Answered step by step

Verified Expert Solution

Question

1 Approved Answer

draw the cash flow , and show me the answer in details , write what you did in each step ,, i don't want to

draw the cash flow , and show me the answer in details , write what you did in each step ,, i don't want to copy the solution from the book

and calculate ROI using PW

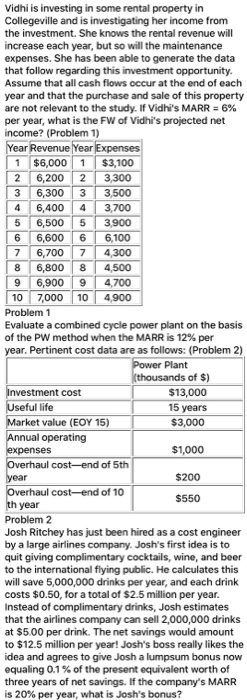

4 5 4 5 6 6 7 8 8 Vidhi is investing in some rental property in Collegeville and is investigating her income from the investment. She knows the rental revenue will increase each year, but so will the maintenance expenses. She has been able to generate the data that follow regarding this investment opportunity. Assume that all cash flows occur at the end of each year and that the purchase and sale of this property are not relevant to the study. If Vidhi's MARR = 6% per year, what is the FW of Vidhi's projected net income? (Problem 1) Year Revenue Year Expenses 1 $6,000 1 $3,100 2 6,200 2 3,300 3 6,300 3 3,500 6,400 3,700 6,500 3,900 6,600 6,100 6,700 7 4,300 6,800 4,500 9 6,900 9 4,700 10 7,000 10 4.900 Problem 1 Evaluate a combined cycle power plant on the basis of the PW method when the MARR is 12% per year. Pertinent cost data are as follows: (Problem 2) Power Plant (thousands of $) Investment cost $13,000 Useful life 15 years Market value (EOY 15) $3,000 Annual operating expenses $1,000 Overhaul cost-end of 5th $200 Overhaul cost-end of 10 $550 Problem 2 Josh Ritchey has just been hired as a cost engineer by a large airlines company. Josh's first idea is to quit giving complimentary cocktails, wine, and beer to the international flying public. He calculates this will save 5,000,000 drinks per year, and each drink costs $0.50, for a total of $2.5 million per year. Instead of complimentary drinks, Josh estimates that the airlines company can sell 2,000,000 drinks at $5.00 per drink. The net savings would amount to $12.5 million per year! Josh's boss really likes the idea and agrees to give Josh a lumpsum bonus now equaling 0.1% of the present equivalent worth of three years of net savings. If the company's MARR is 20% per year, what is Josh's bonus? year th year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started