Answered step by step

Verified Expert Solution

Question

1 Approved Answer

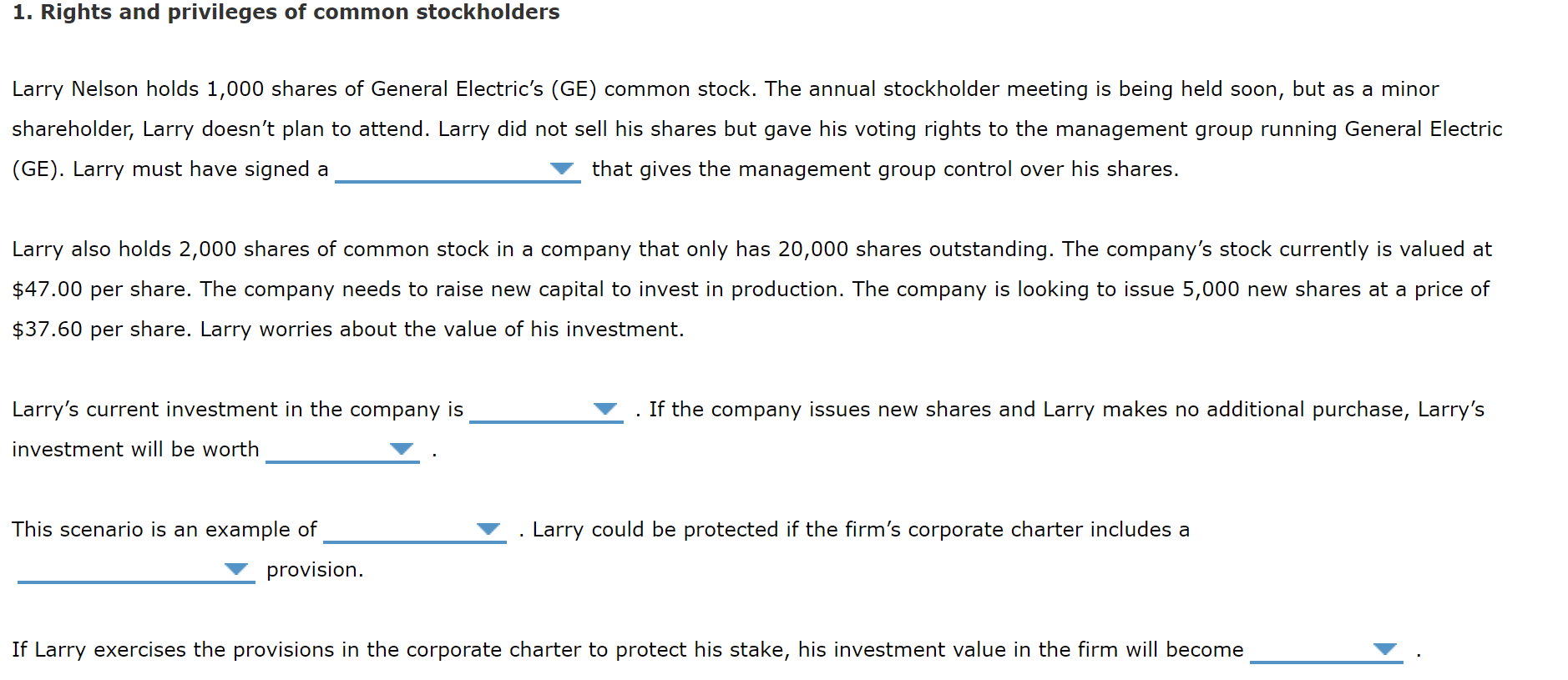

Drop down options: 1.corporate charter/preemptive right/proxy 2.94,000/37,600/56400/103,400 3.94,000/112,800/90.240/135,360 4.a proxy/a takeover/dilution/a poison pill 5.proxy/preemptive right 6.113,800/84,600/112,800/169,200 1. Rights and privileges of common stockholders Larry Nelson

Drop down options:

1.corporate charter/preemptive right/proxy

2.94,000/37,600/56400/103,400

3.94,000/112,800/90.240/135,360

4.a proxy/a takeover/dilution/a poison pill

5.proxy/preemptive right

6.113,800/84,600/112,800/169,200

1. Rights and privileges of common stockholders Larry Nelson holds 1,000 shares of General Electric's (GE) common stock. The annual stockholder meeting is being held soon, but as a minor shareholder, Larry doesn't plan to attend. Larry did not sell his shares but gave his voting rights to the management group running General Electric (GE). Larry must have signed a that gives the management group control over his shares. Larry also holds 2,000 shares of common stock in a company that only has 20,000 shares outstanding. The company's stock currently is valued at $47.00 per share. The company needs to raise new capital to invest in production. The company is looking to issue 5,000 new shares at a price of $37.60 per share. Larry worries about the value of his investment. . If the company issues new shares and Larry makes no additional purchase, Larry's Larry's current investment in the company is investment will be worth This scenario is an example of_ provision. . Larry could be protected if the firm's corporate charter includes a If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will becomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started