Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Draw Design Inventory Depreciation Homework 2020 (2) - Saved to my Mac Mailings Review View Tell me Layout References Calibrl(Bo... 11 w Aaw A 2

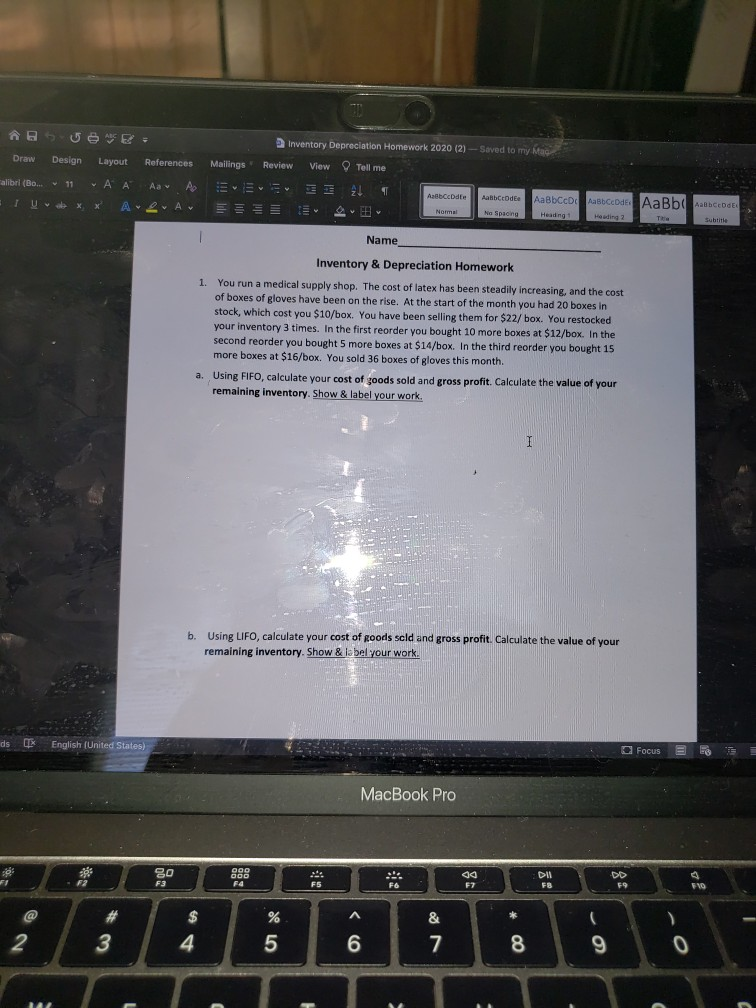

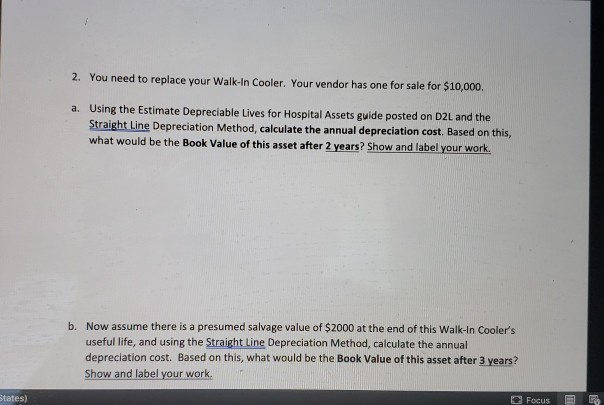

Draw Design Inventory Depreciation Homework 2020 (2) - Saved to my Mac Mailings Review View Tell me Layout References Calibrl(Bo... 11 w Aaw A 2 Aalbcode Aanbod Iub xx AW A v AaBbc Bbcodes AaBb Aabende Heading Normal Na Spaong Heading 2 Subtitle Name Inventory & Depreciation Homework 1. You run a medical supply shop. The cost of latex has been steadily increasing, and the cost of boxes of gloves have been on the rise. At the start of the month you had 20 boxes in stock, which cost you $10/box. You have been selling them for $22/ box. You restocked your inventory 3 times. In the first reorder you bought 10 more boxes at $12/box. In the second reorder you bought 5 more boxes at $14/box. In the third reorder you bought 15 more boxes at $16/box. You sold 36 boxes of gloves this month. a. Using FIFO, calculate your cost of goods sold and gross profit. Calculate the value of your remaining inventory. Show & label your work 1 b. Using LIFO, calculate your cost of goods sold and gross profit. Calculate the value of your remaining inventory. Show & label your work. ds LEX English (United States) Focus MacBook Pro 80 F3 200 000 fa sa F7 Dll FB F2 DD F9 F5 FVD % A C & 7 00 * 2 3 4 5 6 9 142 7 3 2. You need to replace your Walk-In Cooler. Your vendor has one for sale for $10,000. a. Using the Estimate Depreciable Lives for Hospital Assets guide posted on D2L and the Straight Line Depreciation Method, calculate the annual depreciation cost. Based on this, what would be the Book Value of this asset after 2 years? Show and label your work. b. Now assume there is a presumed salvage value of $2000 at the end of this Walk-in Cooler's useful life, and using the Straight line Depreciation Method, calculate the annual depreciation cost. Based on this, what would be the Book Value of this asset after 3 years? Show and label your work. States) Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started