Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following question complete Question 2 (32 Marks) Dr. Shikongo and Dr. Sauer were in a partnership and traded together for some time.

Please answer the following question complete

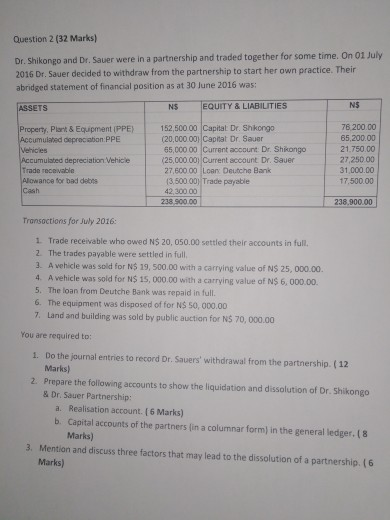

Question 2 (32 Marks) Dr. Shikongo and Dr. Sauer were in a partnership and traded together for some time. On 01 July 2016 Dr. Sauer decided to withdraw from the partnership to start her own practice. Their abridged statement of financial position as at 30 June 2016 was: ASSETS NS EQUITY &LIABILITIES NS Property, Plant & Equpment (PPE) Accumulated depreciaion PPE Mehicies Accumulated depreciation Vehicle 76.200.00 85,200.00 21.750.00 27,250 00 31,000.00 17,500.00 152,50000 Capital Dr. Shikongo (20,000.00) Captat Dr. Sauer 65,00000 Current account Dr. Shikongo (25,00000) Current account Dr. Sauer 27,60000 Loan Deutche Bank 3.50000 Trade payable 42,300 00 238 900.00 Alowance for bad debis Cash 238,900.00 Transoctions for July 2016: 1. Trade receivable who owed N$ 20, 050.00 settled their accounts in full. 2. The trades payable were settled in full 3. A vehicle was sold for N$ 19, 500.00 with a carrying value of N$ 25, 000.00 4. A vehicle was sold for N$ 15, 000.00 with a carrying value of N$ 6, 000.00. 5. The loan from Deutche Bank was repaid in full. 6. The 7. Land and building was sold by public auction for N$ 70, 000.00 equipment was disposed of for N$ 50, 000.00 You are required to 1. Do the journal entries to record Dr. Sauers' withdrawal from the partnership. (12 Marks) Prepare the following accounts to show the liquidation and dissolution of Dr. Shikongo & Dr. Sauer Partnership: 2. a. Realisation account. [6 Marks) b. Capital accounts of the partners (in a columnar form) in the general ledger. ( 8 Marks) 3. Mention and discuss three factors that may lead to the dissolution of a partnership. (6 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started