Answered step by step

Verified Expert Solution

Question

1 Approved Answer

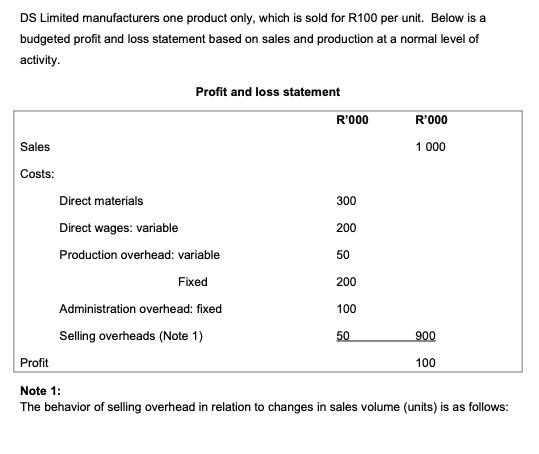

DS Limited manufacturers one product only, which is sold for R100 per unit. Below is a budgeted profit and loss statement based on sales

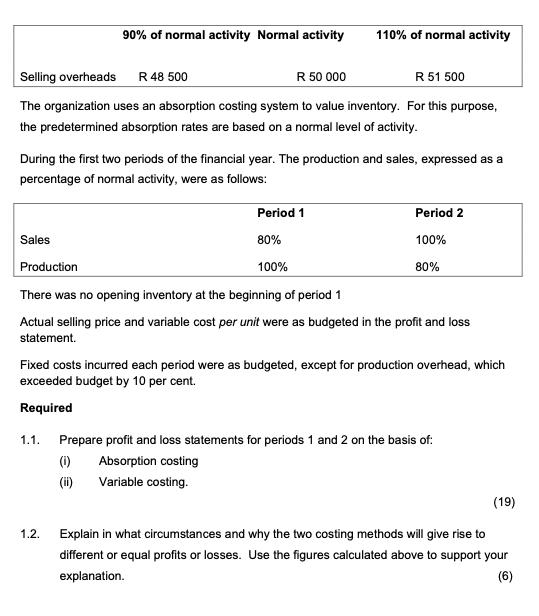

DS Limited manufacturers one product only, which is sold for R100 per unit. Below is a budgeted profit and loss statement based on sales and production at a normal level of activity. Profit and loss statement R'000 R'000 Sales 1 000 Costs: Direct materials 300 Direct wages: variable 200 Production overhead: variable 50 Fixed 200 Administration overhead: fixed 100 Selling overheads (Note 1) 50 900 Profit 100 Note 1: The behavior of selling overhead in relation to changes in sales volume (units) is as follows: 90% of normal activity Normal activity 110% of normal activity Selling overheads R 48 500 R 50 000 R 51 500 The organization uses an absorption costing system to value inventory. For this purpose, the predetermined absorption rates are based on a normal level of activity. During the first two periods of the financial year. The production and sales, expressed as a percentage of normal activity, were as follows: Period 1 Period 2 Sales 80% 100% Production 100% 80% There was no opening inventory at the beginning of period 1 Actual selling price and variable cost per unit were as budgeted in the profit and loss statement. Fixed costs incurred each period were as budgeted, except for production overhead, which exceeded budget by 10 per cent. Required 1.1. Prepare profit and loss statements for periods 1 and 2 on the basis of: (1) Absorption costing (i) Variable costing. (19) 1.2. Explain in what circumstances and why the two costing methods will give rise to different or equal profits or losses. Use the figures calculated above to support your explanation. (6)

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

i Absorption Costing method Profit Loss statement per unit Actual Period 1 Actual Period 2 Opening inventory 2000 Quantity Produced 10000 8000 Quantity Sold 8000 10000 Closing inventory 2000 Sales Qty ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started