DROP DOWN OPTIONS

1. (last year's earnings / full retirement benefits / adjusted first-year benefit)

2. (your benefits or the higher paid spouse benefits / your adjusted first-year benefit / your full retirement benefits)

3. (a decrease / an increase)

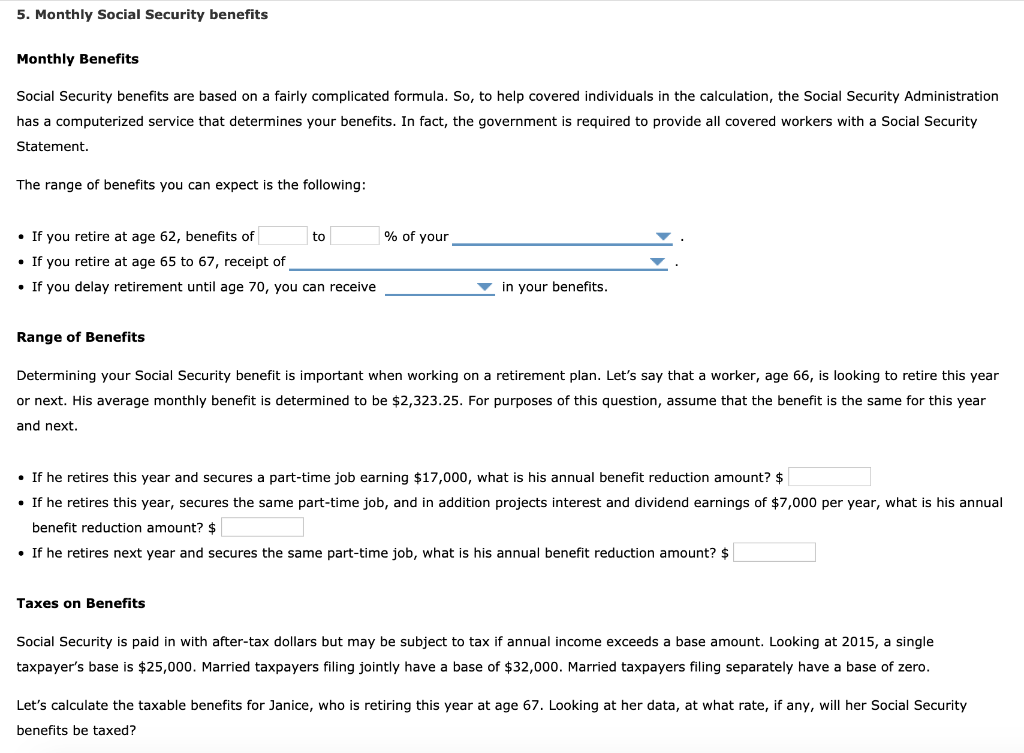

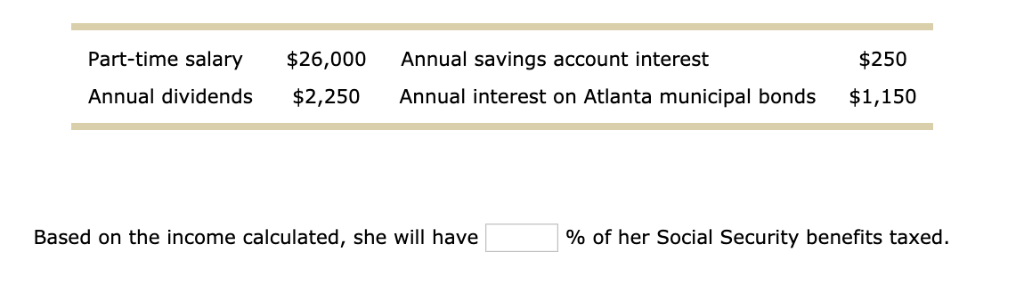

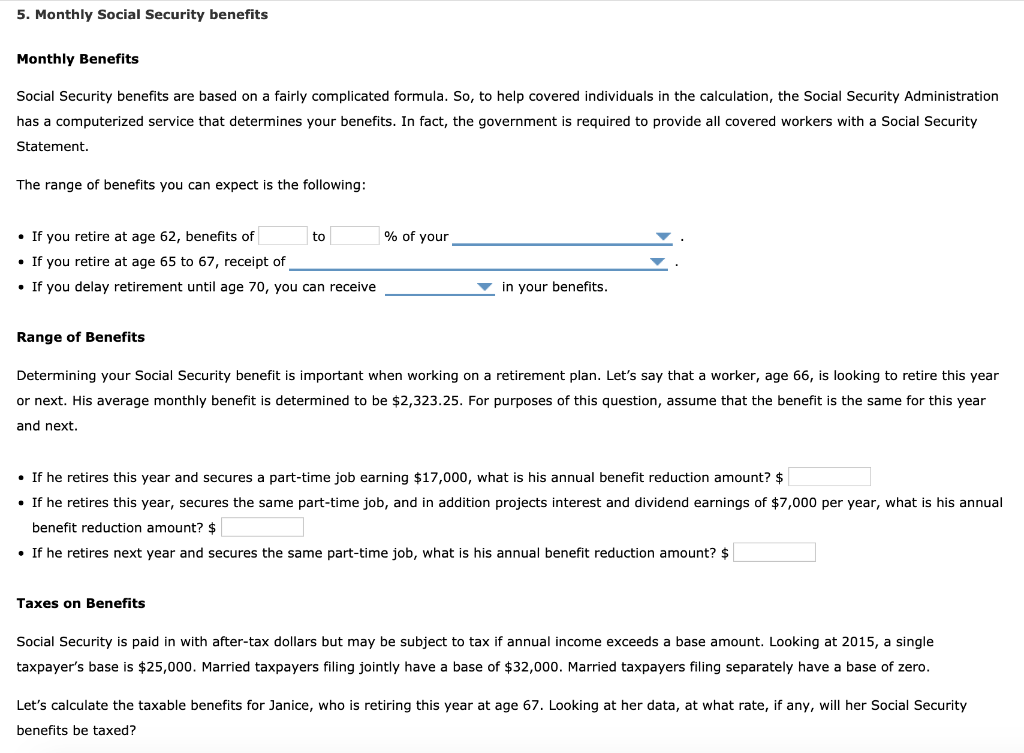

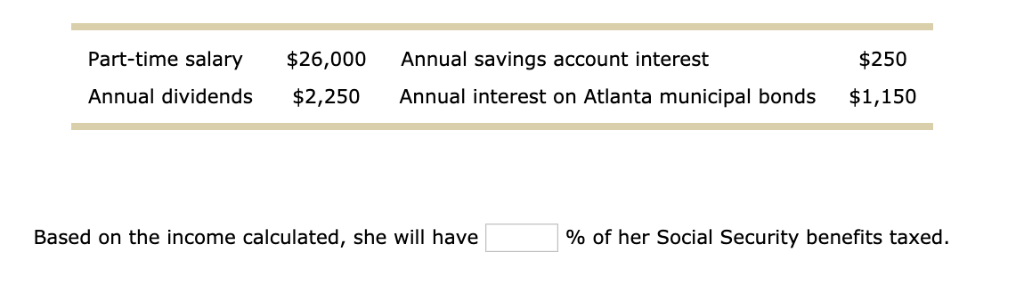

5. Monthly Social Security benefits Monthly Benefits Social Security benefits are based on a fairly complicated formula. So, to help covered individuals in the calculation, the Social Security Administration has a computerized service that determines your benefits. In fact, the government is required to provide all covered workers with a Social Security Statement. The range of benefits you can expect is the following: % of your If you retire at age 62, benefits of to If you retire at age 65 to 67, receipt of If you delay retirement until age 70, you can receive in your benefits. Range of Benefits Determining your Social Security benefit important when working on a retirement plan. Let's say that worker, age 66, is looking to retire this year or next. His average monthly benefit is determined to be $2,323.25. For purposes of this question, assume that the benefit is the same for this year and next If he retires this year and secures a part-time job earning $17,000, what is his annual benefit reduction amount? $ If he retires this year, secures the same part-time job, and in addition projects interest and dividend earnings of $7,000 per year, what is his annual benefit reduction amount? $ If he retires next year and secures the same part-time job, what is his annual benefit reduction amount? $ Taxes on Benefits Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount. Looking at 2015, a single taxpayer's base is $25,000. Married taxpayers filing jointly have a base of $32,000. Married taxpayers filing separately have a base of zero. retiring this year at age 67. Looking at her data, at what rate, if any, will her Social Security Let's calculate the taxable benefits for Janice, who benefits be taxed? Part-time salary $26,000 Annual savings account interest $250 $2,250 Annual interest on Atlanta municipal bonds $1,150 Annual dividends Based on the income calculated, she will have % of her Social Security benefits taxed. 5. Monthly Social Security benefits Monthly Benefits Social Security benefits are based on a fairly complicated formula. So, to help covered individuals in the calculation, the Social Security Administration has a computerized service that determines your benefits. In fact, the government is required to provide all covered workers with a Social Security Statement. The range of benefits you can expect is the following: % of your If you retire at age 62, benefits of to If you retire at age 65 to 67, receipt of If you delay retirement until age 70, you can receive in your benefits. Range of Benefits Determining your Social Security benefit important when working on a retirement plan. Let's say that worker, age 66, is looking to retire this year or next. His average monthly benefit is determined to be $2,323.25. For purposes of this question, assume that the benefit is the same for this year and next If he retires this year and secures a part-time job earning $17,000, what is his annual benefit reduction amount? $ If he retires this year, secures the same part-time job, and in addition projects interest and dividend earnings of $7,000 per year, what is his annual benefit reduction amount? $ If he retires next year and secures the same part-time job, what is his annual benefit reduction amount? $ Taxes on Benefits Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount. Looking at 2015, a single taxpayer's base is $25,000. Married taxpayers filing jointly have a base of $32,000. Married taxpayers filing separately have a base of zero. retiring this year at age 67. Looking at her data, at what rate, if any, will her Social Security Let's calculate the taxable benefits for Janice, who benefits be taxed? Part-time salary $26,000 Annual savings account interest $250 $2,250 Annual interest on Atlanta municipal bonds $1,150 Annual dividends Based on the income calculated, she will have % of her Social Security benefits taxed