold 100,000 1 ordinary shares in ZYX plc, an unconnected company, for 970,600. Dragon Ltd has purchased shares in ZYX plc as follows: Dragon Ltd has a 100% subsidiary company, Elf Ltd, which also has an accounting reference date of 31 March. Elf Ltd made a capital loss of 64,700 on 20 February 2023, with a further capital loss of 39,300 made on 6 April 2023. On 10 April 2023, Dragon Ltd and Elf Ltd made an election so that Dragon Ltd is treated as having incurred Elf Ltd's capital losses. Neither Dragon Ltd nor Elf Ltd have made any other disposals. (c) Calculate Dragon Ltd's taxable total profits for the year ended 31 March 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started