Answered step by step

Verified Expert Solution

Question

1 Approved Answer

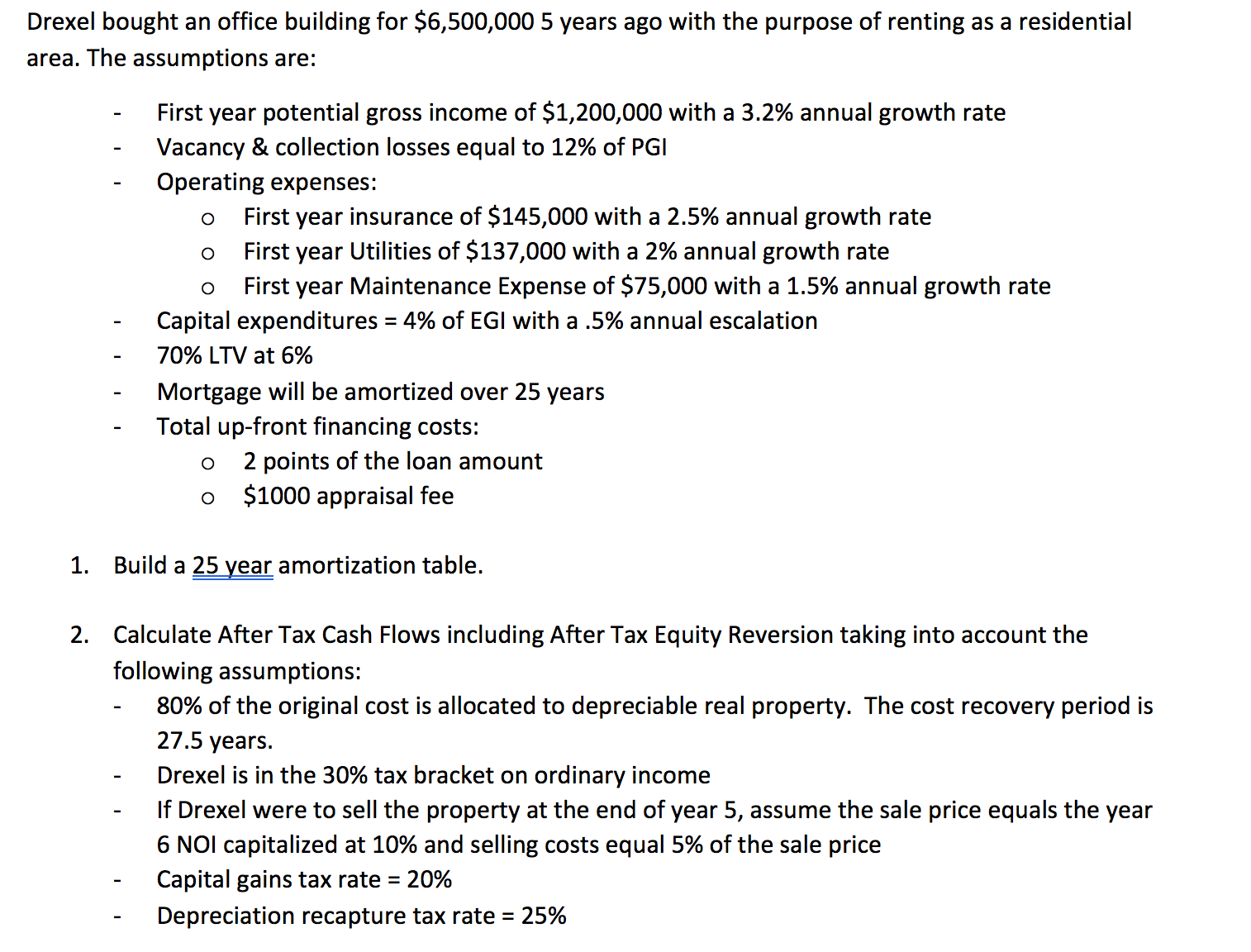

Drexel bought an office building for $ 6 , 5 0 0 , 0 0 0 5 years ago with the purpose of renting as

Drexel bought an office building for $ years ago with the purpose of renting as a residential

area. The assumptions are:

First year potential gross income of $ with a annual growth rate

Vacancy & collection losses equal to of PGI

Operating expenses:

O First year insurance of $ with a annual growth rate

First year Utilities of $ with a annual growth rate

First year Maintenance Expense of $ with a annual growth rate

Capital expenditures of EGI with a annual escalation

LTV at

Mortgage will be amortized over years

Total upfront financing costs:

points of the loan amount

$ appraisal fee

Calculate After Tax Cash Flows including After Tax Equity Reversion taking into account the

following assumptions:

of the original cost is allocated to depreciable real property. The cost recovery period is

years.

Drexel is in the tax bracket on ordinary income

If Drexel were to sell the property at the end of year assume the sale price equals the year

NOI capitalized at and selling costs equal of the sale price

Capital gains tax rate

Depreciation recapture tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started