What are the calculations to work out a long term perpetual growth rate for business in Argentina, Brazil and Chile?

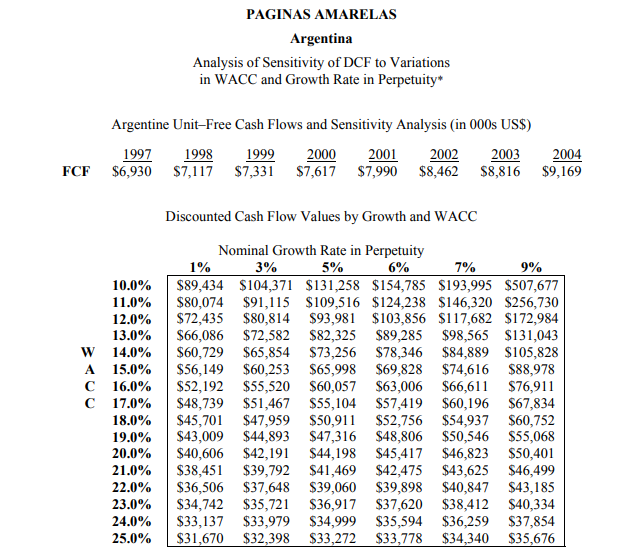

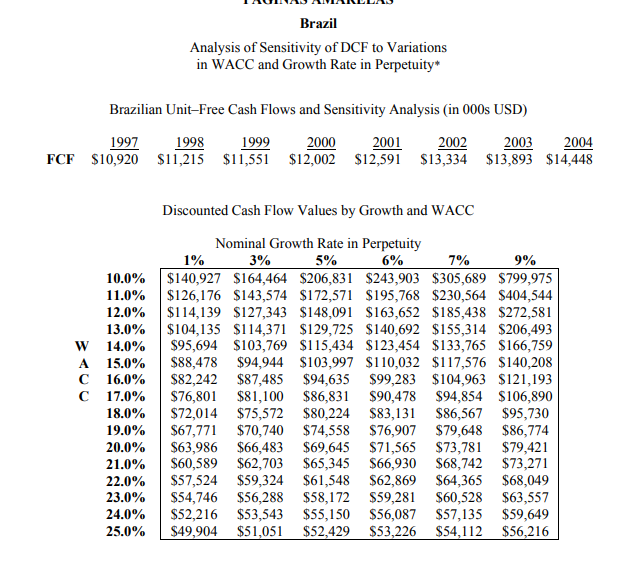

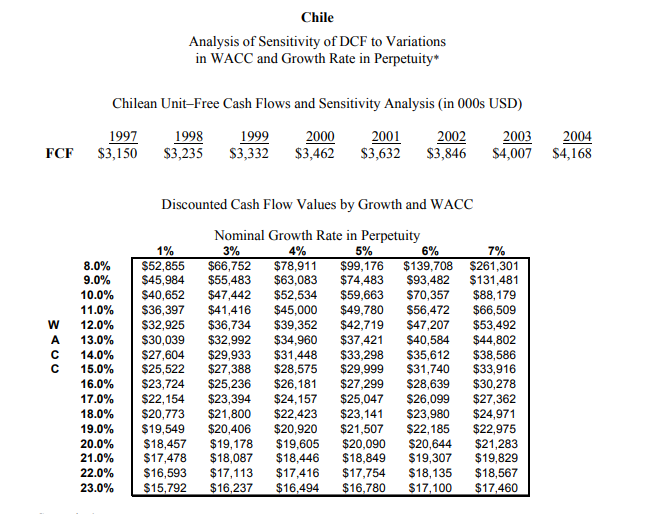

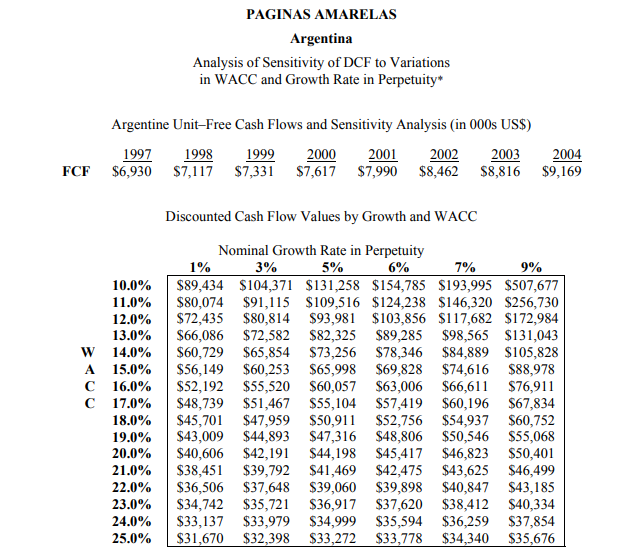

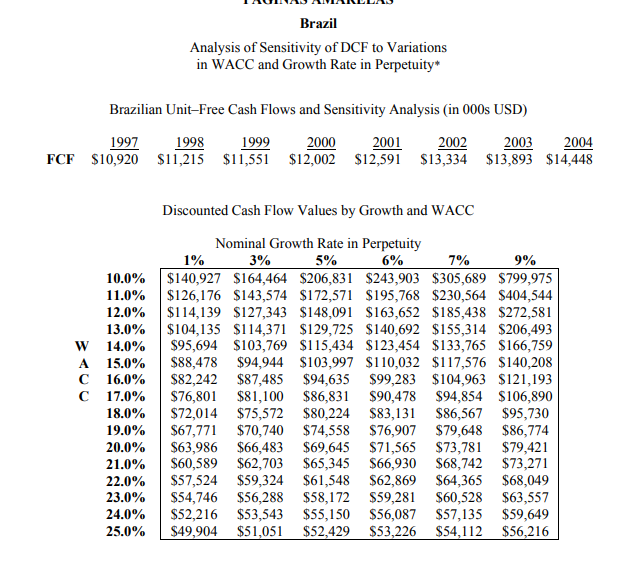

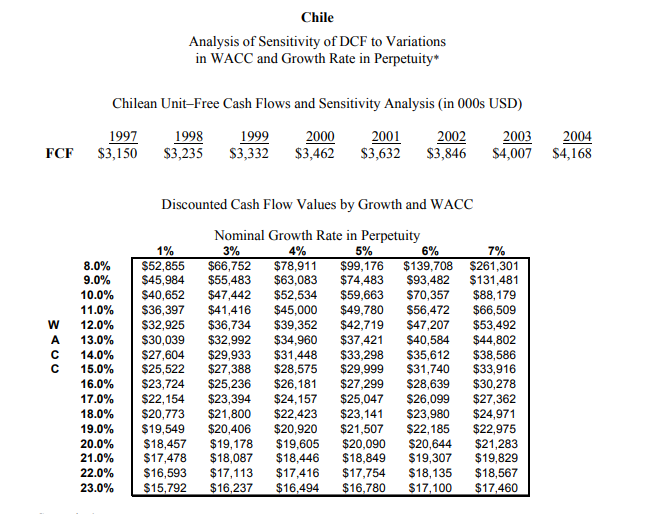

PAGINAS AMARELAS Argentina Analysis of Sensitivity of DCF to Variations in WACC and Growth Rate in Perpetuity* Argentine Unit-Free Cash Flows and Sensitivity Analysis (in 000s US$) 1997 1998 1999 2000 2001 2002 2003 FCF $6,930 $7,117 $7,331 $7,617 $7,990 $8,462 $8,816 2004 $9,169 10.0% 11.0% 12.0% 13.0% W 14.0% A 15.0% C 16.0% C 17.0% 18.0% 19.0% 20.0% 21.0% 22.0% 23.0% 24.0% 25.0% Discounted Cash Flow Values by Growth and WACC Nominal Growth Rate in Perpetuity 1% 3% 5% 6% 7% 9% $89,434 $104,371 $131,258 $154,785 $193,995 $507,677 $80,074 $91,115 $109,516 $124,238 $146,320 $256,730 $72,435 $80,814 $93,981 $103,856 $117,682 $172,984 $66,086 $72,582 $82,325 $89,285 $98,565 $131,043 $60,729 $65,854 $73,256 $78,346 $84,889 $105,828 $56,149 $60,253 $65,998 $69,828 $74,616 $88,978 $52,192 $55,520 $60,057 $63,006 $66,611 $76,911 $48,739 $51,467 $55,104 $57,419 $60,196 $67,834 $45,701 $47,959 $50,911 $52,756 $54,937 $60,752 $43,009 $44,893 $47,316 $48,806 $50,546 $55,068 $40,606 $42,191 $44,198 $45,417 $46,823 $50,401 $38,451 $39,792 $41,469 $42,475 $43,625 $46,499 $36,506 $37,648 $39,060 $39,898 $40,847 $43,185 $34,742 $35,721 $36,917 $37,620 $38,412 $40,334 $33,137 $33,979 $34,999 $35,594 $36,259 $37,854 $31,670 $32,398 $33,272 $33,778 $34,340 $35,676 Brazil Analysis of Sensitivity of DCF to Variations in WACC and Growth Rate in Perpetuity* Brazilian Unit-Free Cash Flows and Sensitivity Analysis (in 000s USD) 1997 1998 1999 2000 2001 2002 2003 2004 FCF $10,920 $11,215 $11,551 $12,002 $12,591 $13,334 $13,893 $14,448 Discounted Cash Flow Values by Growth and WACC Nominal Growth Rate in Perpetuity 1% 3% 5% 6% 7% 9% 10.0% $140,927 $164,464 $206,831 $243,903 $305,689 $799,975 11.0% $126,176 $143,574 $172,571 $195,768 $230,564 $404,544 12.0% $114,139 $127,343 $148,091 $ 163,652 $185,438 $272,581 13.0% $104,135 $114,371 $129,725 $140,692 $155,314 $206,493 W 14.0% $95,694 $103,769 $115,434 $123,454 $133,765 $166,759 A 15.0% $88,478 $94,944 $103,997 $110,032 $117,576 $140,208 C 16.0% $82,242 $87,485 $94,635 $99,283 $ 104,963 $121,193 C 17.0% $76,801 $81,100 $86,831 $90,478 $94,854 $106,890 18.0% $72,014 $75,572 $80,224 $83,131 $86,567 $95,730 19.0% $67,771 $70,740 $74,558 $76,907 $79,648 $86,774 20.0% $63,986 $66,483 $69,645 $71,565 $73,781 $79,421 21.0% $60,589 $62,703 $65,345 $66,930 $68,742 $73,271 22.0% $57,524 $59,324 $61,548 $62,869 $64,365 $68,049 23.0% $54,746 $56,288 $58,172 $59,281 $60,528 $63,557 24.0% $52,216 $53,543 $55,150 $56,087 $57,135 $59,649 25.0% $49,904 $51,051 $52,429 $53,226 $54,112 $56,216 Chile Analysis of Sensitivity of DCF to Variations in WACC and Growth Rate in Perpetuity* Chilean Unit-Free Cash Flows and Sensitivity Analysis (in 000s USD) 1997 1998 1999 2000 2001 2002 2003 2004 $3,150 $3,235 $3,332 $3,462 $3,632 $3,846 $4,007 $4,168 FCF Discounted Cash Flow Values by Growth and WACC 7% w A 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% 20.0% 21.0% 22.0% 23.0% 1% $52,855 $45,984 $40,652 $36,397 $32,925 $30,039 $27,604 $25,522 $23,724 $22,154 $20,773 $19,549 $18,457 $17.478 $16,593 $15,792 Nominal Growth Rate in Perpetuity 3% 4% 5% 6% $66,752 $78,911 $99,176 $139,708 $55,483 $63,083 $74,483 $93,482 $47,442 $52,534 $59,663 $70,357 $41,416 $45,000 $49,780 $56,472 $36,734 $39,352 $42,719 $47,207 $32,992 $34,960 $37,421 $40,584 $29,933 $31,448 $33,298 $35,612 $27,388 $28,575 $29,999 $31,740 $25,236 $26,181 $27,299 $28,639 $23,394 $24,157 $25,047 $26,099 $21,800 $22,423 $23,141 $23,980 $20,406 $20,920 $21,507 $22,185 $19,178 $19,605 $20,090 $20,644 $18,087 $18,446 $18,849 $19,307 $17,113 $17,416 $17,754 $18,135 $16,237 $16,494 $ 16,780 $17,100 $261,301 $131,481 $88,179 $66,509 $53,492 $44,802 $38,586 $33,916 $30,278 $27,362 $24,971 $22,975 $21,283 $19,829 $18,567 $17,460 PAGINAS AMARELAS Argentina Analysis of Sensitivity of DCF to Variations in WACC and Growth Rate in Perpetuity* Argentine Unit-Free Cash Flows and Sensitivity Analysis (in 000s US$) 1997 1998 1999 2000 2001 2002 2003 FCF $6,930 $7,117 $7,331 $7,617 $7,990 $8,462 $8,816 2004 $9,169 10.0% 11.0% 12.0% 13.0% W 14.0% A 15.0% C 16.0% C 17.0% 18.0% 19.0% 20.0% 21.0% 22.0% 23.0% 24.0% 25.0% Discounted Cash Flow Values by Growth and WACC Nominal Growth Rate in Perpetuity 1% 3% 5% 6% 7% 9% $89,434 $104,371 $131,258 $154,785 $193,995 $507,677 $80,074 $91,115 $109,516 $124,238 $146,320 $256,730 $72,435 $80,814 $93,981 $103,856 $117,682 $172,984 $66,086 $72,582 $82,325 $89,285 $98,565 $131,043 $60,729 $65,854 $73,256 $78,346 $84,889 $105,828 $56,149 $60,253 $65,998 $69,828 $74,616 $88,978 $52,192 $55,520 $60,057 $63,006 $66,611 $76,911 $48,739 $51,467 $55,104 $57,419 $60,196 $67,834 $45,701 $47,959 $50,911 $52,756 $54,937 $60,752 $43,009 $44,893 $47,316 $48,806 $50,546 $55,068 $40,606 $42,191 $44,198 $45,417 $46,823 $50,401 $38,451 $39,792 $41,469 $42,475 $43,625 $46,499 $36,506 $37,648 $39,060 $39,898 $40,847 $43,185 $34,742 $35,721 $36,917 $37,620 $38,412 $40,334 $33,137 $33,979 $34,999 $35,594 $36,259 $37,854 $31,670 $32,398 $33,272 $33,778 $34,340 $35,676 Brazil Analysis of Sensitivity of DCF to Variations in WACC and Growth Rate in Perpetuity* Brazilian Unit-Free Cash Flows and Sensitivity Analysis (in 000s USD) 1997 1998 1999 2000 2001 2002 2003 2004 FCF $10,920 $11,215 $11,551 $12,002 $12,591 $13,334 $13,893 $14,448 Discounted Cash Flow Values by Growth and WACC Nominal Growth Rate in Perpetuity 1% 3% 5% 6% 7% 9% 10.0% $140,927 $164,464 $206,831 $243,903 $305,689 $799,975 11.0% $126,176 $143,574 $172,571 $195,768 $230,564 $404,544 12.0% $114,139 $127,343 $148,091 $ 163,652 $185,438 $272,581 13.0% $104,135 $114,371 $129,725 $140,692 $155,314 $206,493 W 14.0% $95,694 $103,769 $115,434 $123,454 $133,765 $166,759 A 15.0% $88,478 $94,944 $103,997 $110,032 $117,576 $140,208 C 16.0% $82,242 $87,485 $94,635 $99,283 $ 104,963 $121,193 C 17.0% $76,801 $81,100 $86,831 $90,478 $94,854 $106,890 18.0% $72,014 $75,572 $80,224 $83,131 $86,567 $95,730 19.0% $67,771 $70,740 $74,558 $76,907 $79,648 $86,774 20.0% $63,986 $66,483 $69,645 $71,565 $73,781 $79,421 21.0% $60,589 $62,703 $65,345 $66,930 $68,742 $73,271 22.0% $57,524 $59,324 $61,548 $62,869 $64,365 $68,049 23.0% $54,746 $56,288 $58,172 $59,281 $60,528 $63,557 24.0% $52,216 $53,543 $55,150 $56,087 $57,135 $59,649 25.0% $49,904 $51,051 $52,429 $53,226 $54,112 $56,216 Chile Analysis of Sensitivity of DCF to Variations in WACC and Growth Rate in Perpetuity* Chilean Unit-Free Cash Flows and Sensitivity Analysis (in 000s USD) 1997 1998 1999 2000 2001 2002 2003 2004 $3,150 $3,235 $3,332 $3,462 $3,632 $3,846 $4,007 $4,168 FCF Discounted Cash Flow Values by Growth and WACC 7% w A 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% 20.0% 21.0% 22.0% 23.0% 1% $52,855 $45,984 $40,652 $36,397 $32,925 $30,039 $27,604 $25,522 $23,724 $22,154 $20,773 $19,549 $18,457 $17.478 $16,593 $15,792 Nominal Growth Rate in Perpetuity 3% 4% 5% 6% $66,752 $78,911 $99,176 $139,708 $55,483 $63,083 $74,483 $93,482 $47,442 $52,534 $59,663 $70,357 $41,416 $45,000 $49,780 $56,472 $36,734 $39,352 $42,719 $47,207 $32,992 $34,960 $37,421 $40,584 $29,933 $31,448 $33,298 $35,612 $27,388 $28,575 $29,999 $31,740 $25,236 $26,181 $27,299 $28,639 $23,394 $24,157 $25,047 $26,099 $21,800 $22,423 $23,141 $23,980 $20,406 $20,920 $21,507 $22,185 $19,178 $19,605 $20,090 $20,644 $18,087 $18,446 $18,849 $19,307 $17,113 $17,416 $17,754 $18,135 $16,237 $16,494 $ 16,780 $17,100 $261,301 $131,481 $88,179 $66,509 $53,492 $44,802 $38,586 $33,916 $30,278 $27,362 $24,971 $22,975 $21,283 $19,829 $18,567 $17,460