Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DU ULLY sluge amount equivalence LAULUES. Method #2: use only uniform series equivalence factors. A bank offers depositors daily compounding of Interest. It adver- tizes

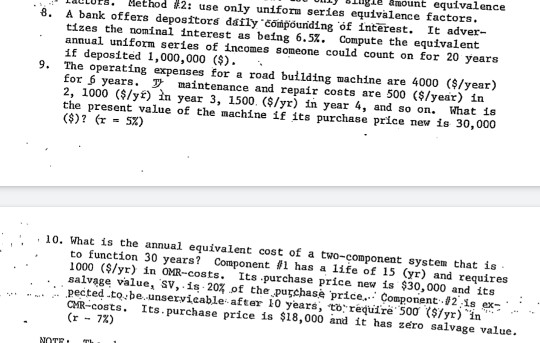

DU ULLY sluge amount equivalence LAULUES. Method #2: use only uniform series equivalence factors. A bank offers depositors daily compounding of Interest. It adver- tizes the nominal interest as being 6.5%. Compute the equivalent annual uniform series of incomes someone could count on for 20 years 1f deposited 1,000,000 ($). The operating expenses for a road building machine are 4000 ($/year) for 6 years. The maintenance and repair costs are 500 ($/year) in 2, 1000 ($/yf) in year 3, 1500. ($/yr) in year 4, and so on. What 1.8 the present value of the machine if its purchase price new is 30,000 ($)? (r = 5X) 9. 10. What is the annual equivalent cost of a two-component system that is to function 30 years? Component fi has a life of 15 (yr) and requires 1000 ($/yr) in OMR-costs. Its purchase price new is $30,000 and its salvage value, sv, is 20% of the purchase price. Component #2 is ex- . pected to be, unservicable after 10 years, to require 500 ($7yr) in CMR-costs. Its purchase price is $18,000 and it has zero salvage value. (r -7%) .. NOTE. DU ULLY sluge amount equivalence LAULUES. Method #2: use only uniform series equivalence factors. A bank offers depositors daily compounding of Interest. It adver- tizes the nominal interest as being 6.5%. Compute the equivalent annual uniform series of incomes someone could count on for 20 years 1f deposited 1,000,000 ($). The operating expenses for a road building machine are 4000 ($/year) for 6 years. The maintenance and repair costs are 500 ($/year) in 2, 1000 ($/yf) in year 3, 1500. ($/yr) in year 4, and so on. What 1.8 the present value of the machine if its purchase price new is 30,000 ($)? (r = 5X) 9. 10. What is the annual equivalent cost of a two-component system that is to function 30 years? Component fi has a life of 15 (yr) and requires 1000 ($/yr) in OMR-costs. Its purchase price new is $30,000 and its salvage value, sv, is 20% of the purchase price. Component #2 is ex- . pected to be, unservicable after 10 years, to require 500 ($7yr) in CMR-costs. Its purchase price is $18,000 and it has zero salvage value. (r -7%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started