Answered step by step

Verified Expert Solution

Question

1 Approved Answer

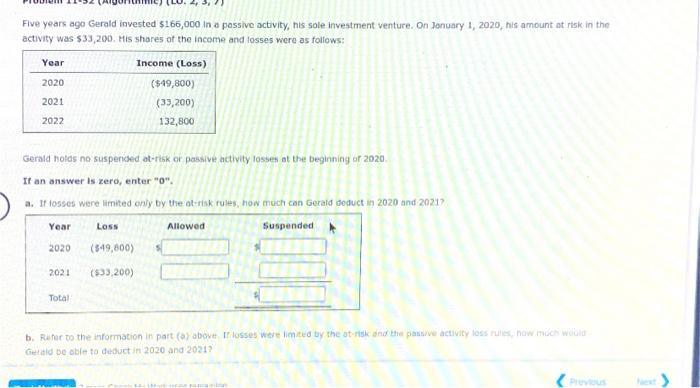

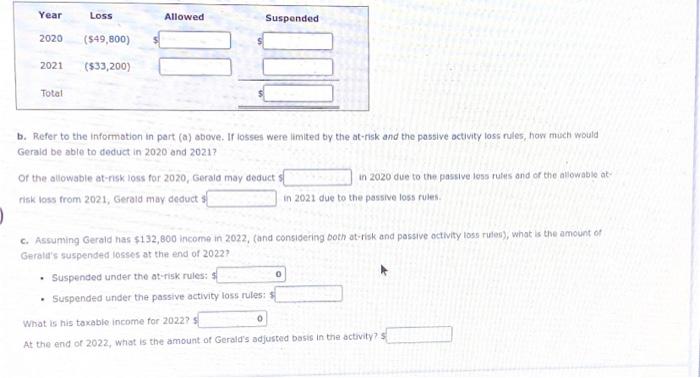

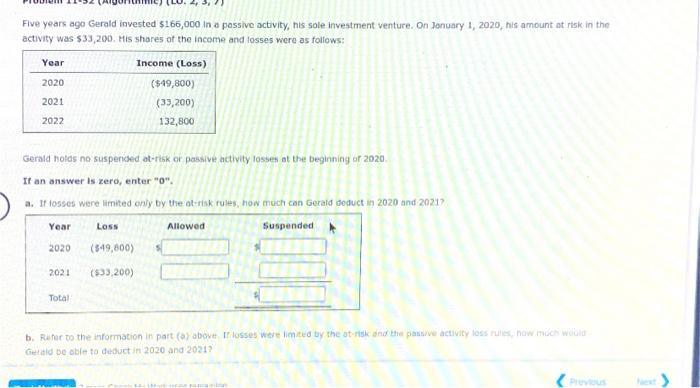

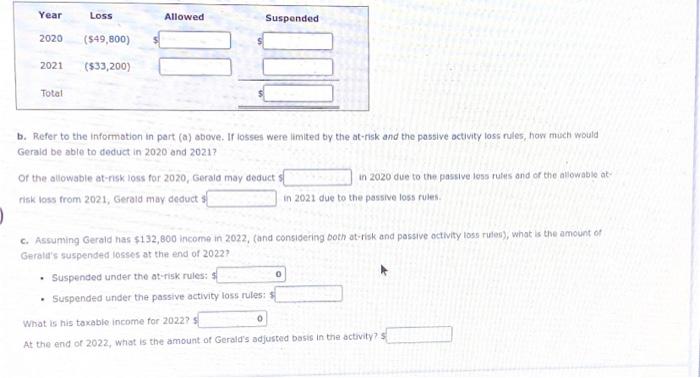

DUE SOOOON Year Five years ago Gerald invested $165,000 in a passive activity, his sole investment venture. On January 1, 2020, his amount at risk

DUE SOOOON

Year Five years ago Gerald invested $165,000 in a passive activity, his sole investment venture. On January 1, 2020, his amount at risk in the activity was $33,200. Mis shares of the income and losses were as follows: Income (Loss) ($49,800) (33,200) 132,800 2020 2021 2022 Gerald holds no susperised at-risk or passive activity lassen at the beginning or 2020 If an answer is zero, enter"0" a. If losses were limited only by the arriskultes, how much con Gerald deduct in 2020 and 2021 Year Loss Allowed Suspended 2020 (549,800) 5 2021 (533,200) Total b. Rater to the information in part() above losses were limited by the stand the passive activity loss how much will Geld be able to deductin 2020 and 2021 Year Loss Allowed Suspended 2020 (549,800) 2021 ($33,200) Total b. Refer to the information in part (a) above. If losses were limited by the at-risk and the passive activity loss rules, how much would Gerald be able to deduct in 2020 and 2017 of the allowable at-risk loss for 2020, Gerald may deducts in 2020 due to the passive les rues and or the allowable at risk loss from 2021, Gerald may deduct $ in 2021 due to the passive loss rules C. Assuming Gerald has $132,800 income in 2022, and considering both at risk and passive activity loss rules), what is the amount of Gerald's suspended losses at the end of 20221 Suspended under the at-risk rules: . Suspended under the passive activity loss rules: s 0 0 What is his taxable income for 202275 At the end of 2022, what is the amount of Gerald's adjusted basis in the activity? Year Five years ago Gerald invested $165,000 in a passive activity, his sole investment venture. On January 1, 2020, his amount at risk in the activity was $33,200. Mis shares of the income and losses were as follows: Income (Loss) ($49,800) (33,200) 132,800 2020 2021 2022 Gerald holds no susperised at-risk or passive activity lassen at the beginning or 2020 If an answer is zero, enter"0" a. If losses were limited only by the arriskultes, how much con Gerald deduct in 2020 and 2021 Year Loss Allowed Suspended 2020 (549,800) 5 2021 (533,200) Total b. Rater to the information in part() above losses were limited by the stand the passive activity loss how much will Geld be able to deductin 2020 and 2021 Year Loss Allowed Suspended 2020 (549,800) 2021 ($33,200) Total b. Refer to the information in part (a) above. If losses were limited by the at-risk and the passive activity loss rules, how much would Gerald be able to deduct in 2020 and 2017 of the allowable at-risk loss for 2020, Gerald may deducts in 2020 due to the passive les rues and or the allowable at risk loss from 2021, Gerald may deduct $ in 2021 due to the passive loss rules C. Assuming Gerald has $132,800 income in 2022, and considering both at risk and passive activity loss rules), what is the amount of Gerald's suspended losses at the end of 20221 Suspended under the at-risk rules: . Suspended under the passive activity loss rules: s 0 0 What is his taxable income for 202275 At the end of 2022, what is the amount of Gerald's adjusted basis in the activity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started