DROP DOWN OPTIONS!!

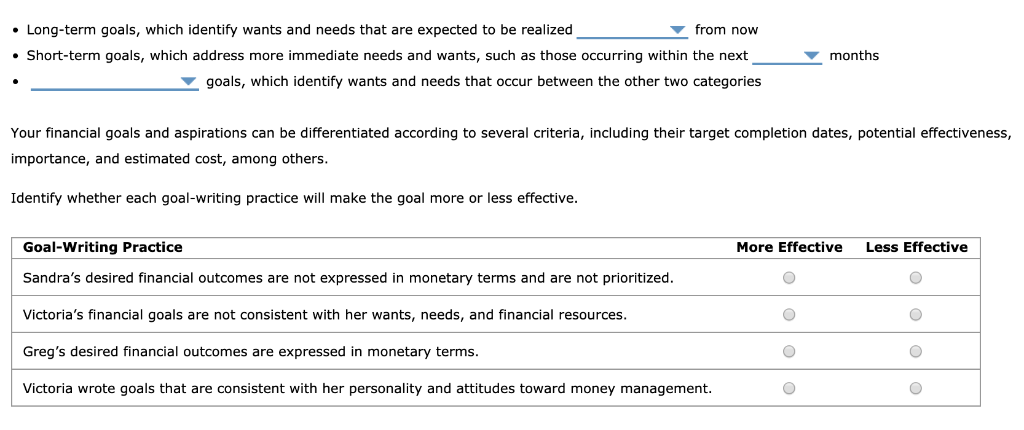

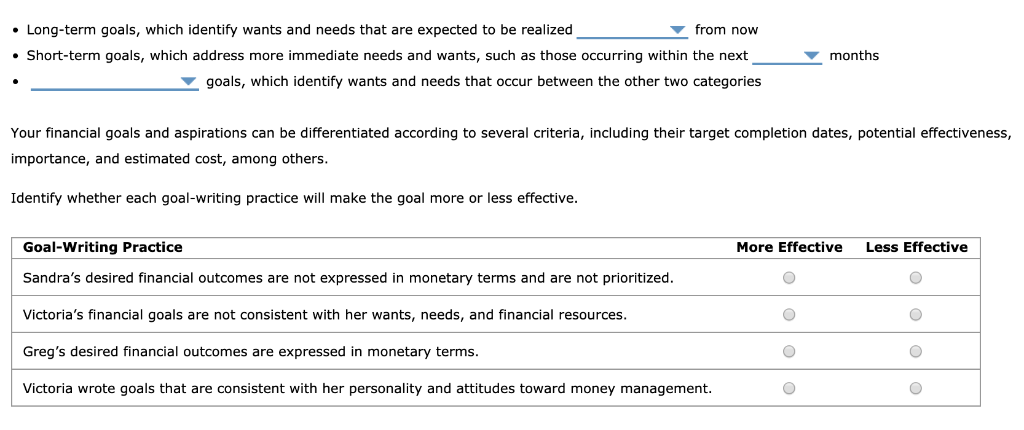

1. (inputs, outputs, contributions)

2. (1-3 years, 6-40 years, 5-10 years)

3. (24, 12)

4. (Intermediate-term, intermittent-term, interactive term)

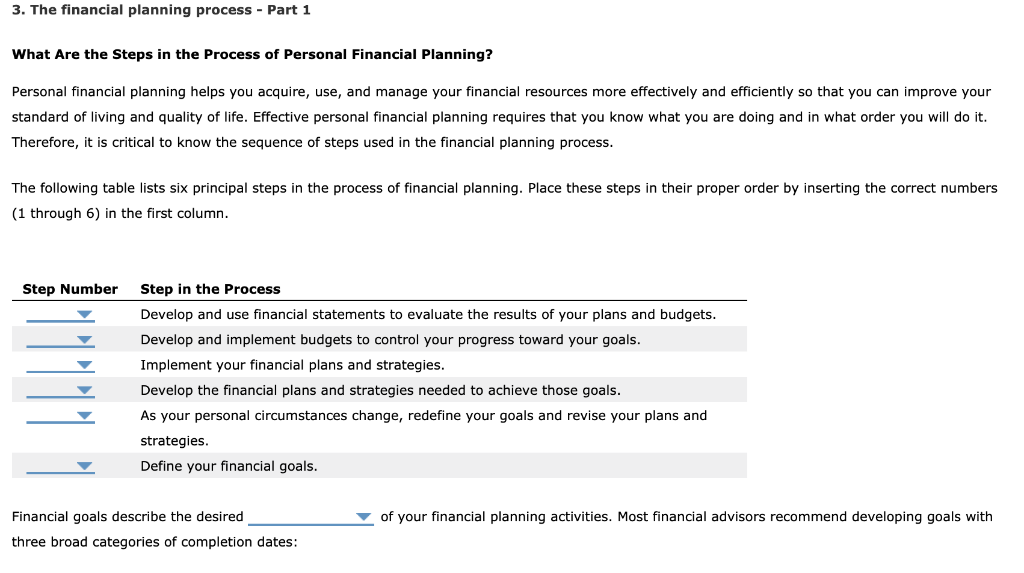

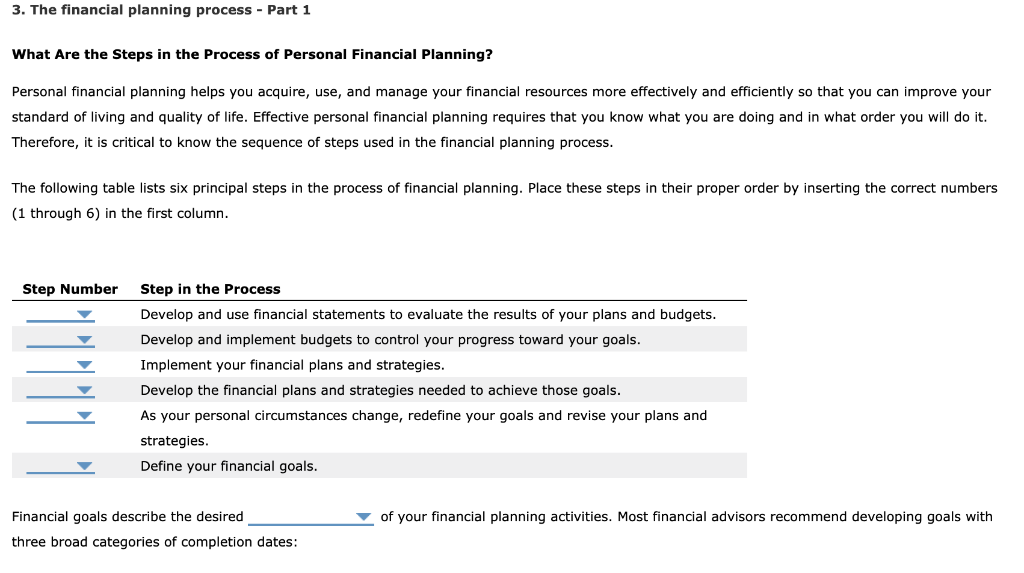

3. The financial planning process Part 1 What Are the Steps in the Process of Personal Financial Planning? Personal financial planning helps you acquire, use, and manage your financial resources more effectively and efficiently so that you can improve your standard of living and quality of life. Effective personal financial planning requires that you know what you are doing and in what order you will do it. Therefore, it is critical to know the sequence of steps used in the financial planning process. The following table lists six principal steps in the process of financial planning. Place these steps in their proper order by inserting the correct numbers (1 through 6) in the first column Step Number Step in the Process Develop and use financial statements to evaluate the results of your plans and budgets. Develop and implement budgets to control your progress toward your goals. Implement your financial plans and strategies. Develop the financial plans and strategies needed to achieve those goals. As your personal circumstances change, redefine your goals and revise your plans and strategies. Define your financial goals Financial goals describe the desired of your financial planning activities. Most financial advisors recommend developing goals with three broad categories of completion dates: from now Long-term goals, which identify wants and needs that are expected to be realized Short-term goals, which address more immediate needs and wants, such as those occurring within the next months goals, which identify wants and needs that occur between the other two categories Your financial goals and aspirations can be differentiated according to several criteria, including their target completion dates, potential effectiveness, importance, and estimated cost, among others Identify whether each goal-writing practice will make the goal more or less effective. Goal-Writing Practice More Effective Less Effective Sandra's desired financial outcomes are not expressed in monetary terms and are not prioritized. Victoria's financial goals are not consistent with her wants, needs, and financial resources Greg's desired financial outcomes are expressed in monetary terms Victoria wrote goals that are consistent with her personality and attitudes toward money management. 3. The financial planning process Part 1 What Are the Steps in the Process of Personal Financial Planning? Personal financial planning helps you acquire, use, and manage your financial resources more effectively and efficiently so that you can improve your standard of living and quality of life. Effective personal financial planning requires that you know what you are doing and in what order you will do it. Therefore, it is critical to know the sequence of steps used in the financial planning process. The following table lists six principal steps in the process of financial planning. Place these steps in their proper order by inserting the correct numbers (1 through 6) in the first column Step Number Step in the Process Develop and use financial statements to evaluate the results of your plans and budgets. Develop and implement budgets to control your progress toward your goals. Implement your financial plans and strategies. Develop the financial plans and strategies needed to achieve those goals. As your personal circumstances change, redefine your goals and revise your plans and strategies. Define your financial goals Financial goals describe the desired of your financial planning activities. Most financial advisors recommend developing goals with three broad categories of completion dates: from now Long-term goals, which identify wants and needs that are expected to be realized Short-term goals, which address more immediate needs and wants, such as those occurring within the next months goals, which identify wants and needs that occur between the other two categories Your financial goals and aspirations can be differentiated according to several criteria, including their target completion dates, potential effectiveness, importance, and estimated cost, among others Identify whether each goal-writing practice will make the goal more or less effective. Goal-Writing Practice More Effective Less Effective Sandra's desired financial outcomes are not expressed in monetary terms and are not prioritized. Victoria's financial goals are not consistent with her wants, needs, and financial resources Greg's desired financial outcomes are expressed in monetary terms Victoria wrote goals that are consistent with her personality and attitudes toward money management