Answered step by step

Verified Expert Solution

Question

1 Approved Answer

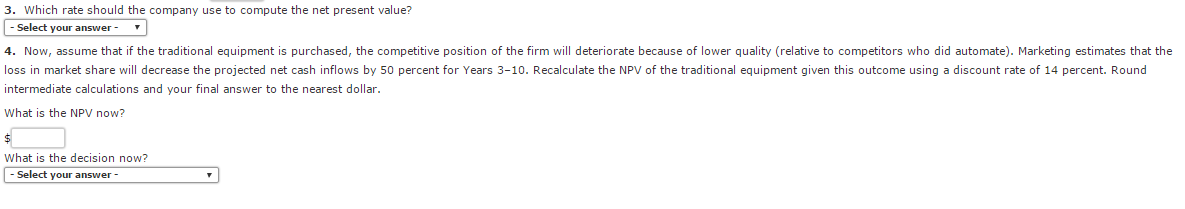

**Drop down 1 : 18% discount rate, 14% cost of capital, rate higher than 18%,or rate lower than 14% Drop down 2 :contemporary technology is

**Drop down 1 : 18% discount rate, 14% cost of capital, rate higher than 18%,or rate lower than 14%

Drop down 2 :contemporary technology is preferred or traditional equipment is preferred

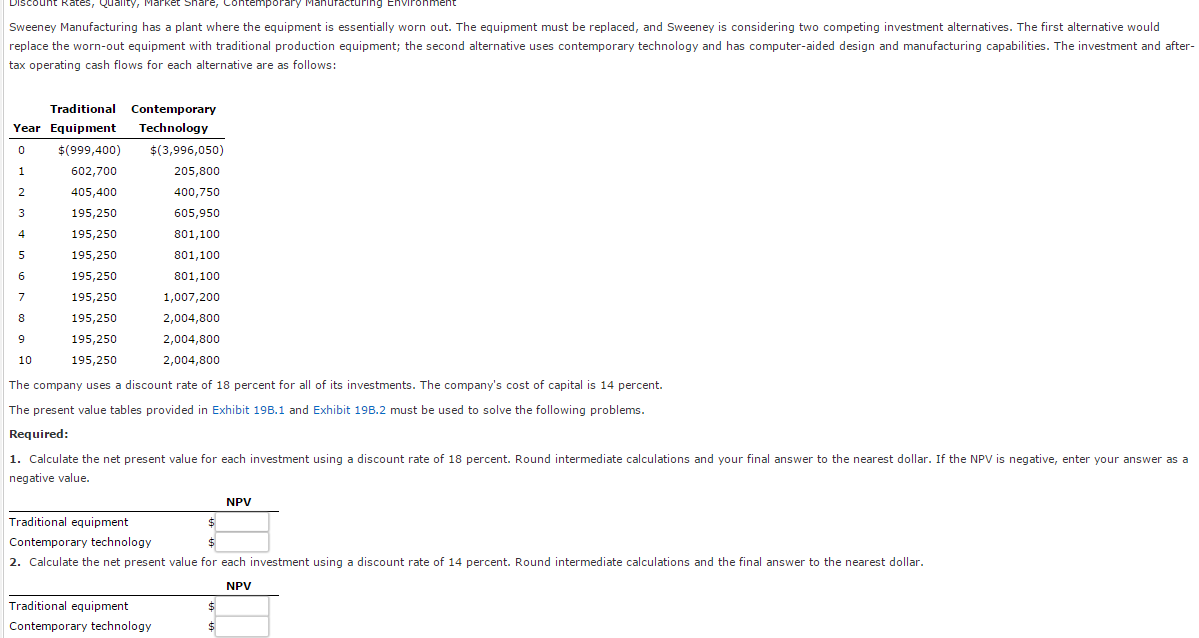

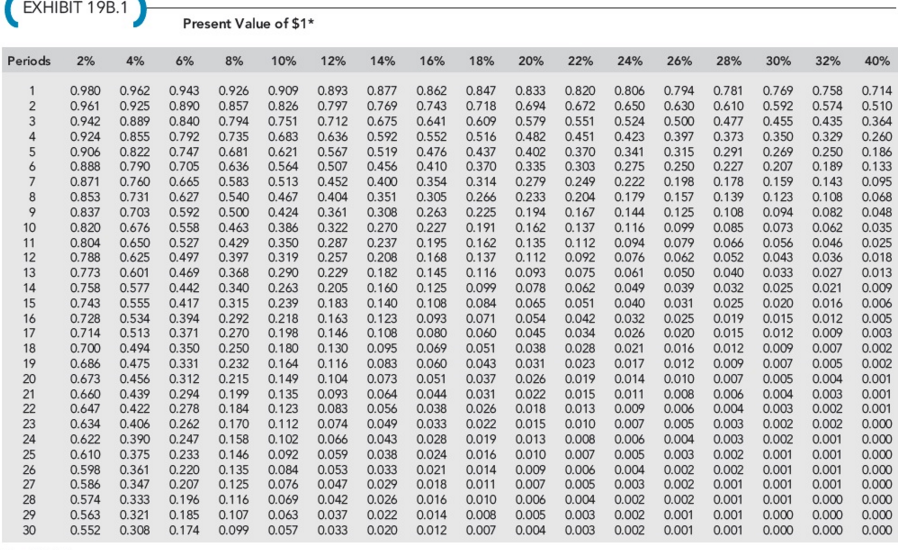

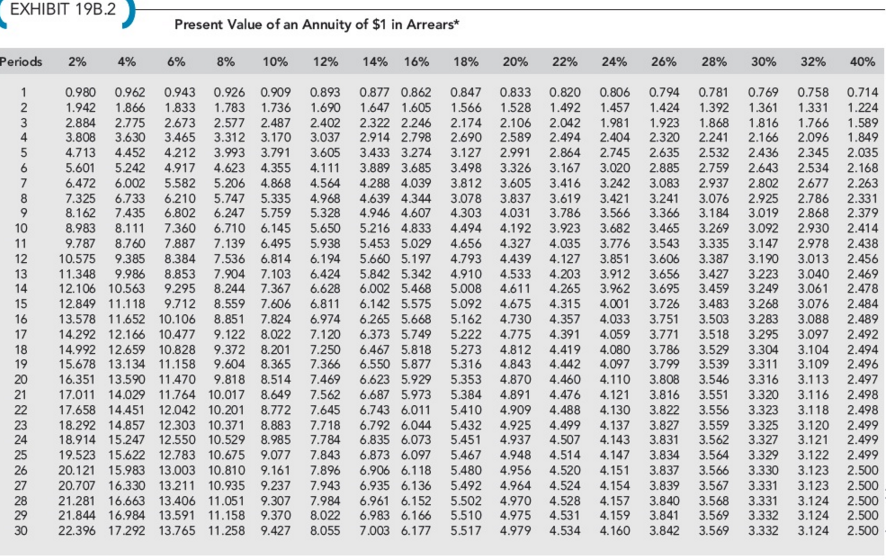

Discount Rates, Quallty, Market Share, Contemporary Manuracturing Environmen Sweeney Manufacturing has a plant where the equipment is essentially worn out. The equipment must be replaced, and Sweeney is considering two competing investment alternatives. The first alternative would replace the worn-out equipment with traditional production equipment; the second alternative uses contemporary technology and has computer-aided design and manufacturing capabilities. The investment and after- tax operating cash flows for each alternative are as follows: Traditional Contemporary Year Equipment Technology (999,400) $(3,996,050) 205,800 400,750 605,950 801,100 801,100 801,100 1,007,200 2,004,800 2,004,800 2,004,800 602,700 405,400 195,250 195,250 195,250 195,250 195,250 195,250 195,250 195,250 4 7 8 9 10 The company uses a discount rate of 18 percent for all of its investments. The company's cost of capital is 14 percent. The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems Required: 1. Calculate the net present value for each investment using a discount rate of 18 percent. Round intermediate calculations and your final answer to the nearest dollar. If the NPV is negative, enter your answer as a negative value. NPV Traditional equipment Contemporary technology 2. Calculate the net present value for each investment using a discount rate of 14 percent. Round intermediate calculations and the final answer to the nearest dollan NPV Traditional equipment Contemporary technology

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started