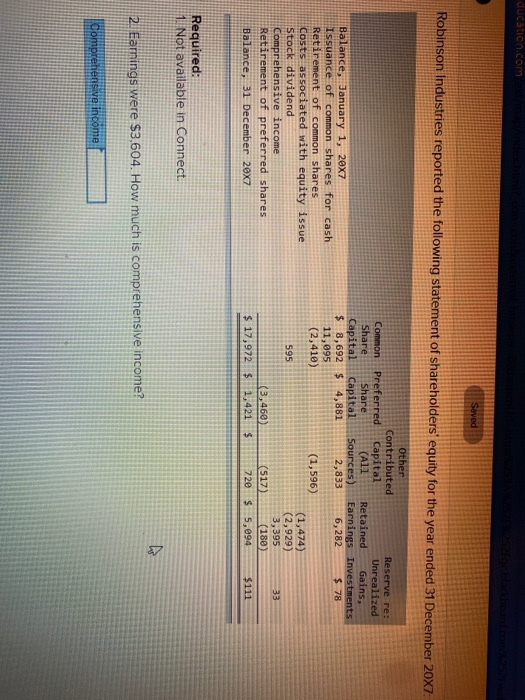

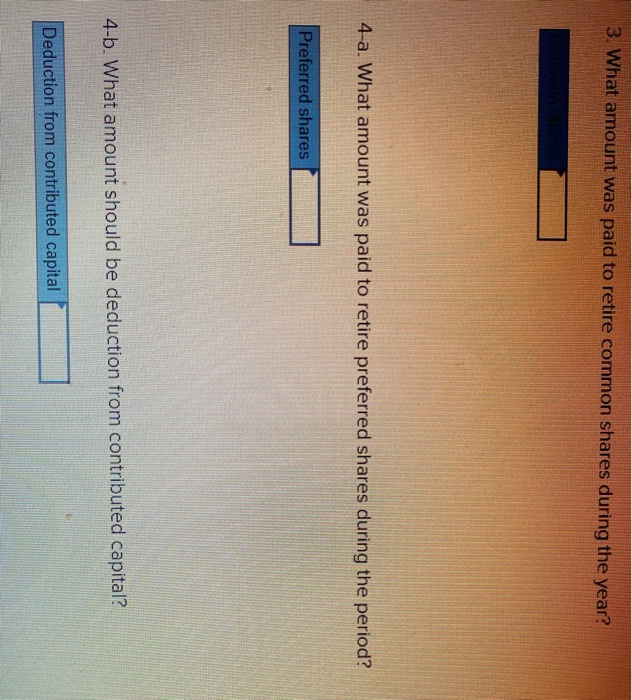

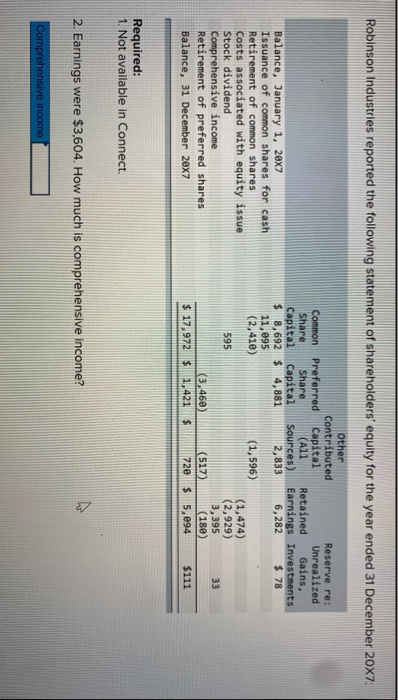

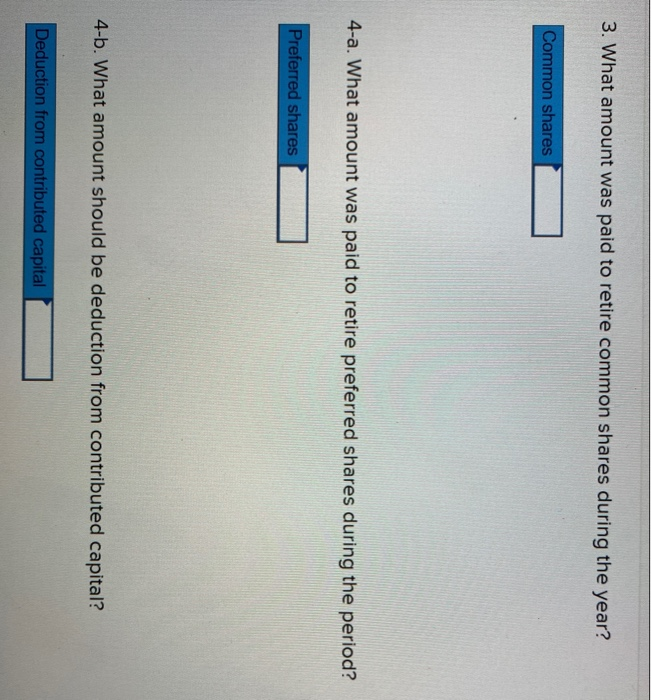

ducation.com Saved Robinson Industries reported the following statement of shareholders' equity for the year ended 31 December 20X7 Common Preferred Share Share Capital Capital $ 8,692 $ 4,881 11,095 (2,410) Other Contributed Reservere: Capital Unrealized (All Retained Gains, Sources) Earnings Investments 2,833 6,282 $ 78 Balance, January 1, 20x7 Issuance of common shares for cash Retirement of common shares Costs associated with equity issue Stock dividend Comprehensive income Retirement of preferred shares Balance, 31 December 2007 595 (1,596) (1,474) (2,929) 3,395 (517) (180) 720 $ 5,094 33 13,460) $ 17,972 $ 1,421 $ $111 Required: 1. Not available in Connect. 2. Earnings were $3,604. How much is comprehensive income? Comprehensive income 3. What amount was paid to retire common shares during the year? 4-a. What amount was paid to retire preferred shares during the period? Preferred shares 4-b. What amount should be deduction from contributed capital? Deduction from contributed capital 4-c. What amount should be deduction from retained earnings? Deduction from retained earnings Robinson Industries reported the following statement of shareholders' equity for the year ended 31 December 20X7: Other Contributed Common Preferred Capital Share Share (All Capital Capital Sources) $ 8,692 $ 4,881 2,833 11,095 (2,410) (1,596) Reserve re: Unrealized Retained Gains, Earnings Investments 6,282 $ 78 Balance, January 1, 20x7 Issuance of common shares for cash Retirement of common shares Costs associated with equity issue Stock dividend Comprehensive income Retirement of preferred shares Balance, 31 December 20x7 595 (1,474) (2,929) 3,395 (180) $ 5,094 33 (3,468) 1,421 $ (517) 720 $ 17,972 $ $111 Required: 1. Not available in Connect. 2. Earnings were $3,604. How much is comprehensive income? Comprehensive income 3. What amount was paid to retire common shares during the year? Common shares 4-a. What amount was paid to retire preferred shares during the period? Preferred shares 4-b. What amount should be deduction from contributed capital? Deduction from contributed capital 4-c. What amount should be deduction from retained earnings? Deduction from retained earings