drop down options:

1. neither, she broke even

no

yes

2. more than

less than

the same as

3.the more premium

her employer only contributes

the more premium her employer pays the less coverage

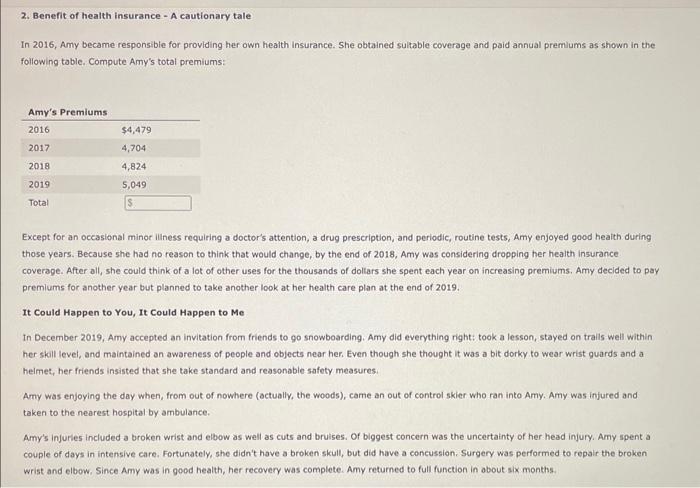

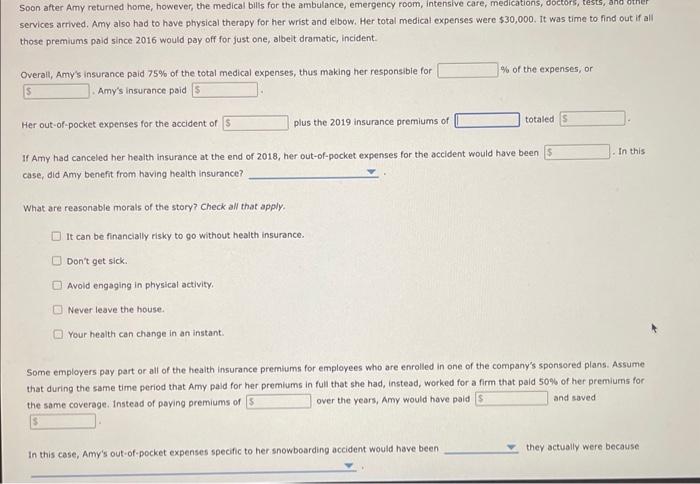

2. Benefit of health insurance - A cautionary tale In 2016, Amy became responsible for providing her own health insurance. She obtained sultable coverage and paid annual premlums as shown in the following table. Compute Amy's total premiums: Except for an occasional minor illiness requiring a doctor's attention, a drug prescription, and periodic, routine tests, Amy enjoyed good health during those years. Because she had no reason to think that would change, by the end of 2018 , Amy was considering dropping her health insurance. coverage. After all, she could think of a lot of other uses for the thousands of doltars she spent each year on increasing premiums. Amy decided to pay premlums for another year but planned to take another look at her health care plan at the end of 2019. It Could Happen to You, It Could Happen to Me In December 2019, Amy accepted an invitation from friends to go snowboarding. Amy did everything right: took a lesson, stayed on trails well within her skill level, and maintained an awareness of people and objects near her. Even though she thought it was a bit dorky to wear wrist guards and a helmet, her friends insisted that she take standard and reasonable safety measures. Amy was enjoying the day when, from out of nowhere (actually, the woods), came an out of control skier who ran into Amy. Amy was injured and taken to the nearest hospital by ambulance. Amy's injuries included a broken wrist and elbow as well as cuts and bruises. Of blggest concern was the uncertainty of her head injury. Amy spent a couple of days in intensive care. Fortunately, she didn't have a broken skull, but did have a concussion. Surgery was performed to repair the broken wrist and elbow, Since Amy was in good health, her recovery was complete. Amy returned to full function in obout six months. services arrived. Amy also had to have physical therapy for her wrist and elbow. Her total medical expenses were $30,000. It was time to find out if all those premiums paid since 2016 would pay off for just one, albeit dramatic, incident. Overall, Amy's insurance paid 75% of the total medical expenses, thus making her responsibie for Amy's insurance paid Her out-of-pocket expenses for the accident of plus the 2019 insurance premiums of % of the expenses, or If Amy had canceled her health insurance at the end of 2018 , her out-of-pocket expenses for the accident would have been In this case, did Amy benefit from having health insurance? What are reasonable morals of the story? Check all that apply. It can be financially risky to go without health insurance. Don't get sick. Avold engaging in physical activity. Never leave the house. Your health can change in an instant. Some employers pay part or all of the health insurance premiums for employees who are enrolled in one of the company's sponsored plans. Assume that during the same time period that Amy paid for her premiums in full that she had, instead, worked for a firm that pald 50% of her premiurns for the same coverage. Instead of paying premiums of over the years, Amy would have paid and saved In this case, Amy's out-of-pocket expenses specific to her snowboarding accident would have been they actually were because 2. Benefit of health insurance - A cautionary tale In 2016, Amy became responsible for providing her own health insurance. She obtained sultable coverage and paid annual premlums as shown in the following table. Compute Amy's total premiums: Except for an occasional minor illiness requiring a doctor's attention, a drug prescription, and periodic, routine tests, Amy enjoyed good health during those years. Because she had no reason to think that would change, by the end of 2018 , Amy was considering dropping her health insurance. coverage. After all, she could think of a lot of other uses for the thousands of doltars she spent each year on increasing premiums. Amy decided to pay premlums for another year but planned to take another look at her health care plan at the end of 2019. It Could Happen to You, It Could Happen to Me In December 2019, Amy accepted an invitation from friends to go snowboarding. Amy did everything right: took a lesson, stayed on trails well within her skill level, and maintained an awareness of people and objects near her. Even though she thought it was a bit dorky to wear wrist guards and a helmet, her friends insisted that she take standard and reasonable safety measures. Amy was enjoying the day when, from out of nowhere (actually, the woods), came an out of control skier who ran into Amy. Amy was injured and taken to the nearest hospital by ambulance. Amy's injuries included a broken wrist and elbow as well as cuts and bruises. Of blggest concern was the uncertainty of her head injury. Amy spent a couple of days in intensive care. Fortunately, she didn't have a broken skull, but did have a concussion. Surgery was performed to repair the broken wrist and elbow, Since Amy was in good health, her recovery was complete. Amy returned to full function in obout six months. services arrived. Amy also had to have physical therapy for her wrist and elbow. Her total medical expenses were $30,000. It was time to find out if all those premiums paid since 2016 would pay off for just one, albeit dramatic, incident. Overall, Amy's insurance paid 75% of the total medical expenses, thus making her responsibie for Amy's insurance paid Her out-of-pocket expenses for the accident of plus the 2019 insurance premiums of % of the expenses, or If Amy had canceled her health insurance at the end of 2018 , her out-of-pocket expenses for the accident would have been In this case, did Amy benefit from having health insurance? What are reasonable morals of the story? Check all that apply. It can be financially risky to go without health insurance. Don't get sick. Avold engaging in physical activity. Never leave the house. Your health can change in an instant. Some employers pay part or all of the health insurance premiums for employees who are enrolled in one of the company's sponsored plans. Assume that during the same time period that Amy paid for her premiums in full that she had, instead, worked for a firm that pald 50% of her premiurns for the same coverage. Instead of paying premiums of over the years, Amy would have paid and saved In this case, Amy's out-of-pocket expenses specific to her snowboarding accident would have been they actually were because