Answered step by step

Verified Expert Solution

Question

1 Approved Answer

wrong problem do not need answer Consolidated Balance Sheet Working Paper, Previously Reported Goodwill Progres P3.7 sive Corporation acquired all of the outstanding stock of

wrong problem do not need answer

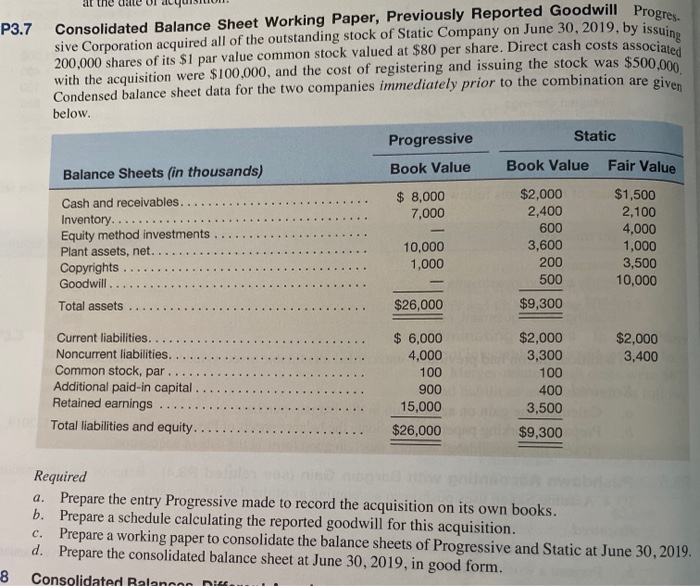

Consolidated Balance Sheet Working Paper, Previously Reported Goodwill Progres P3.7 sive Corporation acquired all of the outstanding stock of Static Company on June 30, 2019, by issuing 200,000 shares of its $1 par value common stock valued at $80 per share. Direct cash costs associated with the acquisition were $100,000, and the cost of registering and issuing the stock was Condensed balance sheet data for the two companies immediately prior to the combination are below. $500,000 given Progressive Static Book Value Book Value Fair Value $ 8,000 7,000 Balance Sheets (in thousands) Cash and receivables.. Inventory.. Equity method investments Plant assets, net.. Copyrights Goodwill.. Total assets $2,000 2,400 600 3,600 200 500 $1,500 2,100 4,000 1,000 3,500 10,000 10,000 1,000 $26,000 $9,300 $2,000 3,400 Current liabilities. Noncurrent liabilities. Common stock, par Additional paid-in capital. Retained earnings Total liabilities and equity.. $ 6,000 4,000 100 900 15,000 $26,000 $2,000 3,300 100 400 3,500 $9,300 Required a. Prepare the entry Progressive made to record the acquisition on its own books. b. Prepare a schedule calculating the reported goodwill for this acquisition. c. Prepare a working paper to consolidate the balance sheets of Progressive and Static at June 30, 2019. d. Prepare the consolidated balance sheet at June 30, 2019, in good form. Consolidated Ralanoon din 8 Consolidated Balance Sheet Working Paper, Previously Reported Goodwill Progres P3.7 sive Corporation acquired all of the outstanding stock of Static Company on June 30, 2019, by issuing 200,000 shares of its $1 par value common stock valued at $80 per share. Direct cash costs associated with the acquisition were $100,000, and the cost of registering and issuing the stock was Condensed balance sheet data for the two companies immediately prior to the combination are below. $500,000 given Progressive Static Book Value Book Value Fair Value $ 8,000 7,000 Balance Sheets (in thousands) Cash and receivables.. Inventory.. Equity method investments Plant assets, net.. Copyrights Goodwill.. Total assets $2,000 2,400 600 3,600 200 500 $1,500 2,100 4,000 1,000 3,500 10,000 10,000 1,000 $26,000 $9,300 $2,000 3,400 Current liabilities. Noncurrent liabilities. Common stock, par Additional paid-in capital. Retained earnings Total liabilities and equity.. $ 6,000 4,000 100 900 15,000 $26,000 $2,000 3,300 100 400 3,500 $9,300 Required a. Prepare the entry Progressive made to record the acquisition on its own books. b. Prepare a schedule calculating the reported goodwill for this acquisition. c. Prepare a working paper to consolidate the balance sheets of Progressive and Static at June 30, 2019. d. Prepare the consolidated balance sheet at June 30, 2019, in good form. Consolidated Ralanoon din 8 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started