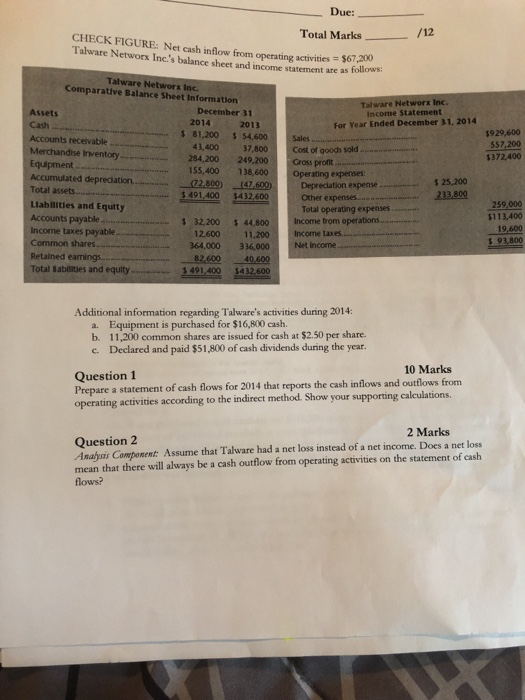

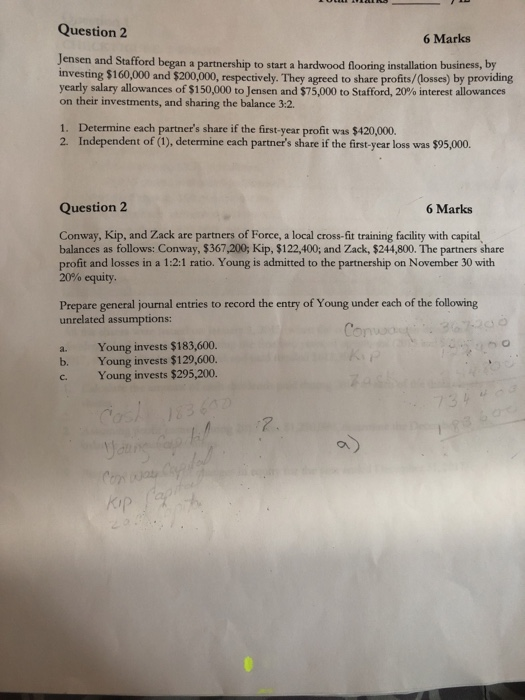

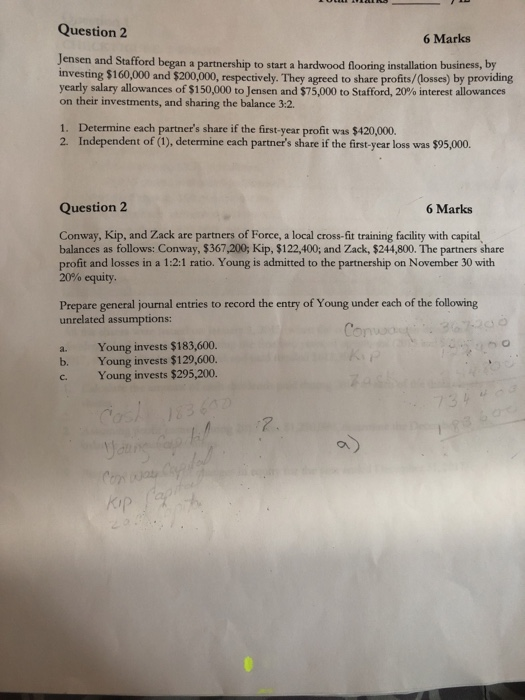

Due: Total Marks CHECK FIGURE: Net cash inflow from operating activities = $67 Talware Network Inc.'s balance sheet and income statement areas cement are as follows /12 $929,600 557,200 5372,400 Talware Networx Inc. Comparative Balance Sheet Information Assets December 31 Cash 2014 2013 - Accounts receivable ................... ,200 $ 54,600 41.400 37.800 Merchandise Inventory 254.200 249,200 Equipment 155,400 138,600 Accumulated depredation.... 02.800) 147.600) Total assets 3491400 1412.600 Liabilities and Equity Accounts payable............. Income taxes payable 12.600 11.200 Common shares 364.000 33.000 Retained earnings. 82.600 Total abilities and equity 491400 1412.600 Talware Network Inc. Income Statement For Year Ended December 31, 2014 Sales .... Cost of boods sold Cross pro Operating expenses Depreciation expense .............. 5 25.200 Other expenses 233.809 Total operating expenses Income from operations........ Income taxes Net Income 259.000 $113,400 19,600 192.800 49.600 Additional information regarding Talware's activities during 2014: 2 Equipment is purchased for $16,800 cash. b. 11,200 common shares are issued for cash at $2.50 per share. c. Declared and paid $51,800 of cash dividends during the year. Question 1 10 Marks Prepare a statement of cash flows for 2014 that reports the cash inflows and outflows from operating activities according to the indirect method. Show your supporting calculations. Question 2 2 Marks na Camport Assume that Talware had a net loss instead of a net income. Does a net loss mean that there will always be a cash outflow from operating activities on the statement of cash flows? Question 2 6 Marks Jensen and Stafford began a partnership to start a hardwood flooring installation business, by investing $160,000 and $200,000, respectively. They agreed to share profits/(losses) by providing yearly salary allowances of $150,000 to Jensen and $75,000 to Stafford, 20% interest allowances on their investments, and sharing the balance 3:2. 1. Determine each partner's share if the first-year profit was $420,000. 2 Independent of (1), determine each partner's share if the first-year loss was $95,000. Question 2 6 Marks Conway, Kip, and Zack are partners of Force, a local cross-fit training facility with capital balances as follows: Conway, $367,200; Kip, $122,400; and Zack, $244,800. The partners share profit and losses in a 1:2:1 ratio. Young is admitted to the partnership on November 30 with 20% equity. Prepare general journal entries to record the entry of Young under each of the following unrelated assumptions: Conde a. Young invests $183,600. Young invests $129,600. c. Young invests $295,200. Youn Cap kop la