Drexel Sisters Inc. operates a retail business. Below are Drexel Sisters trial balances as prepared by the

The two owners, Rachel and Hannah, incorporated the business in 2018 in the state of New Jersey, authorizing 500,000 shares of common stock. On January 1, 2018, each of the owners were issued 100,000 shares of $1 par value common stock in return for the contribution of the following assets on January 1, 2018:

| | Property Contributed | Shareholders initial Cost on 1/1/18 | Fair market value on 1/1/18 |

| | | | |

| Rachel | Cash | $110,000 | $110,000 |

| Hannah | Cash | $20,000 | $20,000 |

| | Building* | $120,000 | $160,000 |

*The building was contributed with a $70,000 interest only balloon mortgage with an interest rate of 5% due December 31, 2020.

Required:

Prepare a Statement of Stockholders Equity for the year 2019.

Additional details for the year 2020 follow.

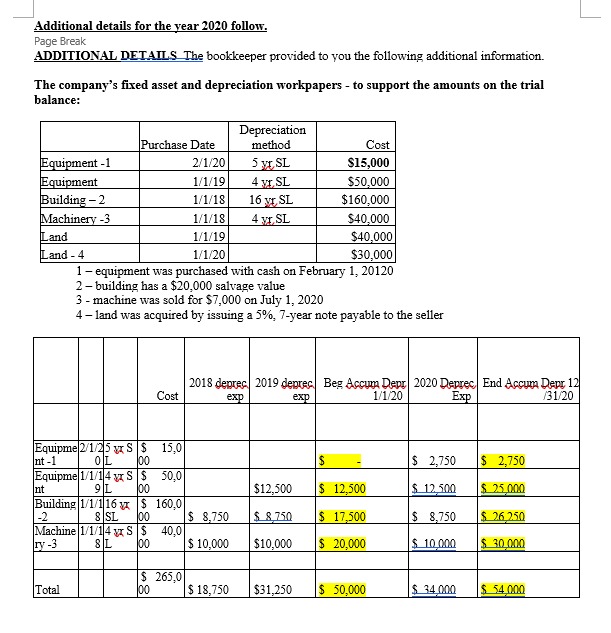

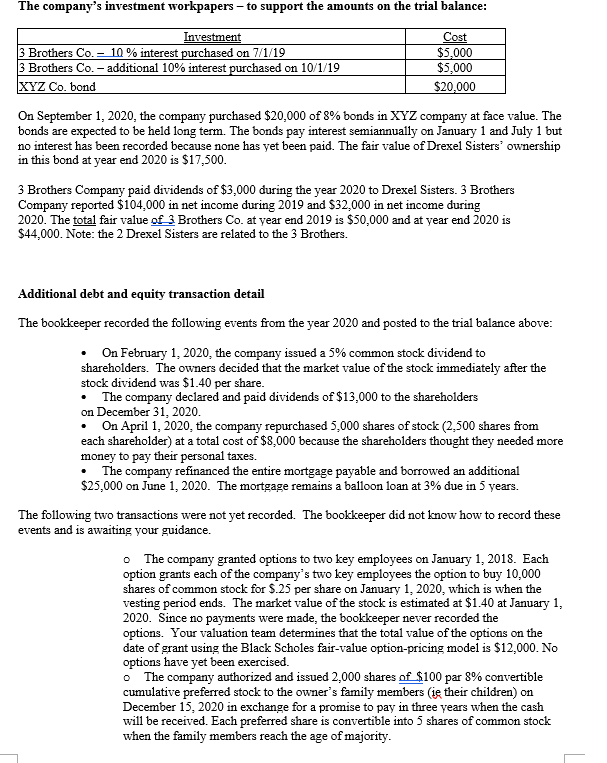

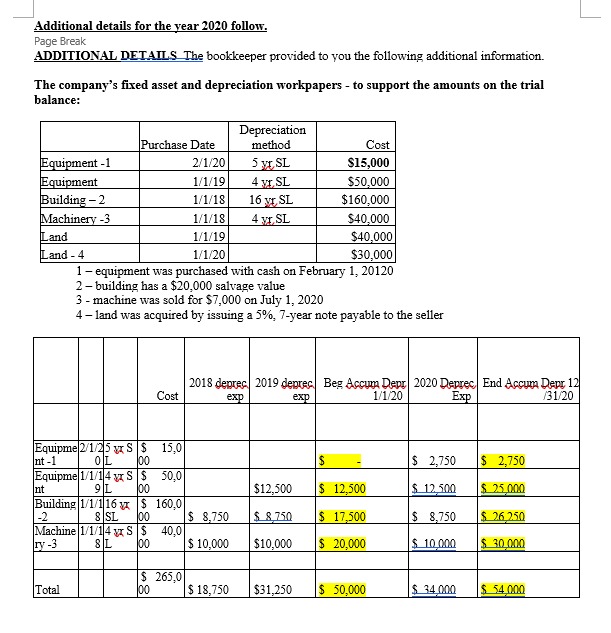

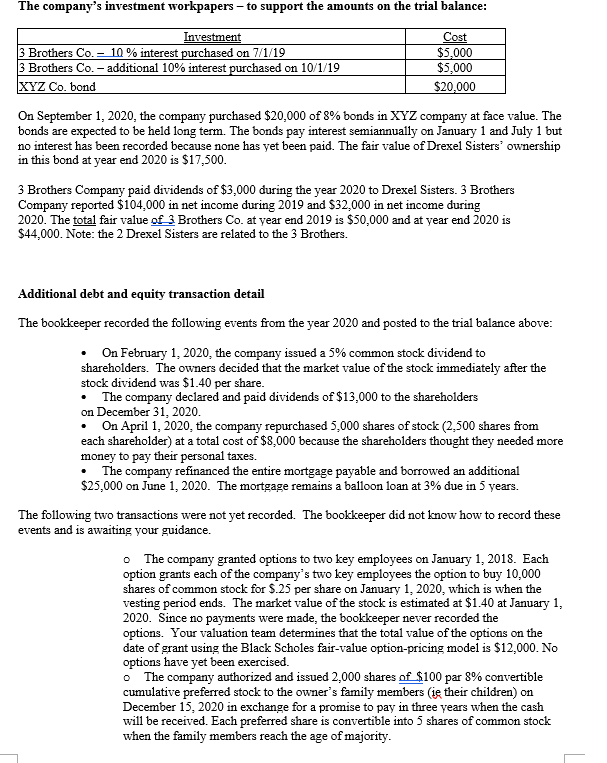

Additional details for the year 2020 follow. Page Break ADDITIONAL DETAILS The bookkeeper provided to you the following additional information. The company's fixed asset and depreciation workpapers - to support the amounts on the trial balance: Depreciation Purchase Date method Cost Equipment -1 2/1/20 5 y SL $15,000 Equipment 1/1/19 4 yr SL $50,000 Building - 2 1/1/18 16 y SL $160,000 Machinery - 3 1/1/18 4 yr SL $40,000 Land 1/1/19 $40,000 Land - 4 1/1/20 $30,000 1 - equipment was purchased with cash on February 1, 20120 2 - building has a $20,000 salvage value 3 - machine was sold for $7,000 on July 1, 2020 4- land was acquired by issuing a 5%, 7-year note payable to the seller 2018 deprec, 2019 deprec Beg Accum Depr 2020 Deprec End Accum Depr 12 exp 1/1/20 Exp /31/20 Cost exp $ 2,750 $ 2,750 $12,500 Equipme2/125 y S S 15,0 Int-1 OL 100 Equipme1/114 y S $ 50,0| Int 9L 100 Building 1/1/116 y $ 160,0 -2 8 SL 100 Machine 1/1/14 y S S 40,0 8L 100 $ 10,000 $ 12,500 $ 12,500 $ 25.000 $ 26,250 $ 8.750 $8.750 $ 17,500 $ 8,750 ty-3 $10,000 $ 20,000 | $ 10,000 $ 30.000 $ 265,0 100 $ 18,750 Total $31,250 $ 50,000 $ 34.000 $ 54,000 The company's investment workpapers - to support the amounts on the trial balance: Investment 3 Brothers Co. = 10 % interest purchased on 7/1/19 3 Brothers Co. - additional 10% interest purchased on 10/1/19 XYZ Co. bond Cost $5,000 $5,000 $20.000 On September 1, 2020, the company purchased $20,000 of 8% bonds in XYZ company at face value. The bonds are expected to be held long term. The bonds pay interest semiannually on January 1 and July 1 but no interest has been recorded because none has yet been paid. The fair value of Drexel Sisters' ownership in this bond at year end 2020 is $17,500. 3 Brothers Company paid dividends of $3,000 during the year 2020 to Drexel Sisters. 3 Brothers Company reported $104.000 in net income during 2019 and $32,000 in net income during 2020. The total fair value of 3 Brothers Co. at year end 2019 is $50,000 and at year end 2020 is $44.000. Note: the 2 Drexel Sisters are related to the 3 Brothers. Additional debt and equity transaction detail The bookkeeper recorded the following events from the year 2020 and posted to the trial balance above: On February 1, 2020, the company issued a 5% common stock dividend to shareholders. The owners decided that the market value of the stock immediately after the stock dividend was $1.40 per share. The company declared and paid dividends of $13,000 to the shareholders on December 31, 2020. On April 1, 2020, the company repurchased 5,000 shares of stock (2.500 shares from each shareholder) at a total cost of $8,000 because the shareholders thought they needed more money to pay their personal taxes. The company refinanced the entire mortgage payable and borrowed an additional $25,000 on June 1, 2020. The mortgage remains a balloon loan at 3% due in 5 years. The following two transactions were not yet recorded. The bookkeeper did not know how to record these events and is awaiting your guidance. The company granted options to two key employees on January 1, 2018. Each option grants each of the company's two key employees the option to buy 10,000 shares of common stock for $ 25 per share on January 1, 2020, which is when the vesting period ends. The market value of the stock is estimated at $1.40 at January 1, 2020. Since no payments were made, the bookkeeper never recorded the options. Your valuation team determines that the total value of the options on the date of grant using the Black Scholes fair-value option-pricing model is $12,000. No options have yet been exercised. The company authorized and issued 2,000 shares of $100 par 8% convertible cumulative preferred stock to the owner's family members (ie their children) on December 15, 2020 in exchange for a promise to pay in three years when the cash will be received. Each preferred share is convertible into 5 shares of common stock when the family members reach the age of majority. Additional details for the year 2020 follow. Page Break ADDITIONAL DETAILS The bookkeeper provided to you the following additional information. The company's fixed asset and depreciation workpapers - to support the amounts on the trial balance: Depreciation Purchase Date method Cost Equipment -1 2/1/20 5 y SL $15,000 Equipment 1/1/19 4 yr SL $50,000 Building - 2 1/1/18 16 y SL $160,000 Machinery - 3 1/1/18 4 yr SL $40,000 Land 1/1/19 $40,000 Land - 4 1/1/20 $30,000 1 - equipment was purchased with cash on February 1, 20120 2 - building has a $20,000 salvage value 3 - machine was sold for $7,000 on July 1, 2020 4- land was acquired by issuing a 5%, 7-year note payable to the seller 2018 deprec, 2019 deprec Beg Accum Depr 2020 Deprec End Accum Depr 12 exp 1/1/20 Exp /31/20 Cost exp $ 2,750 $ 2,750 $12,500 Equipme2/125 y S S 15,0 Int-1 OL 100 Equipme1/114 y S $ 50,0| Int 9L 100 Building 1/1/116 y $ 160,0 -2 8 SL 100 Machine 1/1/14 y S S 40,0 8L 100 $ 10,000 $ 12,500 $ 12,500 $ 25.000 $ 26,250 $ 8.750 $8.750 $ 17,500 $ 8,750 ty-3 $10,000 $ 20,000 | $ 10,000 $ 30.000 $ 265,0 100 $ 18,750 Total $31,250 $ 50,000 $ 34.000 $ 54,000 The company's investment workpapers - to support the amounts on the trial balance: Investment 3 Brothers Co. = 10 % interest purchased on 7/1/19 3 Brothers Co. - additional 10% interest purchased on 10/1/19 XYZ Co. bond Cost $5,000 $5,000 $20.000 On September 1, 2020, the company purchased $20,000 of 8% bonds in XYZ company at face value. The bonds are expected to be held long term. The bonds pay interest semiannually on January 1 and July 1 but no interest has been recorded because none has yet been paid. The fair value of Drexel Sisters' ownership in this bond at year end 2020 is $17,500. 3 Brothers Company paid dividends of $3,000 during the year 2020 to Drexel Sisters. 3 Brothers Company reported $104.000 in net income during 2019 and $32,000 in net income during 2020. The total fair value of 3 Brothers Co. at year end 2019 is $50,000 and at year end 2020 is $44.000. Note: the 2 Drexel Sisters are related to the 3 Brothers. Additional debt and equity transaction detail The bookkeeper recorded the following events from the year 2020 and posted to the trial balance above: On February 1, 2020, the company issued a 5% common stock dividend to shareholders. The owners decided that the market value of the stock immediately after the stock dividend was $1.40 per share. The company declared and paid dividends of $13,000 to the shareholders on December 31, 2020. On April 1, 2020, the company repurchased 5,000 shares of stock (2.500 shares from each shareholder) at a total cost of $8,000 because the shareholders thought they needed more money to pay their personal taxes. The company refinanced the entire mortgage payable and borrowed an additional $25,000 on June 1, 2020. The mortgage remains a balloon loan at 3% due in 5 years. The following two transactions were not yet recorded. The bookkeeper did not know how to record these events and is awaiting your guidance. The company granted options to two key employees on January 1, 2018. Each option grants each of the company's two key employees the option to buy 10,000 shares of common stock for $ 25 per share on January 1, 2020, which is when the vesting period ends. The market value of the stock is estimated at $1.40 at January 1, 2020. Since no payments were made, the bookkeeper never recorded the options. Your valuation team determines that the total value of the options on the date of grant using the Black Scholes fair-value option-pricing model is $12,000. No options have yet been exercised. The company authorized and issued 2,000 shares of $100 par 8% convertible cumulative preferred stock to the owner's family members (ie their children) on December 15, 2020 in exchange for a promise to pay in three years when the cash will be received. Each preferred share is convertible into 5 shares of common stock when the family members reach the age of majority