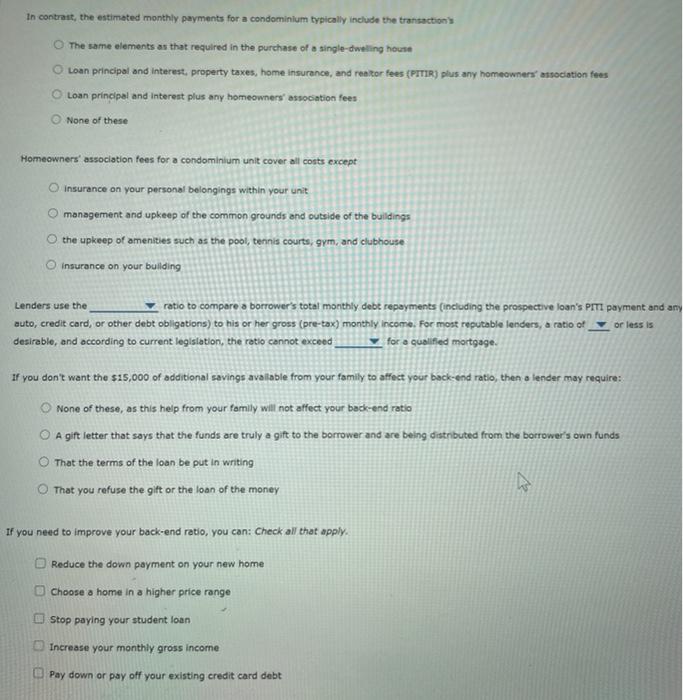

Drop Down Options:

1) back end, front end

2) 25%, 36%, 43%, 50%

3) 43%, 30%, 36%, 50%, 25%

In contrast, the estimated monthly payments for a condominium typically include the transaction's The same elements as that required in the purchase of a single-dwelling house Loan principal and interest, property taxes, home insurance, and reator fees (PITIR) plus any homeowners association fees Loan principal and interest plus any homeowners' association fees None of these Homeowners' association fees for a condominium unit cover all costs except Insurance on your personal belongings within your unit management and upkeep of the common grounds and outside of the buildings the upkeep of amenities such as the pool, tennis courts, gym, and clubhouse Insurance on your building Lenders use the ratio to compare a borrower's total monthly debt repayments (including the prospective loan's PITI payment and any auto, credit card, or other debt obligations) to his or her gross (pre-tax) monthly income. For most reputable lenders, a ratio of or less is desirable, and according to current legislation, the ratio cannot exceed for a qualified mortgage. If you don't want the $15,000 of additional savings available from your family to affect your back-end ratio, then a lender may require: None of these, as this help from your family will not affect your back-end ratio A gift letter that says that the funds are truly a gift to the borrower and are being distributed from the borrower's own funds That the terms of the loan be put in writing That you refuse the gift or the loan of the money If you need to improve your back-end ratio, you can: Check all that apply. Reduce the down payment on your new home Choose a home in a higher price range Stop paying your student loan Increase your monthly gross income Pay down or pay off your existing credit card debt In contrast, the estimated monthly payments for a condominium typically include the transaction's The same elements as that required in the purchase of a single-dwelling house Loan principal and interest, property taxes, home insurance, and reator fees (PITIR) plus any homeowners association fees Loan principal and interest plus any homeowners' association fees None of these Homeowners' association fees for a condominium unit cover all costs except Insurance on your personal belongings within your unit management and upkeep of the common grounds and outside of the buildings the upkeep of amenities such as the pool, tennis courts, gym, and clubhouse Insurance on your building Lenders use the ratio to compare a borrower's total monthly debt repayments (including the prospective loan's PITI payment and any auto, credit card, or other debt obligations) to his or her gross (pre-tax) monthly income. For most reputable lenders, a ratio of or less is desirable, and according to current legislation, the ratio cannot exceed for a qualified mortgage. If you don't want the $15,000 of additional savings available from your family to affect your back-end ratio, then a lender may require: None of these, as this help from your family will not affect your back-end ratio A gift letter that says that the funds are truly a gift to the borrower and are being distributed from the borrower's own funds That the terms of the loan be put in writing That you refuse the gift or the loan of the money If you need to improve your back-end ratio, you can: Check all that apply. Reduce the down payment on your new home Choose a home in a higher price range Stop paying your student loan Increase your monthly gross income Pay down or pay off your existing credit card debt