Question

Due to the nature of Going Lives products, the differences between indirect material cost between products is immaterial. As a result, management prefers to evenly

Due to the nature of Going Lives products, the differences between indirect material cost between products is immaterial. As a result, management prefers to evenly allocate indirect materials cost across its products each month. If this is the case, how much indirect materials cost would be allocated to each product in the month of April?

multiple choice

$2.67

$33.37

$9.56

$18,852

The Silver Center (TSC) produces cups and platters. TSC purchases silver and other metals that are processed into silver alloy that is used to make platters and cups. TSC incurred $54,000 of materials cost and $58,000 of labor cost to produce the silver alloy. Platters are made first and the residual alloy is remixed into a lower grade silver plated material that is used to make the cups. Remixing costs amount to $5,500. The recent batch contained 11,000 platters and 4,500 cups. TSC sold the platters for $170,000 and the cups for $26,000. Based on this information the total amount of joint cost is

Multiple Choice

$54,000.

$58,000.

$112,000.

$117,500.

The Silver Center (TSC) produces cups and platters. TSC purchases silver and other metals that are processed into silver alloy that is used to make platters and cups. TSC incurred $54,000 of materials cost and $58,000 of labor cost to produce the silver alloy. Platters are made first and the residual alloy is remixed into a lower grade silver plated material that is used to make the cups. Remixing costs amount to $5,500. The recent batch contained 11,000 platters and 4,500 cups. TSC sold the platters for $170,000 and the cups for $26,000. If number of units is used to allocate the joint cost, what is the income earned for platters?

Note: Round intermediate calculation to 2 decimal places.

Multiple Choice

$79,530

$90,470

$26,000

$(6,535)

The Silver Center (TSC) produces cups and platters. TSC purchases silver and other metals that are processed into silver alloy that is used to make platters and cups. TSC incurred $54,000 of materials cost and $58,000 of labor cost to produce the silver alloy. Platters are made first and the residual alloy is remixed into a lower grade silver plated material that is used to make the cups. Remixing costs amounts to $5,500. The recent batch contained 11,000 platters and 4,500 cups. TSC sold the platters for $170,000 and the cups for $26,000. Assume number of units is used as the base to allocate the joint cost. Based on this information

Note: Round intermediate calculation to 2 decimal places.

Multiple Choice

the Company's total income will decrease by $26,000 if it stops making and selling cups.

the Company's total income will increase by $12,035 if it stops making and selling cups.

the Company's total income will increase by 6,535 if it stops making and selling cups.

the Company's total income will decrease by $20,500 if it stops making and selling cups.

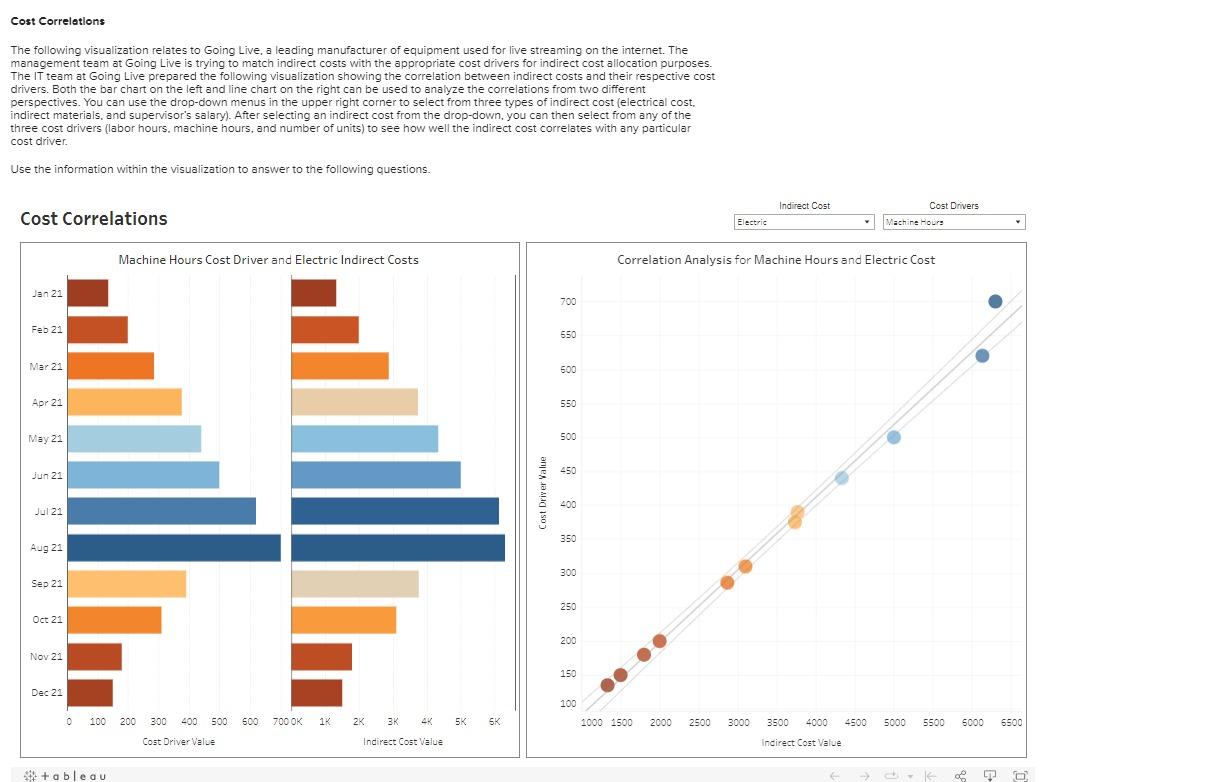

Cost Correlations The following visualization relates to Going Live, a leading manufacturer of equipment used for live streaming on the internet. The management team at Going Live is trying to match indirect costs with the appropriate cost drivers for indirect cost allocation purposes. The IT team at Going Live prepared the following visualization showing the correlation between indirect costs and their respective cost drivers. Both the bar chart on the left and line chart on the right can be used to analyze the correlations from two different perspectives. You can use the drop-down menus in the upper right corner to select from three types of indirect cost (electrical cost, indirect materials, and supervisor's salary). After selecting an indirect cost from the drop-down, you can then select from any of the three cost drivers (labor hours, machine hours, and number of units) to see how well the indirect cost correlates with any particular cost driver. Use the information within the visualization to answer to the following questions. Cost Correlations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started